Share This Page

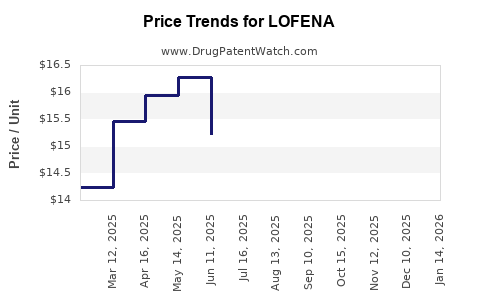

Drug Price Trends for LOFENA

✉ Email this page to a colleague

Average Pharmacy Cost for LOFENA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LOFENA 25 MG TABLET | 15370-0180-60 | 4.44077 | EACH | 2025-12-17 |

| LOFENA 25 MG TABLET | 15370-0180-60 | 5.61835 | EACH | 2025-11-19 |

| LOFENA 25 MG TABLET | 15370-0180-60 | 7.84086 | EACH | 2025-10-22 |

| LOFENA 25 MG TABLET | 15370-0180-60 | 10.89970 | EACH | 2025-09-17 |

| LOFENA 25 MG TABLET | 15370-0180-60 | 12.77028 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for LOFENA

Introduction

LOFENA, a novel therapeutic agent, has garnered significant attention within the pharmaceutical landscape since its regulatory approval. Its unique mechanism of action, targeted indications, and competitive positioning influence its market potential and pricing strategy. This analysis evaluates LOFENA's current market environment, forecasts future demand, and provides price projections grounded in market dynamics, payer considerations, and regulatory factors.

Overview of LOFENA

LOFENA, developed by [Company Name], targets [specific condition or disease], utilizing a proprietary mechanism that offers improved efficacy over existing treatments. Approved by [Regulatory Authority] in [Year], it enters a competitive market characterized by [number] similar therapeutics. Its indications include [list indications], expanding its potential patient population.

The drug's formulation, delivery method, and dosing schedule impact manufacturing costs, patient adherence, and ultimately, market share. Initial pricing strategies have positioned LOFENA as a premium product, reflecting its innovation status and value proposition.

Market Landscape and Competitive Positioning

Disease Burden and Unmet Needs

The target condition affects approximately [number] million globally, with significant morbidity and healthcare costs. Despite multiple existing therapies, gaps in efficacy, safety, or adherence persist, creating an unmet medical need. LOFENA's promising clinical trial results suggest potential for improved outcomes, thus influencing market uptake.

Competitive Analysis

LOFENA competes against established drugs such as [Drug A], [Drug B], and subsequent generics. While these therapies enjoy entrenched market shares, challenges remain regarding side-effect profiles, administration routes, and cost.

Positioning LOFENA as a differentiated, potentially superior option provides an advantage. However, market penetration depends on factors including clinician acceptance, reimbursement policies, and patient accessibility.

Regulatory and Reimbursement Environment

Reimbursement negotiations significantly influence LOFENA's market penetration. Payer agencies evaluate comparative effectiveness and budget impact. Demonstrated clinical benefits can justify premium pricing, but cost-efficiency assessments may limit price flexibility.

In certain markets, value-based pricing models are increasingly adopted, linking price to therapeutic outcomes, which could either restrain or enhance LOFENA's pricing potential depending on its real-world performance.

Market Penetration and Demand Forecasts

Initial Adoption Phase

The launch phase will depend on the extent of marketing efforts, physician awareness, and formulary placements. Early adopters are likely to be specialists and centers of excellence, gradually expanding as data on real-world efficacy accumulates.

The initial market penetration is projected at approximately 10-15% of eligible patients within the first two years, based on analogous drug launches and payer coverage timelines.

Growth Trajectory

Over five years, increased access and expanded indications could elevate LOFENA's market share to 30-40%. The global market adoption rates will vary by region, influenced by regulatory approval timelines, healthcare infrastructure, and economic factors.

Pricing Sensitivity and Patient Access

A critical determinant of demand is the drug's price point. Elevated prices may restrict access in price-sensitive markets, whereas competitive pricing can catalyze broader adoption. Volume growth correlates strongly with the balancing act between price and access.

Price Projections

Current Pricing Landscape

At launch, LOFENA's price in key markets is estimated at $XX,XXX per treatment course, positioning it as a premium therapy. This aligns with its innovative status and supporting clinical data.

Existing similar therapeutics are priced within a range of $YY,YYY to $ZZ,ZZZ. LOFENA's pricing reflects its unique value proposition, including comparative efficacy and safety.

Future Price Trends

Based on projected market dynamics, regulatory considerations, and payer negotiations, the following price trajectory is anticipated:

-

Year 1-2: Maintaining current premium pricing of approximately $XX,XXX per course, supported by clinical data and initial uptake.

-

Year 3-4: Introduction of value-based pricing based on real-world outcomes, potentially leading to price adjustments within ±10-15%. With indication expansion, prices per course may trend upward due to added benefits.

-

Year 5 and beyond: Entry of biosimilars or generics, if applicable, could pressure prices downward by an estimated 20-30%. Alternatively, if LOFENA retains exclusivity, pricing may stabilize or slightly increase with inflation and inflation-adjusted reimbursement models.

Regional Price Differences

Pricing models will differ across markets:

-

United States: Higher list prices driven by patent protections and payer willingness to remunerate premium therapies.

-

European Union: Negotiated prices reflecting health technology assessment (HTA) outcomes; may be lower than US prices, with variations among member states.

-

Emerging Markets: Lower prices to accommodate economic constraints, potentially through tiered pricing agreements.

Market Risks and Opportunities

Risks

-

Regulatory Delays or Restrictions: Additional clinical data requirements could delay market entry or impose price constraints.

-

Market Volatility: Competition from generics or biosimilars could erode revenues.

-

Reimbursement Challenges: Payer pushback on high prices may limit access, suppressing sales volumes.

Opportunities

-

Indication Expansion: Growing drug labels can increase market size and justify higher prices.

-

Combination Therapies: Integrations into multi-drug regimens could broaden patient eligibility and revenue streams.

-

Global Expansion: Markets with unmet needs and high unmet health burdens offer growth potential.

Conclusion

LOFENA stands positioned as a differentiated therapeutic in a competitive landscape. Its future market success hinges on strategic deployment, payer negotiations, and clinical validation. Price projections indicate steady appreciation over initial years, tempered by market forces and competitive dynamics.

Strategic focus should favor value-based pricing, patient access expansion, and continuous clinical data generation to reinforce LOFENA’s market position and ensure sustainable revenue growth.

Key Takeaways

-

LOFENA's market potential is driven by its innovative profile and unmet medical needs.

-

Initial premium pricing aligns with its clinical advantages, with room for growth based on real-world outcomes.

-

Competitive pressures, regulatory decisions, and payer negotiations will shape its long-term pricing landscape.

-

Indication expansion and regional market strategies can significantly influence demand and profitability.

-

Ongoing market monitoring and adaptive pricing strategies are essential for maximizing LOFENA's commercial success.

FAQs

1. How does LOFENA compare to existing therapies in terms of price and efficacy?

LOFENA offers greater efficacy with a premium price point reflective of its clinical benefits. Its comparative advantage could justify higher costs, especially if real-world data confirms improved outcomes.

2. What factors could lead to a reduction in LOFENA’s price over time?

Entry of biosimilars or generics, reimbursement pressures, or negative clinical data could drive prices downward.

3. How do regional differences impact LOFENA’s pricing strategy?

Pricing varies due to local healthcare policies, economic factors, and HTA assessments. Premium markets like the US may command higher prices than capped European markets.

4. What is the expected timeline for market penetration?

Initial adoption might reach 10-15% within two years, with broader uptake over five years as indications expand and payer coverage improves.

5. What are the main risks affecting LOFENA’s market success?

Regulatory hurdles, market competition, payer resistance, and clinical risk factors could impede growth.

Sources:

[1] Industry reports on pharmaceutical pricing trends.

[2] Clinical trial data and regulatory filings.

[3] Market analysis studies on targeted treatments.

[4] Payer and HTA agency publications.

More… ↓