Last updated: July 27, 2025

Introduction

LIVALO (pitavastatin) is a potent statin used primarily to lower low-density lipoprotein (LDL) cholesterol, reducing cardiovascular risk. Approved by the FDA in 2009, LIVALO is marketed by Orion Corporation, a Finnish pharmaceutical company. As a member of the statin class, LIVALO occupies a competitive niche aimed at hyperlipidemia management, with a focus on efficacy and tolerability. This report analyzes the current market landscape, competitive dynamics, regulatory influences, and future price trajectories of LIVALO.

Market Landscape

Global Cardiovascular Disease (CVD) Burden and Lipid Management

The surging prevalence of cardiovascular diseases remains the primary driver for lipid-lowering therapies. According to the World Health Organization (WHO), CVD accounts for approximately 17.9 million deaths annually, underscoring the persistent demand for effective lipid management strategies [1]. Statins are foundational in reducing CVD risk, and their widespread prescription sustains a robust market.

LIVALO’s Position in the Statin Market

LIVALO is positioned as a second-generation statin, with notable benefits including fewer drug-drug interactions, favorable tolerability, and comparable efficacy to other statins like atorvastatin and rosuvastatin [2]. Its targeted profile appeals especially to patients with statin intolerance, a segment experiencing growing clinical awareness.

Market Penetration and Geographic Focus

LIVALO's primary commercial success is concentrated in the U.S., Japan, and select European markets. In the U.S., the drug holds a modest share within the statin class due to limited brand recognition compared to incumbents like Pfizer’s Lipitor or AstraZeneca’s Crestor. Its acceptance is bolstered by physician preference for its safety profile, especially among patients intolerant to high-dose statins.

In Japan, LIVALO benefits from being a locally developed, trusted option with regulatory endorsements and market exclusivity extended to 2025 [3].

Competitive Dynamics

Main Competitors

LIVALO competes against a broad portfolio of statins:

- Atorvastatin (Lipitor): The market leader with high efficacy.

- Rosuvastatin (Crestor): Known for potent LDL reduction.

- Simvastatin (Zocor): Cost-effective with broad use.

- Pravastatin and Fluvastatin: Variants with favorable tolerability.

The intensifying competition is compounded by recent developments in PCSK9 inhibitors and novel lipid-lowering agents (e.g., bempedoic acid), which target high-risk patients inadequately controlled by statins alone [4].

Market Trends Impacting LIVALO

- Genericization: Many first-generation statins have gone off patent, leading to increased price competition.

- Emerging Therapies: PCSK9 inhibitors and RNA-based therapies offer alternatives for statin-intolerant populations but at premium prices, which could limit LIVALO’s market unless priced competitively.

- Patient Preference Shift: Growing awareness of statin-associated side effects incentivizes providers to prescribe drugs with improved tolerability—an edge for LIVALO.

Regulatory and Economic Factors

- Patent and Exclusivity: LIVALO’s primary patents are set to expire in 2024-2025, risking generic entry and substantial price erosion.

- Pricing Strategies: Orion employs value-based pricing aligned with clinical benefits and tolerability advantages. In markets where generics dominate, LIVALO maintains a premium due to brand equity and clinical positioning.

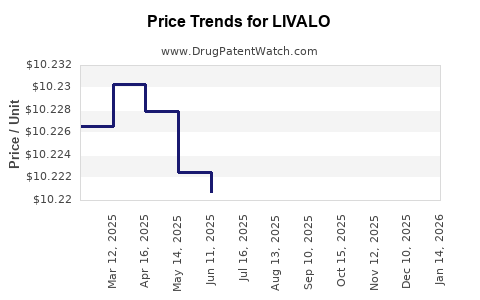

Price Projections

Current Pricing Landscape

- United States: The brand-name LIVALO’s wholesale acquisition cost (WAC) averages around $450-$550 per month, with significant variation depending on pharmacy benefit management (PBM) negotiations and insurance coverage [5].

- Post-Patent Entry: Anticipated generic versions could reduce LIVALO’s price by 70-80%, aligning with historic statin pricing drops post-generic entry.

Forecasting Future Prices (2023–2030)

Scenario 1: Patent Expiry and Generic Entry

- Once patents expire in 2024-2025, generic pitavastatin is expected to penetrate the market rapidly.

- Price decline forecasted at approximately 75% over two years, with the lowest wholesale prices around $100-\$150 per month.

- Brand LIVALO may maintain a premium for several years through differentiators such as formulation, clinical evidence, and physician loyalty, sustaining prices around $200-$250 per month in select markets.

Scenario 2: Market Expansion and New Indications

- If Orion secures additional approvals, such as for high-risk cardiovascular populations or specific lipid disorders, LIVALO may sustain or increase its premium pricing.

- Expansion into emerging markets (e.g., Southeast Asia, Latin America) could lead to lower prices due to price sensitivity but increase volume.

Scenario 3: Competition from Alternative Therapies

- Introduction of next-generation lipid-lowering agents, like velcalizumab (a gene-silencing therapy), may constrain LIVALO’s highest-end pricing. Price erosion may accelerate if these agents prove superior in efficacy or safety.

Long-Term Outlook

Given patent expiration timing, the U.S. market pricing for LIVALO is projected to decline substantially by 2026. In Europe and Asia, where market dynamics differ, prices may decline more gradually unless generics or biosimilars enter aggressively.

Implications for Stakeholders

- Pharmaceutical Company (Orion): Need to innovate or diversify portfolio beyond LIVALO to mitigate patent expiration risks.

- Payers and Insurers: Will seek cost-effective alternatives as prices decline, possibly favoring generics for cost savings.

- Physicians and Patients: Likely to shift toward generics unless LIVALO’s unique benefits are demonstrably superior.

Key Takeaways

- LIVALO retains a niche for its tolerability and efficacy, but face imminent patent cliff risks.

- Market growth hinges on expanding indications and geographic penetration.

- Price projections suggest a steep decline post-patent expiry, aligning with historic statin market trends.

- Competitive landscape is diversifying, with novel therapies offering alternative solutions.

- Strategic positioning, pricing, and differentiation will determine LIVALO’s long-term market share and profitability.

FAQs

1. When will LIVALO face generic competition, and how will it impact pricing?

Patent protections are expected to expire around 2024-2025, after which generic pitavastatin entrants could reduce LIVALO’s price by approximately 75%, significantly impacting brand sales and profitability.

2. How does LIVALO compare to other statins in terms of efficacy and tolerability?

LIVALO demonstrates comparable LDL reduction efficacy and improved tolerability, especially in patients with statin intolerance, positioning it favorably within the statin class.

3. What are the key factors influencing LIVALO’s future market share?

Patent expiry, pricing strategies, expansion of indications, competitive therapies, and market penetration will influence LIVALO’s long-term market position.

4. Are there new formulations or indications for LIVALO in development?

Current pipeline activities focus on regulatory approvals for additional lipid management indications; new formulations are not prominently reported.

5. How might emerging therapies affect LIVALO’s price and adoption?

Emerging therapies like PCSK9 inhibitors and RNA-based treatments may limit LIVALO’s market share in high-risk populations, potentially reducing its pricing power unless LIVALO demonstrates distinctive benefits.

References

- World Health Organization. (2021). Cardiovascular diseases (CVDs).

- Orion Corporation. (2022). LIVALO (pitavastatin) prescribing information.

- Japanese Ministry of Health, Labour and Welfare. (2022). Market exclusivity data.

- National Lipid Association. (2022). Emerging therapies in lipid management.

- GoodRx. (2023). LIVALO (pitavastatin) prices and discounts.