Last updated: July 28, 2025

Introduction

Lofexidine is a centrally acting alpha-2 adrenergic receptor agonist primarily indicated for the management of opioid withdrawal symptoms. Originally approved by the U.S. Food and Drug Administration (FDA) in 2018 under the brand name Lucemyra, it offers a non-opioid alternative to treat opioid detoxification, aligning with the rising demand for safer withdrawal remedies amidst the opioid epidemic. This analysis evaluates the drug’s current market landscape, including key drivers, competitive positioning, regulatory factors, and future pricing trajectories.

Market Overview

Global Market Context

The global opioid withdrawal management market projects robust growth driven by increasing opioid dependence globally. The World Health Organization reports that opioid use disorders affect millions worldwide, with Western countries, particularly the United States, bearing the highest burden. According to MarketsandMarkets, the global opioid dependence treatment market was valued at approximately USD 8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 8.5% through 2027 (1).

Lofexidine’s potential extends across several countries, primarily in North America and Europe, where opioid crisis management and innovative detoxification therapies are high priorities. Its non-opioid profile positions it favorably amid stricter regulations and an increased focus on safety in addiction treatment.

Market Drivers

-

Rising Opioid Crisis: The escalating opioid epidemic in North America, especially in the US, enhances demand for effective withdrawal management solutions. According to the CDC, over 107,000 drug overdose deaths occurred in the US in 2021, with opioids involved in 75% of these deaths (2).

-

Patient Preference Shift: Patients and providers prefer non-opioid alternatives due to concerns about dependency, adverse effects, and regulatory scrutiny associated with opioid medications.

-

Regulatory Approvals and Reimbursement: Since FDA approval in 2018, Lucemyra has garnered coverage from major insurers, facilitating access. Further regulatory support can spur broader adoption.

-

Expansion into New Markets: Pending approvals in Europe, Asia, and other regions can significantly expand the market reach.

Competitive Landscape

Lofexidine's primary competitors include:

- Clonidine: An off-label alternative used off-record for opioid withdrawal, offering lower cost but variable efficacy and side effect profiles.

- Methadone and Buprenorphine: Opioid agonists used for withdrawal and maintenance; while effective, they carry dependency risks [3].

- Other Non-Opioid Agents: Various supportive medications like lofexidine-specific formulations under development.

The differentiation of lofexidine hinges on its receptor selectivity, safety profile, and regulatory status, giving it a competitive edge over off-label options.

Regulatory and Patent Landscape

Regulatory Status

Initially approved exclusively in the US, lofexidine's approval was facilitated by its design to meet high safety standards. Other jurisdictions are evaluating approval pathways, notably through the European Medicines Agency (EMA), with submissions ongoing. The regulatory framework will influence access and pricing.

Patent and Exclusivity

The original patent for Lucemyra expired or is nearing expiry in the US, opening pathways for generic formulations, which could substantially impact pricing. However, the medication's patent landscape varies by region, with some jurisdictions offering data exclusivity and secondary patents protecting formulations or delivery methods.

Pricing Landscape

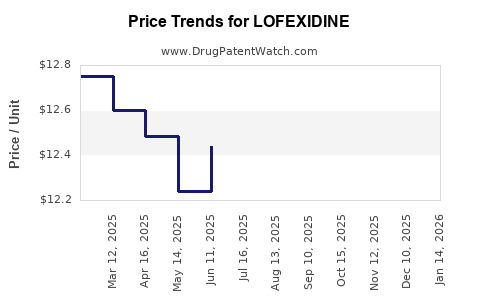

Current Price Points

In the US, Lucemyra is priced around USD 1,200–1,300 per 30-day supply (dosage-dependent). This premium reflects the novelty, regulatory approval, and clinical benefits over off-label options. Insurance coverage mitigates out-of-pocket costs, but high list prices influence overall market penetration.

Price Drivers

- Regulatory Acceptance: Approved medications generally command premium prices, especially if they address unmet needs.

- Market Competition: The emergence of generics could reduce prices, potentially by 40-60% within 2-3 years post-patent expiry.

- Manufacturing Costs: Costs associated with formulation, quality control, and distribution impact initial pricing strategies.

- Reimbursement Policies: Favorable reimbursement supports higher pricing; restrictive policies suppress it.

Future Price Projections

- Short Term (1-3 years): As patent life continues, prices are likely to remain stable or slightly decrease (5-10%), contingent upon insurer negotiations and formulary placements.

- Mid to Long Term (3-7 years): Entry of generics could precipitate a sharp decline in prices, potentially to USD 400–600 per 30-day supply, aligning with typical generic drug price reductions [4].

- Impact of Market Expansion: Approvals in Europe and Asia may initially sustain higher prices due to regional regulatory and market dynamics but are expected to trend downward with increased competition.

Scenario Analysis:

- Optimistic Scenario: Effective reimbursement and rapid market penetration sustain higher prices (~USD 1,200) longer; sales grow robustly.

- Conservative Scenario: Early patent expiry and aggressive generic competition reduce prices rapidly; growth slows but volume increases.

Market Penetration Strategies

- Stakeholder Engagement: Collaborating with healthcare providers and payers can improve adoption.

- Clinical Evidence: Demonstrating superior safety and efficacy can justify premium pricing.

- Regulatory Approvals: Expanding indications and regional clearances open avenues for growth and pricing strategies.

- Manufacturing Efficiency: Cost reduction through scale can facilitate competitive pricing.

Key Challenges Impacting Pricing

- Patent Expiry: Generic entry fundamentally drive prices lower.

- Pricing Pressure: Payers increasingly demand cost-effective alternatives.

- Market Saturation: Competition from established therapies or off-label options limits pricing flexibility.

Conclusion

Lofexidine occupies a niche in opioid withdrawal management, with its market poised for continued growth given the escalating opioid epidemic. Its pricing trajectory will be significantly influenced by patent status, regulatory approval in multiple markets, the competitive landscape, and reimbursement policies. Initially positioned as a premium option, impending patent expirations and market competition will likely lead to substantial price reductions, aligning with generic drug trends. Companies planning market entry or expansion should focus on deploying robust clinical evidence, strategic partnerships, and cost-effective manufacturing to optimize pricing and market capture.

Key Takeaways

- The global opioid withdrawal management market is expanding rapidly, driven by the opioid epidemic and demand for safer treatments.

- Lofexidine's FDA approval positions it as a leading non-opioid withdrawal therapy with premium pricing potential.

- Patent expirations and generic competition are expected to substantially lower prices within 3-5 years.

- Market expansion into Europe and Asia could initially sustain higher prices and volumes but will be moderated by local regulatory and competitive factors.

- Strategic stakeholder engagement and clinical differentiation are vital for maintaining favorable pricing and market share.

FAQs

1. When is generic lofexidine expected to enter the market, and how will it impact prices?

Generic lofexidine could enter approximately 2-3 years post-patent expiry, potentially reducing prices by up to 60%. This will widen access but challenge revenue streams for brand-name manufacturers.

2. Are there any significant regulatory hurdles for lofexidine in jurisdictions outside the US?

Regulatory pathways vary; approval in Europe and Asia depends on regional evaluations of safety and efficacy, with potential delays or additional requirements potentially affecting market entry timelines.

3. How does lofexidine compare cost-wise to alternative withdrawal treatments?

Lofexidine's premium pricing reflects its novel status. Traditional off-label options like clonidine are less costly but offer inferior safety profiles and variable efficacy, often influencing treatment choices.

4. What factors could sustain higher pricing for lofexidine beyond patent expiry?

Limited competition, exclusive regional rights, or formulation patents, coupled with clinical superiority and reimbursement support, could maintain higher prices temporarily.

5. How can companies leveraging lofexidine for opioid withdrawal capitalize on market dynamics?

By establishing robust clinical data, securing regulator approvals in key markets, negotiating favorable reimbursement policies, and planning for cost-effective manufacturing, companies can optimize profitability amid evolving market prices.

References:

- MarketsandMarkets. (2022). Opioid Dependence Treatment Market by Drug Type, Route of Administration, and Region.

- Centers for Disease Control and Prevention (CDC). (2022). Drug Overdose Deaths.

- U.S. Food and Drug Administration. (2018). FDA Approves Lucemyra for Management of Opioid Withdrawal.

- GoodRx. (2023). Drug Price Comparisons and Trends.