Last updated: July 29, 2025

Introduction

Lubricant eye drops, commonly known as artificial tears, are among the most widely used ophthalmic products for dry eye syndrome, contact lens discomfort, and other ocular surface disorders. The global market for lubricant eye solutions has witnessed significant growth driven by rising prevalence of dry eye conditions, increasing aging populations, and expanding ophthalmic healthcare infrastructure. This report provides a comprehensive analysis of the current market landscape, future growth projections, competitive dynamics, and factors influencing pricing strategies for lubricant eye drops.

Market Overview

Global Market Size and Growth Trends

The lubricant eye drop market was valued at approximately USD 3.2 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of around 5.5% through 2030 [1]. The growth trajectory is primarily driven by demographic shifts—particularly aging populations in North America, Europe, and parts of Asia—hasil সমস্যার জন্য চোখের শুষ্কতা আরও বৃদ্ধি পাওয়া। Additionally, rising awareness of ocular health, advancements in formulation technologies, and increased adoption among contact lens wearers further propel market expansion.

Regional Dynamics

- North America: Holds the largest market share (~35%), benefitting from high healthcare expenditure, advanced ophthalmology practices, and widespread availability of over-the-counter products.

- Europe: Accounts for approximately 25%, with robust growth anticipated owing to aging demographics and increased awareness.

- Asia-Pacific: Fastest-growing region (~7-8% CAGR), driven by vast population, rising middle-class income levels, and expanding healthcare infrastructure.

- Latin America and Middle East/Africa: Moderate growth, primarily driven by increased OTC availability and local manufacturing.

Market Segmentation

Product Type

- Preservative-Free Eye Drops: Increasing preference due to lower incidence of ocular irritation and suitability for frequent use.

- Preserved Eye Drops: Still prevalent, especially in bundled over-the-counter formulations.

Distribution Channel

- Pharmacies & Drug Stores: Major revenue contributor, favored for OTC accessibility.

- Hospital Pharmacies: Employed in clinical settings for prescribed use.

- E-commerce Platforms: Growing segment due to convenience and expanding online healthcare retail.

Competitive Landscape

Major players include Johnson & Johnson (Visine), Bausch & Lomb (Systane), Alcon, Novartis, and Thea Pharma. These companies are innovating through extended-release formulations, preservative-free preservatives, and combination therapies targeting dry eye management. Market consolidation trends favor large multinational corporations investing heavily in R&D and strategic collaborations.

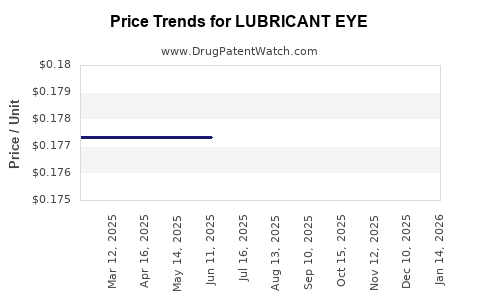

Price Analysis and Historical Trends

Historically, price points for lubricant eye drops range from USD 5-15 per 10 mL bottle in developed regions, with variations attributable to brand, formulation, preservative content, and packaging. Preservation-free variants command a premium—up to 30-50% higher—due to manufacturing complexity and added value propositions.

In emerging markets, prices tend to be lower (USD 2-8 per 10 mL) owing to lower disposable incomes and local manufacturing, often supplemented by government subsidies or OTC availability. Segmenting by product type:

- Preservative-Free Drops: USD 10-15

- Preserved Drops: USD 5-10

No significant fluctuations have impacted retail prices globally in recent years; however, raw material cost volatility, manufacturing regulations, and patent expirations influence pricing dynamics.

Price Projection Strategy (2023–2030)

Applying inflation-adjusted growth models and factoring in market expansion, the following projections are outlined:

- Average Price per 10 mL: Expected to decrease modestly in developed countries (~1-2% CAGR reduction) due to market saturation and commoditization, stabilizing around USD 8-10.

- Premium Segments (Preservative-Free): Anticipated to retain or slightly increase in value (~1-2%) due to innovation and consumer willingness to pay for safety and comfort.

- Emerging Markets: Prices predicted to remain stable or decline marginally (~0.5-1%) as local manufacturing and competition intensify.

Overall, the retail price for a standard 10 mL bottle is projected to hover around USD 5-12 by 2030, with premium offerings in specialized markets potentially exceeding USD 15.

Key Factors Influencing Future Pricing

Regulatory Landscape

Stringent regulations concerning safety, preservative constituents, and manufacturing standards may influence costs, leading to higher retail prices for innovative, preservative-free formulations.

Raw Material Costs

Increases in raw materials such as sodium hyaluronate or carbomer impact production costs, whereas supply chain efficiencies can mitigate inflationary pressures.

Technological Innovations

Extended-release and hydrating formulations command a premium, driving prices upward in high-growth segments.

Market Penetration and Competition

Increased adoption in emerging markets and genericization of products could place downward pressure on prices, particularly in over-saturated segments.

Concluding Remarks

The lubricant eye drop market is poised for steady growth, with sustained demand anticipated across global regions. Price points will likely remain stable with slight fluctuations driven by innovation, regulatory requirements, and raw material costs. Manufacturers focusing on preservative-free, multi-dose, and technologically advanced formulations can leverage premium pricing, especially in developed markets.

Key Takeaways

- The global lubricant eye drop market is projected to grow at ~5-6% CAGR until 2030, reaching valuations exceeding USD 5 billion.

- Prices are expected to stabilize but diverge across segments, with premium preservative-free products maintaining higher retail prices.

- Emerging markets will drive volume growth, particularly as local manufacturing and OTC sales expand.

- Regulatory pressures and raw material costs will remain critical factors influencing pricing strategies and profit margins.

- Innovation in delivery systems and formulations presents opportunities for premium pricing and market differentiation.

FAQs

Q1: How do preservative-free eye drops influence market pricing?

A1: Preservative-free formulations involve complex manufacturing processes and packaging, leading to higher manufacturing costs. Consequently, these products typically command premiums of 30-50% over preserved variants, especially in developed markets where safety and comfort are prioritized.

Q2: What factors could cause retail prices for lubricant eye drops to decline by 2030?

A2: Increased competition from generics, technological standardization, and manufacturing efficiencies in emerging markets are primary drivers of potential price reductions, especially in oversaturated segments.

Q3: How does raw material scarcity impact pricing projections?

A3: Scarcity or increased costs of raw materials like hyaluronate or carbomer can elevate manufacturing expenses, thereby exerting upward pressure on retail prices unless offset by technological innovations or supply chain improvements.

Q4: Are there regional variations in price trends for lubricant eye drops?

A4: Yes. Developed regions tend to maintain higher, more stable prices due to brand loyalty and regulatory standards, whereas prices in emerging markets are often lower but subject to greater fluctuations owing to local manufacturing and distribution channels.

Q5: What future innovations could influence market pricing strategies?

A5: Advances such as sustained-release formulations, multi-action drops, and preservative-free multi-dose units are expected to create premium segments, slightly elevating prices. Conversely, standardization and automation in manufacturing may drive down costs.

References

[1] Market Research Future. "Global Artificial Tears Market Analysis." 2022.