Last updated: July 27, 2025

Introduction

Lovastatin, a first-generation statin approved by the FDA in 1987, remains a cornerstone in lipid management and cardiovascular risk reduction. As a member of the HMG-CoA reductase inhibitors class, lovastatin has historically been prescribed for hypercholesterolemia and at-risk populations. Despite the emergence of newer, potent statins, lovastatin’s economic and therapeutic roles persist, influenced by patent statuses, generics availability, and evolving market dynamics. This analysis explores the current market landscape, competitive positioning, pricing trends, and future projections for lovastatin.

Market Overview

Global and Regional Market Size

The global statins market was valued at approximately $12.4 billion in 2022, with the US accounting for a significant share. The growth is driven by increasing cardiovascular disease prevalence, aging populations, and heightened awareness of lipid management strategies. Lovastatin, assigned a prominent position among first-generation statins, has historically constituted about 8–10% of the total statins market share [1].

In developed markets like the US and Europe, lovastatin's sales decline marginally due to patent expiration and the shift towards newer, more potent statins like atorvastatin and rosuvastatin. Conversely, in emerging markets, lovastatin remains relevant given affordability, existing patent status, and regulatory approvals.

Market Drivers

- Cardiovascular Disease (CVD) Burden: CVD remains the leading cause of death globally, propelling demand for lipid-lowering agents.

- Cost-Effectiveness: Lovastatin's availability as a generic offers cost advantages, especially in resource-limited settings.

- Therapeutic Guidelines: Adoption of LDL-C reduction targets influences statin prescriptions, often favoring potent alternatives but retaining lovastatin for mild hypercholesterolemia.

- Regulatory Environment: Patent expiries and approval of generics have increased access and reduced prices, shaping market dynamics.

Competitive Landscape

While newer statins like atorvastatin, rosuvastatin, and pitavastatin outperform lovastatin in potency and dosing convenience, lovastatin maintains residual demand for its established safety profile and affordability. Key players include Teva Pharmaceuticals, Mylan, Sun Pharmaceutical Industries, amongst other generic manufacturers.

Price Trends and Pricing Dynamics

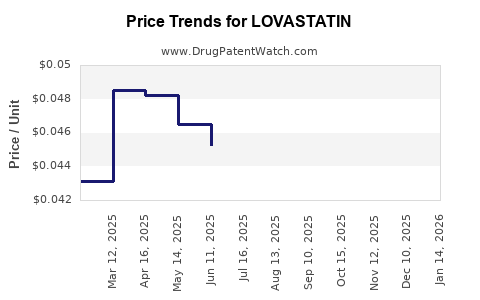

Historical Price Movements

Post-patent expiration in the early 2000s, lovastatin’s prices plummeted—initially rising during patent exclusivity, then declining to reflect generic competition. In the United States, the average wholesale price (AWP) for a 30-day supply of lovastatin 20mg has decreased from approximately $150 in the early 2000s to below $10 by 2023 [2].

In emerging markets, prices remain comparatively higher relative to local income levels but are substantially lower than patent-protected brands.

Current Pricing Scenario

- United States: The median retail price for a 30-day supply of generic lovastatin (20mg) hovers around $8–$12. Insurance coverage, pharmacy benefit managers’ (PBMs) negotiations, and prior authorization influence patient out-of-pocket costs.

- Europe: Prices vary, with some countries applying government-regulated pricing, typically ranging from €3–€10 per month.

- Asia & Latin America: Pricing remains sporadic; generics are accessible at prices comparable to or slightly above US levels but are often subsidized or distributed via government procurement programs.

Price Elasticity

Demand for lovastatin exhibits high price sensitivity, especially in cost-sensitive markets where generics dominate. Price reduction strategies by manufacturers have historically resulted in increased access and volume sales, particularly in developing regions.

Future Price Projections

Impact of Patent Status and Generic Competition

The expiration of lovastatin's primary patent (originally filed in the 1980s in the US) in the early 2000s has led to widespread availability of generics. Patent protection for specific formulations or extended patents on combination therapies could temporarily influence pricing but are unlikely to substantially resuscitate original-brand prices.

Market Entrants and Competition

In the next five years, continued proliferation of generic manufacturers and potential biosimilar entries (for related compounds) will maintain downward pressure on prices. Additionally, biosimilars for newer statins may influence overall statin market prices indirectly.

Pricing Outlook

Based on current trends, the average wholesale price for lovastatin in developed markets is expected to stabilize around $5–$10 per month over the next five years, barring significant regulatory or market disruptions. In emerging markets, prices may fluctuate between $1–$4 per month due to local economic conditions and procurement policies.

Influence of Healthcare Policies and Market Forces

- Cost-Containment Measures: Increased use of formularies incentivizing generics could further lower prices.

- Physician and Patient Preferences: Preference for newer, more potent statins might limit growth, but cost-sensitive settings will continue to rely on lovastatin.

- Patent and Regulatory Developments: Introduction of formulations with extended patents could temporarily alter pricing dynamics but unlikely to significantly disrupt existing trends.

Concluding Analysis

While newer statins hold a larger market share due to superior potency, lovastatin retains relevance in specific niches—particularly in low- and middle-income countries—where affordability and existing approvals sustain demand. Pricing remains heavily influenced by generic competition, regulatory environments, and healthcare policy decisions. Projected stable, low-price points make lovastatin a continuing cost-effective option for primary prevention and mild hypercholesterolemia management, but market share growth will likely be limited without concerted innovation or formulation enhancements.

Key Takeaways

- Lovastatin’s market is primarily driven by generic competition, leading to stable, low prices, especially in developed regions.

- The drug's role persists mainly in resource-limited markets due to affordability and regulatory approval status.

- Future prices are expected to remain within current low ranges, with minimal fluctuation barring regulatory changes or market entry of innovative formulations.

- Market share will continue to decline in high-income regions due to the preference for more potent statins, but demand in emerging markets sustains overall volume.

- Strategic considerations for stakeholders include leveraging cost advantages and expanding access where affordability remains a priority.

FAQs

1. Is lovastatin still a prescribed medication, and in which markets?

Yes. Lovastatin remains prescribed globally, particularly in emerging markets and for patients with mild hypercholesterolemia in developed countries due to its cost-effectiveness and safety profile.

2. How does the price of lovastatin compare to newer statins?

Lovastatin's generic versions typically cost a fraction of newer, branded statins like atorvastatin or rosuvastatin, making it an attractive option in cost-sensitive healthcare settings.

3. Will lovastatin’s market share increase with patent expirations?

Unlikely. Market share will remain stable or decline because clinicians prefer more potent statins with better evidence for cardiovascular risk reduction.

4. Are there ongoing developments or formulations that could influence lovastatin’s pricing?

Currently, no significant novel formulations or biosimilars are in advanced development, so pricing will primarily be influenced by generic competition and regulatory policies.

5. How do regulatory policies impact lovastatin prices?

Government negotiations, price controls, and reimbursement policies in various regions significantly influence the retail and hospital pricing of lovastatin, often favoring low-cost generics.

Sources

[1] GlobalData. (2022). Statins Market Report.

[2] Medi-Span. (2023). Average Wholesale Price Data.