Last updated: July 29, 2025

Introduction

LOTREL (amlodipine and benazepril) is a fixed-dose combination antihypertensive medication approved for managing high blood pressure. Its dual mechanism provides comprehensive blood pressure control, reducing the risk of cardiovascular events. This analysis evaluates current market dynamics, competitive landscape, regulatory environment, and price trends to project future pricing and market potential.

Market Overview

Global Hypertension Medication Market

The global antihypertensive drugs market was valued at approximately USD 32 billion in 2022, with an expected compound annual growth rate (CAGR) of 4.5% through 2030[1]. The rising prevalence of hypertension, especially in aging populations, fuels demand. Data suggest that over 1 billion people worldwide suffer from hypertension, highlighting an expanding patient base for drugs like LOTREL.

Therapeutic Position

LOTREL, combining amlodipine (a calcium channel blocker) and benazepril (an ACE inhibitor), offers claimed benefits of improved compliance and synergistic efficacy. Its positioning as a fixed-dose combination supports adherence, a critical factor amid rising chronic disease management needs.

Market Penetration and Competitive Landscape

Key Competitors

LOTREL competes primarily with monotherapies and other combination antihypertensive drugs, including:

- Vasotec (enalapril) + Norvasc (amlodipine) — a similar combination available separately.

- Hydralazine and hydrochlorothiazide combinations

- Other fixed-dose combinations such as lisinopril and amlodipine.

Major industry players include Pfizer, Novartis, and AstraZeneca. Pfizer markets LOTREL, capturing a significant share early since FDA approval in 2000. Long-term patent protections have lapsed, exposing the drug to generic competition and significantly impacting pricing and market share.

Generic Entry Impact

Generic versions of amlodipine and benazepril entered the market around 2010–2012, collapsing initial brand premiums. Market penetration of generics has resulted in price erosion for branded LOTREL formulations[2].

Regulatory Environment

Patent and Exclusivity

Initially protected by patents, LOTREL's exclusivity expired around 2010, permitting generic manufacturing. This transition shifted the market from branded to predominantly generic consumption, reducing prices substantially.

Pricing Regulations

Pricing of antihypertensive drugs in major markets, notably the US, faces increasing regulation focus, especially concerning inflation, transparency, and patient access. Medicare and other payers favor lower-cost generics.

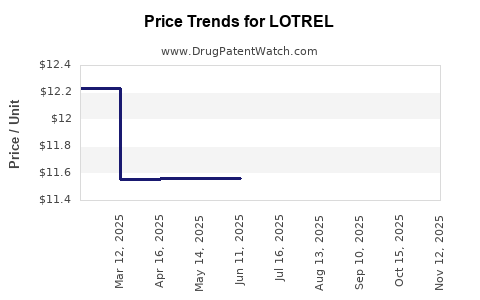

Current Pricing Dynamics

Branded vs. Generic Pricing

As of 2023, the average wholesale price (AWP) for branded LOTREL remains elevated but is increasingly overshadowed by generics:

- Branded LOTREL: Approximately USD 250–USD 350 per month.

- Generic equivalents: Typically USD 10–USD 20 per month, representing over 90% savings.

Market Share Trajectory

Generic versions hold over 85% of the market share, with branded formulations decreasing proportionally. Payers and patients prefer generics, constraining prices and revenue for the branded product.

Future Price Projections

Short to Medium Term (2023–2028)

Given the current dominance of generics coupled with moderate brand resurgence unlikely, prices for the branded LOTREL are expected to decline further, potentially stabilizing around USD 150–USD 200 per month due to market saturation and payer negotiations.

Long Term (2028 and beyond)

Emerging biosimilar and innovative therapies targeting resistant hypertension may reshape the landscape. However, unless a novel formulation or delivery method emerges, existing drugs’ prices are unlikely to recover substantially. Price erosion for generics is projected to continue at approximately 3–5% annually, with branded formulations nearing marginal profitability.

Impact of Value-Based Pricing and Policy Changes

Ongoing healthcare reforms emphasizing cost-effectiveness may further restrict premium pricing. Payers increasingly favor lower-cost, effective generics, pressing manufacturers to lower prices or innovate to regain premium margins.

Market Opportunities and Risks

Opportunities

- Expanding Markets: High-growth regions like Asia-Pacific and Latin America present increasing hypertension burdens, offering potential for increased generic and branded sales.

- Combination Therapies: Innovations into triple or quadruple fixed-dose combinations could create differentiation.

- Digital Health Integration: Incorporating adherence tools and remote monitoring can optimize treatment outcomes, possibly sustaining premium pricing.

Risks

- Generic Competition: Entrenched generics continually compress prices.

- Patent Expirations: Further patent lapses or patent litigations influence pricing strategies.

- Regulatory and Reimbursement Shifts: Policy changes may restrict price increases and favor generics.

Conclusion

The market for LOTREL has transitioned from profitable branded sales to a commoditized generic environment. Price projections indicate further declines in the short to medium term, with stabilization at low price points for generic versions. The overall market remains robust due to high disease prevalence, but competitive pressures and regulatory trends limit potential for significant price resurgence of the branded product. Manufacturers seeking growth should focus on innovation, regional expansion, and value-based offerings.

Key Takeaways

- Market saturation by generics has significantly suppressed LOTREL's pricing, with future declines likely due to continuing price compression.

- Patents and regulatory environments primarily favor generics, constraining branded drug revenues.

- Emerging markets in Asia-Pacific and Latin America could present growth opportunities amid rising hypertension prevalence.

- Innovation in drug formulations or delivery methods may offer avenues for premium pricing in the future.

- Healthcare policy shifts emphasizing cost-effectiveness will increasingly favor low-cost generics, challenging branded formulations’ profitability.

FAQs

-

What is the current market share of branded LOTREL versus generics?

Currently, over 85% of the antihypertensive market share for similar compounds is dominated by generic versions, with branded LOTREL holding a marginal share primarily through existing patient and physician preferences.

-

How have patent expirations affected LOTREL prices?

Patent expirations around 2010–2012 led to widespread generic entry, drastically reducing the price of the drug and eroding the profitability of the branded formulation.

-

What are the future price expectations for LOTREL?

It is anticipated that the branded formulation's price will decline further, stabilizing around USD 150–USD 200 per month, with ongoing generic price erosion expected at 3–5% annually.

-

Are there any emerging competitors or formulations that threaten LOTREL’s market?

Yes, newer combination therapies, biosimilars, and innovative antihypertensives could further challenge LOTREL’s market share and pricing.

-

What strategies could manufacturers adopt to sustain profitability?

Focusing on regional expansion, developing value-added formulations, integrating digital health tools, and pursuing innovative delivery methods can help sustain margins amidst price pressures.

References

[1] MarketWatch. "Antihypertensive Drugs Market Size, Share & Trends." 2022.

[2] IMS Health Reports. "Generic Drug Market Penetration." 2019.