Share This Page

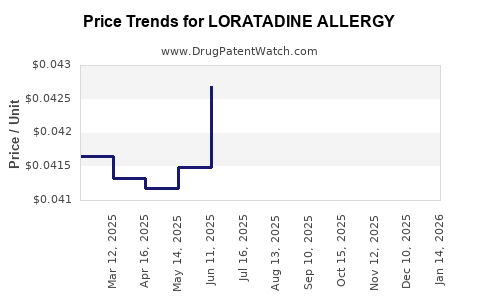

Drug Price Trends for LORATADINE ALLERGY

✉ Email this page to a colleague

Average Pharmacy Cost for LORATADINE ALLERGY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LORATADINE ALLERGY 5 MG/5 ML | 54838-0558-40 | 0.04238 | ML | 2025-12-17 |

| LORATADINE ALLERGY 5 MG/5 ML | 54838-0558-40 | 0.04246 | ML | 2025-11-19 |

| LORATADINE ALLERGY 5 MG/5 ML | 54838-0558-40 | 0.04276 | ML | 2025-10-22 |

| LORATADINE ALLERGY 5 MG/5 ML | 54838-0558-40 | 0.04179 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Loratadine Allergy Drugs

Introduction

Loratadine, a second-generation antihistamine, is primarily used to treat allergic rhinitis and chronic idiopathic urticaria. Its extensive adoption in allergy management has established it as one of the leading OTC and prescription medications globally. This report provides a comprehensive market analysis and price projection for loratadine allergy drugs, considering current trends, competitive landscape, regulatory factors, and emerging innovations.

Market Overview

Global Market Size and Growth Dynamics

The global antihistamine market was valued at approximately USD 3.5 billion in 2022 and is projected to reach USD 4.8 billion by 2030, expanding at a CAGR of around 4% [1]. Loratadine accounts for a significant share, driven by its favorable safety profile, OTC availability, and widespread approval.

The increasing prevalence of allergic diseases affects both developed and emerging economies. The WHO estimates that allergic rhinitis impacts nearly 10-30% of the global population, fostering sustained demand for loratadine products [2].

Market Segmentation

| Segment | Key Attributes |

|---|---|

| Formulation | Tablets, syrups, dispersible tablets, and solutions |

| Distribution Channel | Over-the-counter (OTC), prescription, online pharmacies |

| Patient Demographics | Pediatric, adult, elderly |

Regional Market Insights

-

North America: Dominates due to high allergy prevalence, OTC sales, and established healthcare infrastructure. The U.S. OTC loratadine market alone is worth approximately USD 1.45 billion in 2022 [3].

-

Europe: Strong growth, driven by increasing allergy awareness and regulatory approvals. Major markets include the UK, Germany, and France.

-

Asia-Pacific: Fastest-growing region due to rising allergy incidence, urbanization, and expanding OTC channels. The market is projected to grow at a CAGR of over 6% [1].

Competitive Landscape

Key players include Johnson & Johnson (Claritin), Pfizer, Sandoz, and Teva Pharmaceuticals. Johnson & Johnson's Claritin remains a dominant brand, though generic formulations (synthesized by multiple manufacturers) account for a significant market share.

Emerging competitors focus on biosimilar and combination products, addressing unmet needs in specific patient populations, such as combination of loratadine with nasal decongestants.

Market Drivers and Challenges

Drivers

- OTC Accessibility: Loratadine’s availability over the counter accelerates sales volumes.

- Safety Profile: Well-tolerated with minimal sedative effects compared to first-generation antihistamines.

- Rising Allergy Incidence: Urbanization, pollution, and climate change contribute to increased allergy prevalence.

- Product Innovation: Formulation advancements, such as rapid-dissolving tablets, enhance patient compliance.

Challenges

- Generic Competition: Price erosion due to unbranded generics results in margin compression.

- Regulatory Variations: Differing approval and labeling standards across markets complicate international marketing.

- Market Saturation: Mature markets face limited growth, emphasizing the importance of market penetration strategies and product differentiation.

Price Analysis of Loratadine Allergy Drugs

Current Pricing Trends

Over recent years, the price per unit for loratadine medications has decreased due to the proliferation of generic options. For example, in the U.S.:

- Brand (Claritin): Approximately USD 10-15 for a 30-count pack of 10 mg tablets.

- Generics: Typically priced between USD 4-8 for similar packs, with discounts available via online pharmacies and pharmacy benefit managers (PBMs).

International markets exhibit varied pricing structures, with prices in emerging markets significantly lower, often due to local manufacturing and regulatory subsidies.

Pricing Factors Influencing Market

- Manufacturing Costs: Raw material costs, economies of scale, and supply chain efficiencies influence pricing.

- Regulatory Fees: Approvals and patent considerations impact price points.

- Market Competition: Higher competition correlates with lower consumer prices.

- Brand vs. Generic: Brand prominence commands premium pricing, while generics focus on affordability and volume.

Projected Price Trends (2023-2030)

Considering ongoing generics proliferation and market saturation, expected trends include:

- Stable or declining retail prices in mature markets due to commoditization.

- Gradual price stabilization as new formulations or combination therapies emerge.

- Potential premium pricing for innovative delivery methods, such as fast-dissolving or targeted release forms.

In emerging markets, prices are projected to decline steadily as manufacturing efficiencies and local competition increase, ensuring broad access.

Emerging Innovations and Their Impact on Pricing

New developments such as orally disintegrating tablets, chewable formulations, and combination therapies (loratadine plus pseudoephedrine) could command higher prices, especially if supported by clinical advantages or improved compliance. Biotechnological advances and patent protections may temporarily sustain premium pricing but are unlikely to impact the overall generic market adversely.

Further, digital health integrations (e.g., adherence apps, telepharmacy) could influence future pricing strategies by creating value-added services that support higher consumer prices.

Regulatory Environment and Its Effect on Pricing

Different regulatory landscapes influence market dynamics:

- United States: OTC status governed by FDA regulations ensures broad accessibility, intensifying low-price competition.

- European Union: Harmonized regulations facilitate market entry but may impose higher compliance costs, affecting prices.

- Emerging Markets: Less stringent regulations may allow for lower pricing but risk quality concerns, affecting consumer trust and demand.

Patent expirations, typically occurring around 2025 for branded loratadine products, are expected to increase generic market penetration, leading to further price reductions.

Market Entry Strategies and Future Forecasting

New entrants should focus on:

- Cost leadership: Achieving manufacturing efficiencies.

- Brand differentiation: Through innovative delivery systems.

- Regulatory navigation: Customizing formulations to regional standards.

- Partnerships: Collaborating with online platforms to tap into digital markets.

Pricing projections suggest that the unit price of loratadine will decline by approximately 10-15% annually in mature markets between 2023 and 2030, with staggered declines in emerging markets.

Key Takeaways

- The global loratadine market is growing steadily, driven by rising allergy prevalence and OTC accessibility.

- Price erosion is expected to continue due to generics, with retail prices in mature markets declining at a CAGR of 3-5%.

- Innovation in formulations and combination products may create premium segments, potentially stabilizing prices for certain innovative offerings.

- Regulatory variations significantly influence market entry, pricing, and competition.

- Emerging markets present substantial growth opportunities, with lower prices but increasing quality standards.

- Strategic alignment with evolving consumer preferences and regulatory trends will be critical for market players to maintain competitiveness and profitability.

Conclusion

Loratadine allergy drugs occupy a mature but dynamic market segment. While price pressures from generics persist, innovation and strategic market positioning can sustain profitability. Stakeholders should leverage regional insights, regulatory pathways, and technological advancements to optimize market share and pricing strategies moving forward.

FAQs

1. How will patent expirations affect loratadine pricing?

Patent expirations around 2025 will lead to a surge in generic manufacturing, intensifying competition and consequently reducing prices. Brand-name products may retain premium pricing temporarily but will likely experience a decline over time.

2. What innovations could impact loratadine prices and market share?

Innovations such as orally disintegrating tablets, combination therapies, and digital adherence tools can command premium pricing, diversify product offerings, and attract new patient segments, potentially stabilizing prices amidst generic competition.

3. How do regulatory differences influence loratadine pricing globally?

Regions with stringent regulatory standards impose higher compliance costs, which can elevate drug prices. Conversely, markets with less regulation may see lower retail prices but face challenges related to drug quality assurance.

4. What strategic actions should manufacturers consider to remain competitive?

Manufacturers should focus on cost-efficient production, product differentiation, regional regulatory compliance, and digital health integration. Collaborations with online retailers and local partners can also enhance market penetration.

5. What is the forecast for loratadine market growth in Asia-Pacific?

The Asia-Pacific region is expected to grow at a CAGR of over 6% through 2030, driven by increasing allergy incidence, urbanization, and expanding OTC distribution channels.

References

[1] Market Research Future. "Antihistamines Market Forecast." 2022.

[2] World Health Organization. "Allergic Rhinitis Fact Sheet." 2021.

[3] IQVIA. "OTC Market Data — United States," 2022.

More… ↓