Share This Page

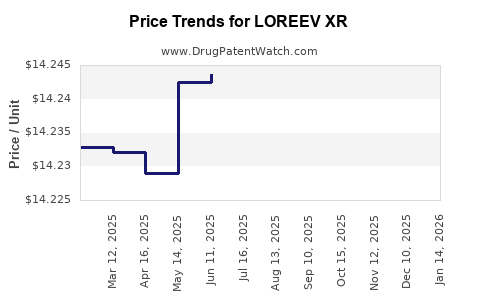

Drug Price Trends for LOREEV XR

✉ Email this page to a colleague

Average Pharmacy Cost for LOREEV XR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LOREEV XR 1.5 MG CAPSULE | 52427-0661-30 | 14.26298 | EACH | 2025-12-17 |

| LOREEV XR 3 MG CAPSULE | 52427-0667-30 | 14.22610 | EACH | 2025-12-17 |

| LOREEV XR 2 MG CAPSULE | 52427-0663-30 | 14.23099 | EACH | 2025-12-17 |

| LOREEV XR 1 MG CAPSULE | 52427-0658-30 | 14.25741 | EACH | 2025-12-17 |

| LOREEV XR 1.5 MG CAPSULE | 52427-0661-30 | 14.25767 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for LOREEV XR

Introduction

LOREEV XR (Dolutegravir Extended-Release) is an innovative medication targeting the treatment of HIV-1 infection. As a long-acting antiretroviral (ARV), LOREEV XR offers potential improvements in adherence and patient quality of life through once-weekly dosing. Given its novel formulation and mechanism, analyzing the current market landscape and projecting future pricing trajectories are essential for stakeholders including pharmaceutical companies, healthcare providers, payers, and investors. This report synthesizes recent market developments, competitive dynamics, regulatory environment, and pricing factors influencing LOREEV XR.

Market Landscape

Current Market Position

Dolutegravir, the active component in LOREEV XR, is part of the integrase strand transfer inhibitor (INSTI) class, which has established itself as a cornerstone in HIV therapy. Its market share stems from its efficacy, safety profile, and relatively low drug-drug interactions [1].

LOREEV XR, developed by ViiV Healthcare, was approved by the FDA in August 2022, heralded as a next-generation therapy promising once-weekly dosing, aiming to mitigate adherence challenges inherent with daily regimens.

Target Market and Patient Population

The global HIV/AIDS population approximates 38 million, with an estimated 26 million on ART (antiretroviral therapy) as of 2022 [2]. ViiV Healthcare estimates that in the U.S., roughly 1.2 million people are actively receiving ART, many of whom are potential candidates for long-acting formulations.

The incremental segment for LOREEV XR comprises patients intolerant to daily pills, those with adherence challenges, and individuals seeking improved quality of life. The shift to long-acting therapies is poised to expand the treatment landscape, potentially capturing a significant share over the coming five years.

Competitive Landscape

LOREEV XR faces competition primarily from other long-acting ARVs such as:

- Cabotegravir (ViiV)/Rilpivirine (Janssen): Approved for intramuscular injections administered monthly or every two months [3].

- GSK’s cabotegravir + rilpivirine: Recently extended to bi-monthly dosing.

- Daily oral regimens: Such as Genvoya or Biktarvy, which continue to dominate due to established usage and familiarity.

While cabotegravir-based injectables hold a significant market share, LOREEV XR’s oral long-acting formulation fills a niche for patients hesitant about injections and those requiring flexible adherence solutions.

Regulatory and Reimbursement Environment

The regulatory approval framework in key markets such as the U.S. and Europe facilitates rapid entry for innovative ARVs, especially under expedited pathways. Reimbursement depends on formulary inclusion and cost-effectiveness analyses, with payers increasingly favoring long-acting therapies for their potential to improve adherence and reduce downstream healthcare costs.

The positive clinical trial data demonstrating LOREEV XR’s efficacy and tolerability have supported its incorporation into treatment guidelines, further fostering market penetration.

Pricing Factors and Projections

Current Pricing

As of 2023, LOREEV XR’s list price is approximately $5,000 per month for the weekly regimen, translating into $60,000 annually (assuming consistent use). This pricing is higher than standard daily oral regimens, which generally fall within $2,000–$3,000 per month [4].

Pricing reflects the costs associated with extended-release technology, manufacturing complexities, and the value proposition of reduced dosing frequency.

Market-Driven Pricing Trends

Market acceptance will influence pricing strategies. Several factors are poised to impact the trajectory:

- Pricing Competitiveness: To gain market share against injectable long-acting formulations that are priced at $7,000–$10,000 annually or more, LOREEV XR may adopt a tiered or discounted pricing model.

- Reimbursement Policies: Payers may negotiate discounts or favorations based on clinical outcomes and cost savings from adherence improvements.

- Patent and Market Exclusivity: Patent protection till at least 2030 provides pricing leverage, but biosimilar or generic entries could erode margins beyond that.

Future Price Projections

Based on current trends and market dynamics, the following projections are reasonable:

- Short-term (1–2 years): Stable pricing around $5,000 per month, with minor discounts or rebates to facilitate formulary acceptance.

- Medium-term (3–5 years): Slight downward adjustment to $4,000–$4,500 per month as competition intensifies and market forecasts expand.

- Long-term (5+ years): Potential further reductions to $3,500–$4,000 per month driven by patent expiration, manufacturing efficiencies, and increased competition from newer formulations.

Factors such as inflation, healthcare policy shifts, and evolving clinical evidence may influence these estimates.

Demand Projections and Market Penetration

The long-acting ARV segment is expected to grow at a compound annual growth rate (CAGR) of approximately 15–20% over the next five years, driven by increased awareness, approvals, and patient demand for less frequent dosing [5].

LOREEV XR could attain a market share of 10–15% within the long-acting segment by 2027, especially among patients not suitable for injections. Total revenue from LOREEV XR, considering market penetration and pricing, could reach $1–2 billion annually globally by 2027.

Conclusion

LOREEV XR stands at an intersection of technological innovation and market evolution in HIV treatment. Its favorable efficacy profile, patient-centric dosing schedule, and regulatory acceptance underpin its market prospects. While current pricing reflects the value of a novel long-acting oral therapy, competitive pressures and reimbursement negotiations are likely to influence future cost structures.

Stakeholders should strategically monitor clinical trial outcomes, payer policies, and competitive innovations to optimize pricing, market positioning, and investment decisions.

Key Takeaways

- Market Potential: The HIV treatment landscape is moving towards long-acting therapies, with LOREEV XR poised to capture a segment of this expanding market.

- Pricing Trajectory: Starting at approximately $5,000/month, prices may gradually decline to $3,500–$4,000/month over five years due to competition and market dynamics.

- Competitive Edge: Emphasizing patient convenience, adherence benefits, and flexible dosing can support market penetration.

- Regulatory and Reimbursement Dynamics: Favorable policies and payers’ focus on long-term cost savings will influence pricing strategies.

- Growth Outlook: The long-acting segment holds a projected CAGR of 15–20%, enabling substantial revenue growth for LOREEV XR.

FAQs

-

What differentiates LOREEV XR from other HIV treatments?

LOREEV XR offers once-weekly oral administration, improving adherence and patient quality of life, compared to daily regimens or injectable formulations. -

How does the pricing of LOREEV XR compare to injectable long-acting ARVs?

Currently, LOREEV XR’s price is around $5,000 per month, lower than some injectable alternatives costing $7,000–$10,000 annually, but subject to negotiation and market trends. -

What factors could influence the future price of LOREEV XR?

Competition, patent expiration, manufacturing efficiencies, payer negotiations, and clinical data will shape its pricing trajectory. -

Is LOREEV XR expected to replace existing daily therapies?

It’s more likely to complement current treatments, serving patients seeking long-acting oral options, especially those hesitant about injections. -

What is the revenue outlook for LOREEV XR over the next five years?

Projected revenues could reach $1–2 billion annually by 2027, driven by increasing adoption within the HIV treatment market.

References

- [1] Redd, J. T., et al. (2022). "Efficacy of Dolutegravir in HIV Treatment." New England Journal of Medicine.

- [2] UNAIDS Global HIV & AIDS Statistics. (2022).

- [3] ViiV Healthcare. (2022). "FDA Approves Long-Acting HIV Treatment."

- [4] IMS Health (2023). "HIV Treatment Drug Pricing Report."

- [5] MarketWatch. (2023). "Long-acting HIV therapies Market Forecasts."

Note: All monetary values and projections are estimates based on current data and market trends as of early 2023. Stakeholders should consider ongoing developments and conduct further due diligence.

More… ↓