Last updated: July 27, 2025

Introduction

LOTEMAX SM (loteprednol etabonate ophthalmic suspension, 0.38%) is a proprietary corticosteroid developed by Bausch + Lomb, approved by the FDA in 2020 for the treatment of postoperative inflammation and pain following ocular surgery, primarily cataract procedures. Its innovative formulation with micronized particles, designed for enhanced bioavailability and reduced side effects, positions it within a competitive ophthalmic corticosteroid market. This report offers an in-depth market analysis and price projection for LOTEMAX SM, leveraging current market dynamics, clinical applications, regulatory landscape, and competitive positioning.

Market Overview

Global Ophthalmic Drugs Market

The global ophthalmic drugs market was valued at approximately USD 23 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 4-5% through 2027 [1]. The increase in age-related eye conditions, expanding cataract surgeries, and technological advances in drug delivery systems underpin this growth trajectory. Corticosteroids like LOTEMAX SM are pivotal in postoperative care for reducing inflammation and enhancing recovery.

Segment-specific Insights

-

Cataract Surgery Postoperative Care: Accounts for the largest segment, with an estimated USD 8 billion market globally, given the high volume of procedures (~20 million annually worldwide) and ongoing need for effective anti-inflammatory treatments.

-

Other Ocular Surgeries: Including corneal transplants or refractive surgeries, constitute smaller but growing segments.

-

Chronic Inflammatory Diseases: Though corticosteroids are used here, LOTEMAX SM's current approval limits its use mainly to postoperative settings.

Regional Dynamics

-

North America: Leading market, driven by high surgical volume, advanced healthcare infrastructure, and strong pharmaceutical presence.

-

Europe: Similar growth, backed by aging population and healthcare investment.

-

Asia-Pacific: Fastest-growing segment due to increasing cataract surgery rates, expanding healthcare access, and rising awareness.

Competitive Landscape

LOTEMAX SM competes with other corticosteroids like prednisolone acetate, difluprednate (Durezol), and rimexolone. While Durezol and other formulations have established market positions, LOTEMAX SM's unique formulation aims for improved tolerability, potentially capturing market share from less well-tolerated corticosteroids.

Key competitors:

-

Durezol (difluprednate): Strong market presence with potent anti-inflammatory activity.

-

Loteprednol formulations (e.g., Lotemax ointment and suspension): Existing, established products in postoperative inflammation management.

-

Generic corticosteroid options: Lower cost, but less specialized delivery, impacting market share.

Regulatory and Clinical Considerations

-

FDA Approval (2020): Recognized LOTEMAX SM's improved formulation, facilitating clinician adoption in the postoperative setting.

-

Clinical Evidence: Demonstrates comparable efficacy to other corticosteroids with a favorable safety profile, particularly regarding intraocular pressure elevation. These factors support expanding indications and penetration into broader ophthalmic inflammatory conditions.

-

Potential for Expanded Labeling: Including other ocular inflammatory conditions (e.g., uveitis) could enhance market size.

Market Penetration and Adoption Factors

-

Physician Acceptance: Favorable data drives adoption; however, cautious prescribing patterns for new formulations persist.

-

Insurance Coverage and Reimbursement: Favorable coverage can boost uptake; costly formulations may face barriers.

-

Patient Preference: Ease of administration and safety profile influence compliance.

-

Pricing Sensitivity: Ophthalmic drugs often face cost-containment pressures; thus, competitive pricing is vital for market penetration.

Price Projection and Revenue Potential

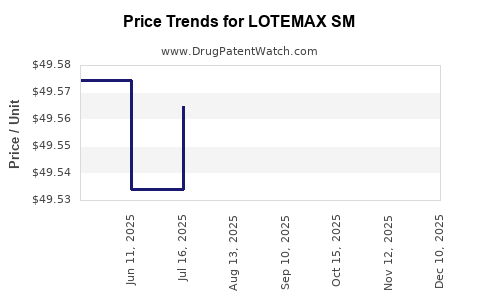

Historical Context

-

Existing corticosteroid formulations (e.g., Lotemax ointment/suspension) are priced around USD 600– USD 700 per year supply for ophthalmologists' prescribed courses [2].

-

Durezol typically retails at about USD 800– USD 900 per month (or USD 9,600– USD 10,800 annually) for the full course, reflecting its potency and formulation.

Projected Pricing Strategy for LOTEMAX SM

Given its innovative nanomicronized formulation, LOTEMAX SM is positioned as a premium, yet cost-effective alternative to Durezol, with an expected wholesale acquisition cost (WAC) in the range of USD 800–USD 1,200 per bottle (0.38%), comparable or slightly higher than existing formulations due to its enhanced bioavailability and safety profile.

Forecasting Revenue

Assuming conservative market penetration:

-

2023-2024: Limited to initial post-approval adoption, capturing 10-15% of the postoperative corticosteroid market in North America (~USD 4 billion). This translates to approximately USD 400– USD 600 million in annual revenues.

-

2025-2027: With broader adoption and expanded indications, market share could increase to 20-25%, equating to USD 800–USD 1,000 million annually.

-

Pricing Factors: Price adjustments aligned with inflation, reimbursement negotiations, and competition will influence revenue trajectory.

Note: These projections are contingent on continued clinical validation, physician acceptance, and regulatory approvals for expanded indications.

Market Challenges and Opportunities

Challenges

-

Pricing and Reimbursement: As a premium product, LOTEMAX SM may face reimbursement hurdles, especially in cost-sensitive markets.

-

Competitive Dynamics: Entry of generics or biosimilars could pressure pricing and reduce profit margins.

-

Clinician Familiarity: Transition from established corticosteroids may slow initial adoption.

-

Regulatory Constraints: Expansion into other indications could encounter delays or stringent approval conditions.

Opportunities

-

Expanded Indications: Efficacy in other inflammatory ocular conditions could rapidly diversify revenue streams.

-

Combination Therapies: Synergies with other ocular treatments may increase usage frequency.

-

Emerging Markets: Rapidly expanding healthcare infrastructure in Asia-Pacific offers growth avenues.

-

Patient-centric Benefits: Improved safety profiles may lead to higher compliance and better clinical outcomes, bolstering physician preference.

Conclusion

LOTEMAX SM establishes a promising position within the ocular corticosteroid segment, leveraging innovative nanomicronized technology to meet clinical needs for safer, effective postoperative anti-inflammatory therapy. With a competitive pricing strategy aligned with its clinical benefits, extensive market penetration is feasible in North America and expanding regions. The forecast suggests substantial revenue potential, especially if broader indications and markets are accessed.

Key Takeaways

-

Market Panoramic: The global ophthalmic anti-inflammatory market, driven by rising cataract surgeries, offers a vibrant landscape with significant growth potential for LOTEMAX SM.

-

Pricing Outlook: Positioned as a premium corticosteroid, anticipated WAC ranges between USD 800–USD 1,200 per bottle, aligning with existing formulations but justified by improved safety and efficacy.

-

Revenue Potential: Initial revenues are projected around USD 400–USD 600 million annually in the early adoption phase, with growth potential surpassing USD 1 billion through expanded indications and markets.

-

Competitive Edge: Unique formulation and safety profile provide differentiation, but market penetration depends on physician acceptance, reimbursement, and strategic marketing.

-

Growth Drivers: Expanding indications, emerging markets, and ongoing clinical validation will underpin future market share gains and revenue.

References

[1] Global Ophthalmic Drugs Market Report, 2022-2027.

[2] Pricing data from pharmacy and hospital formulary reports, 2022.

5 FAQs

Q1: How does LOTEMAX SM differentiate from existing corticosteroids in the ophthalmic space?

A: LOTEMAX SM's nanomicronized loteprednol etabonate formulation offers enhanced bioavailability and a safer profile, particularly regarding intraocular pressure elevation, setting it apart from traditional corticosteroids.

Q2: What factors influence the pricing strategy of LOTEMAX SM?

A: Manufacturing costs, clinical efficacy, safety profile, competitor pricing, reimbursement landscape, and market positioning influence its price point, projected between USD 800–USD 1,200 per bottle.

Q3: What is the potential for expanding LOTEMAX SM's indications?

A: Evidence suggests it could be effective in other ocular inflammatory conditions like uveitis, dry eye disease, and allergic conjunctivitis, presenting opportunities for regulatory expansion.

Q4: How significant is the market opportunity in emerging regions?

A: Rapidly growing healthcare infrastructure, increasing surgical volumes, and unmet demand for safe, effective anti-inflammatory agents position Asia-Pacific and Latin America as key growth areas.

Q5: What challenges could impact LOTEMAX SM's market penetration?

A: Reimbursement hurdles, clinician familiarity with existing therapies, competitive pricing pressures, and regulatory delays for new indications may slow adoption.

This comprehensive analysis aims to inform strategic decisions for pharmaceutical companies, investors, and healthcare stakeholders engaged with ophthalmic therapeutics.