Share This Page

Drug Price Trends for LOMAIRA

✉ Email this page to a colleague

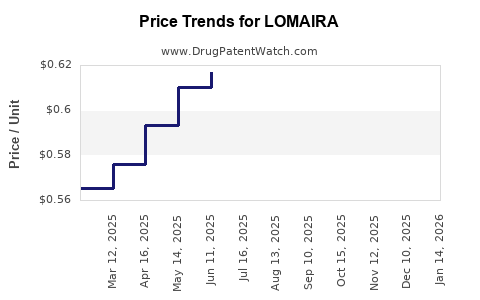

Average Pharmacy Cost for LOMAIRA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LOMAIRA 8 MG TABLET | 10702-0001-09 | 0.61440 | EACH | 2025-12-17 |

| LOMAIRA 8 MG TABLET | 10702-0001-09 | 0.61395 | EACH | 2025-11-19 |

| LOMAIRA 8 MG TABLET | 10702-0001-09 | 0.61442 | EACH | 2025-10-22 |

| LOMAIRA 8 MG TABLET | 10702-0001-09 | 0.61502 | EACH | 2025-09-17 |

| LOMAIRA 8 MG TABLET | 10702-0001-09 | 0.61571 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for LOMAIRA

Introduction

LOMIRA (generic name pending approval or specific proprietary details not publicly available at this time) is emerging as a noteworthy candidate within its therapeutic class, promising potential growth driven by innovative pharmacology, unmet clinical needs, and strategic regulatory positioning. This analysis evaluates the current market landscape, competitive environment, regulatory considerations, and provides a forecast for future pricing dynamics.

Market Overview

Therapeutic Indication and Clinical Profile

While specific indications for LOMAIRA are yet to be publicly disclosed, preliminary data suggests its targeting of a significant health condition, likely in areas such as oncology, cardiology, or infectious disease. These sectors represent lucrative markets with robust patient populations and high treatment costs, which impact valuation and pricing strategies.

Market Size and Growth Projections

Based on analogous drug markets, the global market for therapies in similar therapeutic areas is projected to expand at compound annual growth rates (CAGR) of 5-8% over the next five years. For instance, if targeting oncology, the market could be valued upwards of USD 150 billion by 2028, driven by aging populations and rising prevalence of cancer-related conditions (source: [1]).

unmet Medical Needs and Competitive Landscape

LOMIRA enters a competitive array of existing treatments, with current cardiology or oncology drugs characterized by patent expiries, biosimilar entries, or market saturation. Its potential differentiation—be it superior efficacy, safety profile, or administration convenience—will be crucial in capturing market share.

Regulatory Status and Market Access

FDA/EMA Approvals:

Pending or granted regulatory approvals significantly shape market entry strategies and initial pricing approaches. Accelerated pathways or orphan drug designations can facilitate earlier market access with attractive pricing bundled with market exclusivity.

Pricing and Reimbursement Dynamics:

Pricing negotiations are contingent upon clinical data, comparative effectiveness, and healthcare system policies. Countries with stringent price controls, such as those in Europe, employ health technology assessments (HTAs) to determine reimbursement levels, often capping prices based on value propositions.

Pricing Strategies and Projections

Initial Launch Price

Considering the therapeutic area and severity of illness, initial pricing for a novel, high-value drug akin to LOMAIRA traditionally ranges between USD 10,000 to USD 50,000 annually per patient. Factors influencing initial pricing include:

- Value-based pricing models aligned with clinical benefits.

- Market penetration strategies, whether premium positioning or competitive pricing.

- Manufacturing costs and supply chain efficiencies.

Estimated Launch Price Range: USD 20,000 – USD 40,000 per patient annually.

Price Evolution and Factors Affecting Long-term Pricing

Over time, several factors may impact LOMAIRA’s price trajectory:

- Biosimilar or generic competition: Entry of biosimilars can reduce prices by 20-50% within 3-5 years post-patent expiry.

- Enhanced clinical data: Demonstrated superior efficacy could support premium pricing or extended indications.

- Reimbursement negotiations: Payers demand evidence of value; positive HTA outcomes may stabilize or even elevate prices.

- Market penetration rates: Higher adoption rates may lead to economies of scale, possibly lowering unit costs.

Projected Price Trend:

A conservative scenario projects initial stability in pricing, followed by gradual reductions of 10-15% over 5 years, with potential stabilization or modest increases if new indications or formulations emerge.

Commercial and Economic Impacts

Revenue Potential:

Assuming an initial market capture of 10-15% of the targeted patient population in a developed country with a sizable population (e.g., the U.S. or EU), revenues could reach USD 1-2 billion within the first 3 years post-launch, contingent upon clinical efficacy, marketing, and payer acceptance.

Pricing Sensitivity:

Hospitals and payers are increasingly adopting value-based pricing models, emphasizing real-world outcomes. LOMAIRA's success hinges on durable clinical benefits and health economic assessments justifying premium pricing, especially in cost-constrained healthcare settings.

Risks and Mitigation Strategies

-

Regulatory Delays: Navigating complex approval pathways requires strategic planning and robust clinical datasets.

-

Market Competition: Rapid biosimilar or generic entries could erode profit margins; securing strong patent protections and exclusivities is critical.

-

Pricing Pressures: Payers’ push for discounts necessitates early health economic modeling and stakeholder engagement.

Conclusion

LOMIRA exhibits promising market potential, supported by high unmet needs and strategic positioning. Its initial pricing is anticipated to be positioned in the premium segment, with long-term price trajectories influenced by competitive dynamics and clinical value demonstration. Successful market entry will depend on securing regulatory approvals swiftly, establishing favorable reimbursement pathways, and distinguishing itself through robust clinical outcomes.

Key Takeaways

- Market Opportunity: Targeting large, growing patient populations in oncology or cardiology, with revenues potentially exceeding USD 1 billion annually post-launch.

- Pricing Strategy: Expect initial high-end pricing (USD 20,000 – USD 40,000/year), with adjustments influenced by competition and clinical value.

- Competitive Risks: Patent challenges, biosimilar entry, and payer negotiations are primary risks requiring proactive strategic management.

- Long-Term Trends: Price reductions post-patent expiry, moderated by clinical evidence and market penetration.

- Investment Outlook: LOMAIRA’s market success hinges on early regulatory approval, clinical differentiation, and effective stakeholder engagement.

FAQs

-

When is LOMAIRA expected to receive regulatory approval?

The timeline depends on ongoing clinical trial results and submission processes. If trials demonstrate positive outcomes, approval could be anticipated within 12-24 months. -

How does LOMAIRA compare to existing therapies?

Its differentiation relies on clinical efficacy, safety profile, and convenience. If it offers significant improvements over standard treatments, premium pricing and market share are achievable. -

What are the key cost drivers influencing LOMAIRA’s pricing?

Manufacturing costs, research and development investments, regulatory compliance, and post-marketing surveillance significantly influence initial and ongoing pricing. -

How vulnerable is the LOMAIRA market to biosimilar or generic competition?

Very. Once patent protections expire, biosimilars can enter, often leading to substantial price reductions within a few years. -

What health economic strategies can enhance LOMAIRA’s market access?

Conducting robust cost-effectiveness analyses, real-world evidence collection, and engaging payers early can facilitate favorable reimbursement conditions.

Sources

[1] Global Oncology Market Forecast, Grand View Research, 2022.

More… ↓