Last updated: July 27, 2025

Introduction

Loteprednol, a corticosteroid with anti-inflammatory properties, is widely used in ophthalmology to treat conditions such as seasonal allergic conjunctivitis, postoperative inflammation, and keratitis. Its unique formulation offers a favorable safety profile compared to traditional steroids, making it a preferred option for both acute and chronic ocular inflammation. Given its therapeutic profile and rising global demand, understanding the current market landscape and forecasting future pricing trends are critical for stakeholders including pharmaceutical companies, investors, healthcare providers, and policymakers.

Market Overview

Current Market Landscape

The global ophthalmic corticosteroids market, which includes loteprednol, was valued at approximately USD 860 million in 2022, with a compound annual growth rate (CAGR) of around 4.8% projected through 2030 [1]. Loteprednol, marketed under brands such as Lotemax and Alrex, holds a significant share within this market due to its safety profile and efficacy.

Therapeutic Applications and Market Drivers

-

Prevalence of ocular inflammatory conditions: Conditions like dry eye syndrome, allergic conjunctivitis, and post-surgical inflammation are on the rise globally, driven by aging populations and increased awareness.

-

Safety profile advantages: Compared to earlier corticosteroids, loteprednol's decreased risk of intraocular pressure elevation and cataract formation makes it preferable, especially in long-term use.

-

Regulatory approvals: The approval of branded formulations by major regulatory bodies (FDA, EMA) bolsters market trust and accessibility.

Competitive Landscape

Key players include Bausch + Lomb (Lotemax), Alcon, Santen Pharmaceutical, and Hovione. Patent expirations and the entry of generic equivalents are expected to influence pricing and market share dynamics moving forward.

Regulatory and Patent Dynamics

Patent Status and Generics

- The primary patent for Lotemax, held by Bausch + Lomb, expired in the United States in 2018, opening avenues for generic formulations.

- Several generic versions are now available, intensifying price competition and downward pressure.

Regulatory Environment

- Regulatory approvals for both branded and generic formulations in Europe, Asia-Pacific, and Latin America are expanding.

- Ongoing clinical trials and research foster the development of novel delivery systems (e.g., sustained-release implants), potentially diversifying market offerings.

Price Analysis and Projections

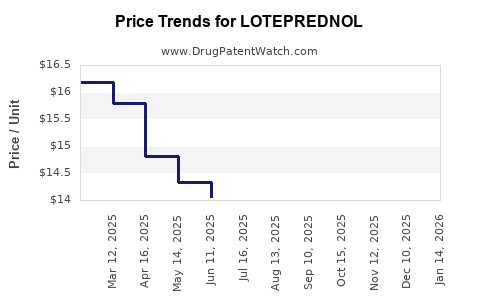

Historical Pricing Trends

- Branded formulations: The retail price for a 0.5% ophthalmic suspension (e.g., Lotemax) has historically ranged between USD 150–200 per bottle in the United States.

- Generic formulations: Post-patent expiry led to a price reduction of approximately 30–50%, with retail prices falling to USD 80–110.

The pricing variability is influenced by factors such as formulation, packaging, pharmacy pricing strategies, and regional healthcare policies.

Factors Influencing Future Prices

- Market competition: Increased generic entry is expected to sustain downward pricing trends.

- Regulatory incentives: Price controls in certain regions may further suppress costs.

- Manufacturing costs: Advances in formulation and scalable manufacturing could reduce production expenses, influencing retail prices.

- Value-added formulations: Development of novel delivery systems (nanoemulsions, sustained-release implants) could command premium pricing in niche markets.

Forecasted Price Trends (2023–2030)

Price Projections Summary

| Region |

Branded (USD) |

Generic (USD) |

Expected Trend |

| North America |

180–220 |

50–70 |

Stabilization with incremental decline |

| Europe |

170–210 |

45–65 |

Similar to North America, sustained demand |

| Asia-Pacific |

150–200 |

20–40 |

Decline due to increased generics, volume growth |

| Latin America |

140–190 |

20–40 |

Competitive pricing, local production |

Note: These projections are contingent upon regulatory changes, patent litigation, and market entry of new formulations.

Emerging Trends and Their Impact

Novel Delivery Systems

-

Sustained-release implants: Companies are exploring biodegradable implants releasing loteprednol over extended periods, potentially commanding premium prices (USD 300–500 per unit) due to convenience and improved adherence.

-

Nanotechnology-based formulations: These may enhance bioavailability and reduce dosing frequency, influencing price settlement and competitive positioning.

Regulatory and Reimbursement Policies

- Price controls in regions like the European Union may limit profit margins but ensure broader access.

- Reimbursement frameworks influence retail prices, with pathways for premium formulations to command higher prices.

Market Penetration and Adoption

- Increasing ophthalmic surgery volume and expanding indications, such as for dry eye and inflammation management, will sustain demand.

- Generic availability and clinician familiarity will accelerate adoption, impacting pricing strategies.

Key Market Opportunities and Challenges

Opportunities

- Expansion into emerging markets via partnerships and licensing.

- Development of combination eye drops (e.g., loteprednol + antihistamines) offering value-added therapies.

- Investment in novel delivery platforms promising better patient compliance.

Challenges

- Patent expiration and generic competition threaten revenue streams.

- Stringent regulatory requirements across regions pose hurdles for new formulations.

- Pricing pressures driven by healthcare cost containment policies.

Conclusion

The loteprednol market is positioned for steady growth, with a clear trend toward lower prices driven by patent expiries and increasing generic availability. Despite this downward pricing pressure, innovative delivery formulations and expanding indications could preserve premium segment margins. Stakeholders should focus on differentiating formulations and strategic regional expansion to capitalize on emerging opportunities.

Key Takeaways

- The global ophthalmic corticosteroids market, including loteprednol, is forecasted to grow at a CAGR of approximately 4.8% through 2030.

- Patent expirations have catalyzed the proliferation of generics, significantly reducing prices in mature markets.

- Branded loteprednol formulations are expected to stabilize around USD 180–220 in developed regions, with generics likely to trade below USD 70.

- Emerging markets will see more aggressive price declines, driven by local manufacturing and regulatory policies.

- Innovation in delivery systems, such as sustained-release implants, presents an opportunity for premium pricing but requires regulatory approval and market acceptance.

FAQs

1. How does patent expiration influence loteprednol pricing?

Patent expiration opens the market to generics, increasing competition and exerting downward pressure on prices, especially in mature markets like the U.S. and Europe.

2. What factors could disrupt current price projections?

Regulatory changes, patent litigation, technological breakthroughs in delivery systems, and shifts in healthcare reimbursement policies could alter pricing trends.

3. Are there any emerging formulations that could command higher prices?

Yes, sustained-release implants and nanotechnology-based formulations could command premium prices due to enhanced efficacy and patient compliance.

4. How does regional variation affect loteprednol prices?

Pricing is influenced by regional regulatory environments, competitive landscape, healthcare budgets, and local manufacturing, leading to significant variation across markets.

5. What should stakeholders prioritize for future success in the loteprednol market?

Investing in innovative delivery technologies, expanding into emerging markets, and navigating regulatory pathways efficiently are critical for maintaining profitability amid price pressures.

Sources

[1] MarketsandMarkets, "Ophthalmic Drugs Market," 2022.