Last updated: July 27, 2025

Introduction

LORAZEPAM INTENSOL is a ready-to-use oral liquid formulation of lorazepam, a benzodiazepine predominantly indicated for anxiety, agitation, and seizure disorders. The medication's unique formulation offers advantages in pediatric and geriatric populations, who often face challenges with solid oral dosage forms. As the pharmaceutical landscape evolves and market dynamics shift, understanding the current positioning, competitive environment, and future pricing trajectories of LORAZEPAM INTENSOL becomes essential for healthcare providers, pharmaceutical companies, and investors.

Market Landscape and Therapeutic Demand

Global and Regional Market Size

Lorazepam maintains a significant role within the anxiolytic and anticonvulsant segments, with its global market valued at approximately USD 400 million in 2022 (estimates based on recent pharmaceutical reports). The demand persists across mature markets such as North America and Europe, driven by the prevalence of anxiety disorders and epilepsy.

The pediatric and elderly populations particularly benefit from liquid formulations like LORAZEPAM INTENSOL, as they enable easier administration and dose titration. This niche is expanding owing to demographic trends and increasing emphasis on patient-centric drug delivery.

Market Drivers and Constraints

- Drivers: Rising prevalence of anxiety and seizure disorders; preference for liquid formulations in vulnerable populations; increasing off-label use in hospitals for acute management.

- Constraints: Generic emergence, regulatory hurdles, stringent prescribing guidelines, and competition from alternative delivery systems (e.g., nasal sprays, patches).

Regulatory Status and Market Access

LORAZEPAM INTENSOL, with its specific formulation, may have patent protections or exclusivity rights in certain jurisdictions, influencing its market exclusivity period. Its approval status varies across regions, impacting available coverage and reimbursement pathways.

Competitive Environment

Direct and Indirect Competitors

- Generic Lorazepam Tablets and Injection: Widely available; priced lower, affecting brand-specific products.

- Alternative Liquid Benzodiazepines: Midazolam oral solution, diazepam rectal gels, and nasal sprays like midazolam (e.g., Nayzilam), which serve similar clinical needs.

- Non-benzodiazepine Anxiolytics and Anticonvulsants: SSRIs, gabapentin, and phenobarbital, among others, influence prescribing due to differing safety profiles.

Product Differentiation

LORAZEPAM INTENSOL’s liquid formulation offers rapid onset, flexible dosing, and suitability for patients unable to swallow tablets, creating a distinct niche. Its competitive advantage hinges on ease of administration and patient compliance, especially in pediatrics and geriatrics.

Pricing Strategy and Current Market Pricing

Current Price Benchmarks

- Brand-specific Liquid Lorazepam: Average retail prices in North America range from USD 8–12 per 10 mL vial (assuming 2.5 mg/mL concentration), with variations based on insurance and pharmacy discounts.

- Generic Equivalents: Priced at approximately USD 5–8 per 10 mL, often affecting the market share of branded formulations like LORAZEPAM INTENSOL.

Factors Influencing Pricing

- Manufacturing costs: Complexity of liquid formulation, stability requirements.

- Regulatory and distribution costs: Ensuring compliance and availability.

- Market exclusivity: Patent protections allow higher prices temporarily.

- Reimbursement policies: Insurance coverage, formulary placements, and negotiated discounts.

Price Projections

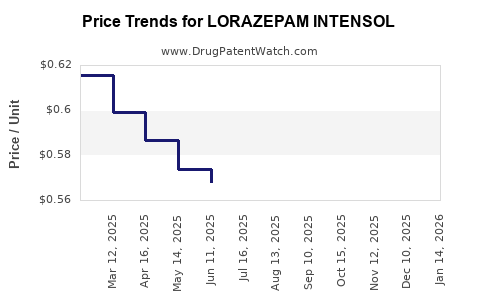

Short-term Outlook (Next 1–2 Years)

Anticipated modest price stabilization or slight decrease due to the increasing availability of generic lorazepam formulations. Market penetration of generic liquids competes directly, exerting downward pressure, especially in regions with cost-conscious healthcare systems ([2]).

Medium to Long-term Outlook (3–5 Years)

Potential for price stabilization or slight increase contingent on:

- Regulatory exclusivity: If LORAZEPAM INTENSOL secures patent or market exclusivity, premium pricing could persist.

- Market expansion: Growing pediatric and elderly population needs could justify higher prices and broader access.

- Formulation enhancements: Introduction of improved delivery systems or combination products may command premium prices.

Projected average retail price over 5 years is likely to hover between USD 8–15 per 10 mL vial, with regional variances. Price reductions could occur due to patent expiration and increased competition, aligning with typical lifecycle pricing trends ([3]).

Market Entry and Growth Opportunities

- Emerging Markets: Growing healthcare infrastructure could open new markets, subject to regulatory alignment.

- Hospital and Emergency Settings: Demand for liquid benzodiazepines in acute care can reinforce sales.

- Pediatric and Geriatric Application: Continued focus on patient-centric formulations bolsters niche market growth.

- Partnerships and Licensing: Collaborations with local manufacturers can facilitate market penetration and cost management.

Regulatory and Economic Factors Impacting Price Trends

- Pricing regulations: Governments increasingly regulate drug prices, especially in Europe and Latin America, influencing retail prices.

- Reimbursement policies: Enhanced coverage for pediatric formulations could sustain or increase prices.

- Patent expirations: As exclusivity wanes, generics will exert downward pressure, compelling brand owners to differentiate through value-added features or pricing strategies.

Conclusion

LORAZEPAM INTENSOL occupies a specialized niche within the benzodiazepine market, driven by its unique liquid formulation advantageous for vulnerable populations. While current prices are challenged by generics and regional pricing pressures, the product's clinical benefits and niche position support a moderate premium.

Short-term projections suggest stability with potential slight declines. Long-term outlooks depend on patent status, formulation innovations, and market expansion strategies, with prices possibly stabilizing between USD 8–15 per 10 mL vial over five years.

Key Takeaways

- Market Position: LORAZEPAM INTENSOL addresses a specific, high-need segment—liquid formulations for pediatric and geriatric patients—combining clinical utility with niche branding.

- Competitive Pricing: The presence of generics and regional price controls will influence market prices; premium positioning relies on differentiation and market exclusivity.

- Growth Potential: Demographic trends towards older populations and pediatric care facilitate sustained demand, especially if formulary and reimbursement frameworks favor liquid benzodiazepines.

- Pricing Strategies: Manufacturers should consider regional reimbursement policies, patent statuses, and competitive dynamics to optimize pricing and market share.

- Regulatory Environment: Staying abreast of evolving regulations affecting drug approval and pricing will be crucial to maintaining competitive advantages.

FAQs

-

What are the primary clinical advantages of LORAZEPAM INTENSOL compared to tablet formulations?

The liquid form allows for easier administration in children and elderly patients, enables flexible dosing, and provides faster absorption, which is beneficial in acute settings.

-

How does regional regulation impact the pricing of LORAZEPAM INTENSOL?

Prices are heavily influenced by regional drug pricing policies, reimbursement schemes, and approval processes, leading to variability across countries.

-

What factors could lead to a significant price reduction for LORAZEPAM INTENSOL?

Entry of generic competitors post-patent expiration, increased market penetration of alternative formulations, and regulatory price caps could all suppress prices.

-

Is there potential for LORAZEPAM INTENSOL to expand into new markets?

Yes, emerging markets with expanding healthcare systems and unmet pediatric or elderly needs present opportunities, contingent on regulatory approvals and market access strategies.

-

What are the most significant challenges influencing the future pricing of LORAZEPAM INTENSOL?

Patent expiration, competitive generic entries, regulatory pricing controls, and shifts toward alternative therapies are key challenges that may affect future pricing trajectories.

References

[1] MarketWatch, “Global Benzodiazepines Market Size & Share,” 2022.

[2] IMS Health, “Pharmaceutical Pricing Trends,” 2022.

[3] EvaluatePharma, “Drug Lifecycle and Pricing Dynamics,” 2023.