Last updated: July 27, 2025

Introduction

LOTEMAX, a brand of loteprednol etabonate ophthalmic suspension, is a corticosteroid used primarily to treat postoperative inflammation and ocular allergies. Its unique formulation offers a targeted anti-inflammatory effect with a favorable side effect profile. Understanding the current market landscape, competitive positioning, and future pricing trajectories of LOTEMAX is essential for stakeholders, including pharmaceutical companies, healthcare providers, and investors aiming to gauge commercial potential and strategic opportunities.

Market Overview

Therapeutic Area and Demand Drivers

LOTEMAX operates within the ophthalmic corticosteroid market, which is driven by factors such as increasing incidence of ocular surgeries, rising prevalence of allergic conjunctivitis, and expanding aging populations prone to eye inflammations. The global ophthalmic anti-inflammatory drugs market was valued at approximately USD 4.8 billion in 2022 and is projected to grow at a CAGR of about 4.5% through 2030 [1].

Indications and Patient Demographics

The primary indications for LOTEMAX include postoperative ocular inflammation management following cataract surgery and anterior segment surgeries, as well as seasonal allergic conjunctivitis. The aging global population and increasing surgical volumes contribute to sustained demand, with cataract surgeries alone surpassing 50 million annually worldwide [2].

Competitive Landscape

LOTEMAX faces competition from other corticosteroid eye drops such as dexamethasone, prednisolone acetate, and loteprednol formulations from other brands, as well as non-steroidal anti-inflammatory drugs (NSAIDs). Notably, its US FDA approval for both postoperative inflammation and allergic conjunctivitis distinguishes it from competitors with narrower indications or less favorable safety profiles.

Market Penetration and Adoption

Market penetration varies regionally, with high adoption rates in North America and Europe owing to established clinical guidelines and healthcare infrastructure, while emerging markets display potential growth due to increasing healthcare access and surgical volume. Prescribing patterns are influenced by clinician familiarity, insurance reimbursement policies, and patient preferences for safety and efficacy.

Pricing Landscape

Current Pricing Models

LOTEMAX is marketed under the brand name Akorn's Lotemax and Bausch + Lomb’s Lotemax. In the US, the average wholesale price (AWP) for a 0.25% loteprednol etabonate suspension averages around USD 300 for a 5-mL bottle, equating to approximately USD 60 per milliliter [3]. These prices reflect a premium compared to generic corticosteroids, justified by proprietary formulation, patent protections, and clinical efficacy.

Insurance and Reimbursement

Insurance coverage significantly influences out-of-pocket expenses. In the United States, private insurers often reimburse at or near AWP, favoring higher-priced options where clinical benefits justify costs. Medicaid and Medicare may negotiate lower reimbursement rates, affecting overall market pricing dynamics.

Patent and Market Exclusivity

Patent protections for LOTEMAX, including method-of-use and formulation patents, provide market exclusivity until at least 2024–2026 [4]. This exclusivity supports premium pricing strategies. Once patents expire, generic formulations are expected to enter the market, exerting downward pressure on prices.

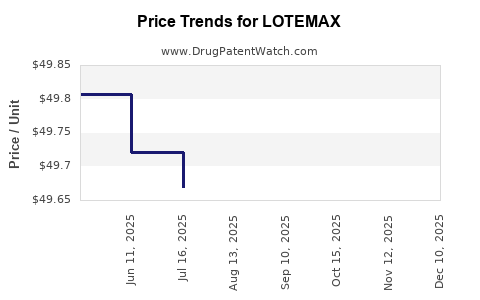

Future Price Projections

Short-Term Outlook (Next 1-2 Years)

Given patent protections and continued clinical demand, the price premium for LOTEMAX is expected to remain relatively stable. Manufacturers may consider strategic price adjustments to optimize market share, but substantial reductions are unlikely without the introduction of generics.

Long-Term Projections (3-5 Years)

Post-patent expiration, a significant volume of generic loteprednol-based products is anticipated to flood the market, leading to substantial price erosion—potentially by 30–50%. Innovator brand prices could decrease by approximately 20–30% as generics gain market share, with a stabilization at lower levels driven by manufacturing costs and competitive dynamics.

Influence of Market Entry and Regulatory Changes

The entry of biosimilars or new formulations offering improved efficacy or convenience could alter the pricing trajectory. Regulatory approval processes and pricing strategies in different regions (e.g., Europe, Asia) will also affect global price patterns.

Strategic Considerations for Stakeholders

- Pharmaceutical Companies: Should focus on maintaining clinical differentiation through evidence of safety and efficacy to sustain premium pricing. Preparing for generic competition necessitates innovation in formulation or delivery methods.

- Healthcare Providers: Must weigh cost vs. benefit, considering newer formulations that may offer safety advantages, potentially increasing acceptance and usage rates.

- Investors: Need to monitor patent expiry timelines, reimbursement policies, and competitive product launches to evaluate valuation risks and opportunities.

Key Takeaways

- Market Growth: The ophthalmic corticosteroid market, driven by rising surgical volumes and allergy prevalence, supports sustained demand for LOTEMAX.

- Pricing Stability: Currently, LOTEMAX's premium pricing is protected by patent exclusivity and clinical positioning.

- Patent Expiry Impact: Entry of generics post-patent expiration is expected to halve or more existing prices, impacting revenue projections.

- Regional Variability: Pricing and adoption will differ globally, influenced by healthcare infrastructure, reimbursement policies, and market competition.

- Innovation Pathways: Continued R&D into novel formulations or delivery systems may preserve pricing premiums beyond patent expiration.

Conclusion

LOTEMAX remains a clinically valuable and commercially viable ophthalmic corticosteroid, supported by patent protections and favorable market demand. However, impending patent cliffs and competitive pressures necessitate strategic planning for pricing and market share retention. Stakeholders should prepare for significant price declines post-generic entry while exploring innovation and expanded indications to sustain profitability.

FAQs

1. When will the patent protection for LOTEMAX expire?

Patent protections are expected to expire between 2024 and 2026, after which generic formulations are likely to enter the market.

2. How much can prices for LOTEMAX decline after patent expiry?

Analysts project a potential 30–50% decrease in prices within 1–2 years of generic entry, aligning with trends seen in similar ophthalmic drugs.

3. Are there generic alternatives to LOTEMAX available currently?

As of 2023, multiple generic loteprednol etabonate formulations are in development or approved in various regions, with full market penetration pending.

4. What factors influence LOTEMAX's pricing in different regions?

Pricing is influenced by local healthcare policies, reimbursement frameworks, regulatory approval processes, and competitive landscape differences.

5. How might new formulations affect the future market for LOTEMAX?

Innovations, such as sustained-release implants or preservative-free drops, could extend market relevance and command premium prices by offering enhanced safety or convenience.

Sources:

[1] MarketsandMarkets. Ophthalmic Anti-Inflammatory Drugs Market report, 2022.

[2] WHO. Global Eye Health Data, 2021.

[3] Red Book Online. Average Wholesale Prices, 2023.

[4] PatentScope. Patent analysis reports on Lotemax formulations, 2023.