Share This Page

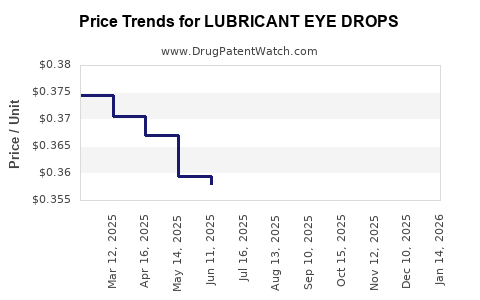

Drug Price Trends for LUBRICANT EYE DROPS

✉ Email this page to a colleague

Average Pharmacy Cost for LUBRICANT EYE DROPS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LUBRICANT EYE DROPS | 70000-0455-01 | 0.35843 | ML | 2025-12-17 |

| LUBRICANT EYE DROPS | 70000-0455-01 | 0.35649 | ML | 2025-11-19 |

| LUBRICANT EYE DROPS | 70000-0455-01 | 0.35588 | ML | 2025-10-22 |

| LUBRICANT EYE DROPS | 70000-0455-01 | 0.35647 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Lubricant Eye Drops

Introduction

Lubricant eye drops, also known as artificial tears, are among the most widely used ophthalmic products globally. They address symptoms of dry eye syndrome, discomfort caused by contact lenses, post-surgical irritation, and environmental exposure. As the demographic landscape shifts towards an aging population with increased prevalence of ocular surface disorders, the demand for lubricant eye drops is poised to expand significantly. This article provides a comprehensive market analysis and price projection for lubricant eye drops, emphasizing key drivers, competitive landscape, regulatory influences, and future pricing trends.

Market Overview

Market Size and Growth Dynamics

The global lubricant eye drops market was valued at approximately USD 3.1 billion in 2022, with projected compound annual growth rates (CAGR) of 6-8% over the next five years [1]. Factors contributing to this growth include rising prevalence of dry eye disease (DED), increased awareness, and innovations in formulation technology.

The Asia-Pacific region represents the largest growth segment due to demographic shifts, increased urbanization, and rising disposable incomes. North America and Europe also sustain substantial market shares driven by high healthcare expenditure, advanced healthcare infrastructure, and proactive therapeutic approaches.

Key Market Drivers

- Aging Population: The increase in elderly populations globally correlates with higher incidences of dry eye and related ocular surface disorders.

- Lifestyle Factors: Prolonged screen time and environmental pollutants exacerbate dry eye symptoms among younger demographics.

- Product Innovation: The development of preservative-free formulations, sustained-release drops, and combined therapeutics enhances consumer appeal and adherence.

- Regulatory Advancements: Clear pathways for OTC approvals in mature markets facilitate wider distribution.

Competitive Landscape

Major pharmaceutical companies and OTC brands dominate the market, including:

- Alcon (Novartis): Leader with a diverse portfolio of artificial tears and lubricants.

- AbbVie: Known for comprehensive ophthalmic therapeutics.

- Bausch + Lomb: Focus on advanced preservative-free options.

- Rohto Pharmaceutical: Significant presence in the Asian markets.

- Innovative Startups: Focused on preservative-free, bio-engineered, and sustained-release formulations.

Emerging players are also investing heavily in R&D to develop novel delivery systems, such as contact lens coatings with lubricating properties and nanotechnology-based formulations.

Regulatory Impact

Regulatory pathways for lubricant eye drops vary geographically. The U.S. FDA considers many formulations as OTC, easing accessibility but demanding rigorous safety and efficacy data. In the EU, CE marking processes regulate product approval, with an increasing emphasis on preservatives and preservative-free formats.

Stringent regulatory environments influence pricing structures, considering manufacturing costs, compliance, and clinical validation expenses. Additionally, patent protection for innovative formulations can impact market exclusivity, affecting pricing strategies.

Pricing Factors and Trends

Current Pricing Landscape

The retail price of lubricant eye drops varies significantly depending on formulation, brand, packaging, and region.

- Generic, preservative-laden eye drops: USD 5-10 per 10 mL bottle.

- Preservative-free, advanced formulations: USD 10-20 per 10 mL bottle.

- Preservative-free multi-dose systems or sustained-release drops: USD 25-50 each due to innovative delivery mechanisms.

OTC sales dominate, but prescription formulations often command higher prices where prescribed for chronic, severe cases.

Factors Influencing Price Fluctuations

- Formulation Complexity: Bio-engineered delivery systems, preservative-free multi-dose bottles, or sustained-release devices incur higher manufacturing costs, translating into higher retail prices.

- Brand Reputation and Patent Status: Well-established brands can command premium prices. Patent protection prevents generic competition, enabling price integrity.

- Distribution Channels: Direct-to-consumer online sales can lower costs but might also impact pricing strategies due to competitive pressures.

- Regulatory Requirements: Meeting safety standards and approval processes elevates costs, which are reflected in the end-price.

Future Price Projections

Short-term Outlook (Next 1-3 Years)

Market growth is expected to stabilize around a CAGR of 6-8%, with price increases limited to 3-5%, driven primarily by inflation, supply chain challenges, and incremental innovation. The introduction of multi-dose preservative-free systems may temporarily elevate costs by 10-15%, but increased competition could moderate these effects over time.

Long-term Outlook (Next 5-10 Years)

- Innovation-driven premium pricing: Sustained-release formulations and nanotechnology-enabled drops could see prices escalate by 20-30% as patent protections and technological barriers sustain exclusivity.

- Market penetration and commoditization: Entry of generic, preservative-free, multi-dose bottles may result in price erosion, potentially dropping the cost of basic formulations by 20-40%.

- Regional disparities: In emerging markets, pricing could remain 50-70% lower than in developed regions due to market elasticity and lower regulatory costs.

Overall, predicted retail prices for advanced lubricant eye drops could reach USD 30-60 per 10 mL bottle within five years, reflecting continued innovation and market segmentation.

Implications for Stakeholders

- Pharmaceutical Companies: Strategic investments in R&D for novel delivery systems can justify higher price points and protect market share through patenting.

- Distributors and Retailers: Understanding regional price sensitivities and regulatory frameworks can optimize margins and market access.

- Healthcare Providers: Awareness of pricing trends influences formulation selection, balancing efficacy and affordability.

- Consumers: Market segmentation offers options aligned with severity, preferences, and income levels.

Key Takeaways

- The lubricant eye drops market is projected to grow steadily, driven by demographic and lifestyle changes.

- Innovation in formulation and delivery systems remains pivotal for premium pricing, while generic options ensure broader access and affordability.

- Regulatory landscapes significantly influence market dynamics and pricing strategies.

- Prices for physiologically advanced and preservative-free formulations are likely to increase at a faster rate, reflecting technological advancement and patent protections.

- Regional disparities necessitate tailored pricing strategies to maximize market penetration.

Frequently Asked Questions

Q1: What are the main factors impacting the price of lubricant eye drops?

A1: Formulation complexity, brand reputation, patent status, manufacturing and regulatory costs, distribution channels, and regional market conditions primarily influence pricing.

Q2: How will emerging technologies affect future pricing?

A2: Innovations such as sustained-release systems and nanotechnology are expected to command premium prices initially, but eventual generic competition may lead to price reductions over time.

Q3: Are there significant geographic variations in lubricant eye drop prices?

A3: Yes. Developed markets typically have higher prices due to regulatory standards and consumer purchasing power, while emerging markets feature lower prices driven by economic factors.

Q4: Will patent expirations impact the pricing landscape?

A4: Absolutely. Expiry of patents on innovative formulations will enable generic entrants, which tend to lower prices significantly.

Q5: What is the outlook for OTC vs. prescription lubricant eye drops?

A5: OTC products dominate due to accessibility and regulatory ease. However, prescription formulations, often with higher efficacy or specialized delivery systems, maintain higher prices and margins.

References

[1] MarketWatch Research, "Global Artificial Tears Market Size and Forecast," 2022.

More… ↓