Share This Page

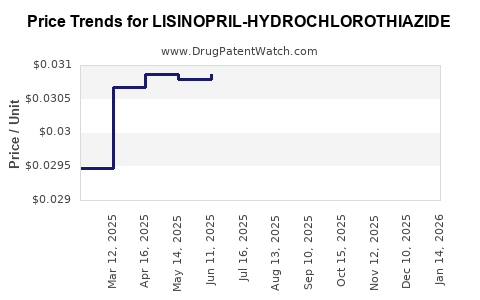

Drug Price Trends for LISINOPRIL-HYDROCHLOROTHIAZIDE

✉ Email this page to a colleague

Average Pharmacy Cost for LISINOPRIL-HYDROCHLOROTHIAZIDE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LISINOPRIL-HYDROCHLOROTHIAZIDE 10-12.5 MG TAB | 00591-0860-05 | 0.03068 | EACH | 2025-12-17 |

| LISINOPRIL-HYDROCHLOROTHIAZIDE 10-12.5 MG TAB | 43547-0420-50 | 0.03068 | EACH | 2025-12-17 |

| LISINOPRIL-HYDROCHLOROTHIAZIDE 10-12.5 MG TAB | 68180-0518-01 | 0.03068 | EACH | 2025-12-17 |

| LISINOPRIL-HYDROCHLOROTHIAZIDE 10-12.5 MG TAB | 43547-0420-10 | 0.03068 | EACH | 2025-12-17 |

| LISINOPRIL-HYDROCHLOROTHIAZIDE 20-25 MG TAB | 76282-0448-90 | 0.04281 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Lisinopril-Hydrochlorothiazide

Introduction

Lisinopril-Hydrochlorothiazide (Lisinopril-HCTZ) is a fixed-dose combination medication primarily indicated for the treatment of hypertension and congestive heart failure. Its significance stems from its dual mechanism: Lisinopril, an ACE inhibitor, reduces blood pressure by vasodilation, while Hydrochlorothiazide, a thiazide diuretic, assists in decreasing blood volume. The combination offers enhanced adherence, efficacy, and a simplified regimen for hypertensive patients.

The drug's competitive landscape, market potential, and pricing dynamics are influenced by regulatory policies, patent statuses, generic entry, and evolving clinical guidelines. Analyzing these factors provides insight into current trends and future price trajectories.

Regulatory and Patent Landscape

Lisinopril-HCTZ formulations have largely transitioned from branded to generic versions, following patent expirations. The original branded formulations, such as Prinivil or Zestril (Lisinopril) combined with existing diuretic formulations, have been on the market for decades. However, patent protections for combination drugs tend to be weak or non-existent, facilitating rapid generic entry post-expiry.

The availability of multiple approved generic versions in the United States, authorized under the Hatch-Waxman Act, has driven prices downward significantly. Regulatory agencies like the FDA have approved numerous generic manufacturers, further increasing competition.

Impact on Pricing:

Patent expiration and subsequent generic proliferation have been pivotal in reducing Lisinopril-HCTZ prices. Although branded products initially commanded premium pricing, generic competition has made the combination affordable, boosting access and adherence.

Market Dynamics and Key Players

Current Market Size

The global antihypertensive market was valued at approximately USD 25 billion in 2022, with fixed-dose combinations (FDCs) representing a growing segment, driven by their convenience and improved compliance. Lisinopril-hydrochlorothiazide accounts for a significant subset within this class, serving as a first-line therapy in many clinical guidelines.

Competitive Landscape

- Generic Suppliers: Over 10 manufacturers in the U.S. market produce Lisinopril-HCTZ generics, leading to intense price competition.

- Branded Firms: Merck and other pharmaceutical firms attempted to extend patent protections via formulation patents; however, most have expired or faced legal challenges, limiting their influence on pricing.

- Biosimilars and Alternatives: Although biosimilars are not applicable for this small-molecule drug, alternative combinations or mono-therapies compete in the broader antihypertensive market.

Market Share Trends:

Generics now dominate the market, with branded formulations holding less than 5% of sales. This saturation further suppresses prices but ensures wide access to the drug.

Price Trends and Projections

Historical Price Trends

Following patent expirations around 2010-2015, U.S. prices for Lisinopril-HCTZ fell sharply. Initially costing around USD 15-20 per month for branded pills, prices for generic versions now hover around USD 4–8 per month, depending on dosage and pharmacy discounts.

Factors Influencing Future Prices

- Market Saturation: Continued proliferation of generic manufacturers will sustain competitive pressure, preventing significant price increases.

- Regulatory Changes: Policy shifts favoring biosimilars and generic drug utilization could further suppress prices.

- Supply Chain Factors: Raw material costs, manufacturing capacity, and logistics disruptions can influence pricing stability.

- Inflation and Healthcare Policies: Price adjustments may occur in line with inflation or reimbursements policies but are unlikely to reverse downtrend trends due to established generic competition.

Future Price Projections (Next 5-10 Years)

- Stable to Slight Decrease: Prices for standard dosages are expected to remain stable or decrease marginally, with annual fluctuations of 0-2%, primarily due to pharmacy discounts, rebates, and insurance negotiations.

- Potential for Minor Price Increases: Rare but possible if raw material shortages or manufacturing issues arise, or if regulatory barriers lead to reduced competition.

- Emergence of Value-Based Pricing: As healthcare systems increasingly adopt value-based models, payers may negotiate for even lower rates, reinforcing the downward trend.

In summary, Lisinopril-HCTZ prices are unlikely to rise significantly in the foreseeable future. Instead, they will likely maintain low levels due to saturated generic competition, with minimal fluctuations driven by external factors.

Market Opportunities and Challenges

Opportunities:

- Continued high demand for affordable antihypertensives worldwide.

- Growing acceptance of fixed-dose combinations enhances adherence, expanding use.

- Potential entry into emerging markets with limited drug access.

Challenges:

- Increased price sensitivity among payers and patients.

- The potential for new, more effective antihypertensives or combination drugs that could cannibalize market share.

- Regulatory hurdles that may impact generic manufacturing or approval processes.

Conclusion

The Lisinopril-Hydrochlorothiazide market exhibits mature, price-competitive characteristics, dominated by generic manufacturers. Historically, prices have declined sharply following patent expiry, and this trend is likely to persist, with prices remaining low or decreasing slightly in the coming years.

Given the drug’s proven efficacy, affordability, and inclusion in standard treatment guidelines, it will continue to be a mainstay therapy for hypertensive patients worldwide. Stakeholders should anticipate limited pricing volatility but remain attentive to regulatory, supply chain, and competitive developments that could influence future price dynamics.

Key Takeaways

- Market Maturity: Lisinopril-HCTZ is an established, highly competitive segment with extensive generic availability.

- Price Trends: Prices have stabilized at low levels post-patent expiry and are expected to remain there, with minimal upward movement.

- Competitive Pressure: High entry of generic manufacturers sustains downward pricing pressure.

- Future Outlook: No significant price increases anticipated; macroeconomic and regulatory factors are unlikely to disrupt the downward trend.

- Strategic Focus: Companies should prioritize efficiency in production and supply chain management to remain competitive. Payers and healthcare providers will continue to favor cost-effective antihypertensive regimens.

FAQs

Q1: Will the price of Lisinopril-HCTZ increase with new formulations or patents?

A: Unlikely. Most patents have expired, and new formulations are not currently under exclusive rights. Generics dominate, keeping prices low.

Q2: Are there any upcoming regulatory changes that could impact pricing?

A: Changes favoring generic drug approval and approval of biosimilars could bolster competition, maintaining or reducing prices.

Q3: How does market competition influence access to Lisinopril-HCTZ globally?

A: Widespread generic competition drives down prices, making the medication accessible in many healthcare settings worldwide.

Q4: Could alternative antihypertensive drugs threaten the market for Lisinopril-HCTZ?

A: Yes. However, due to its efficacy, cost-effectiveness, and clinician familiarity, Lisinopril-HCTZ remains a preferred choice unless newer therapies demonstrate superior outcomes.

Q5: What is the expected impact of supply chain disruptions on prices?

A: Short-term disruptions could cause minor price fluctuations; however, overall market dynamics favor price stability due to multiple manufacturers.

References

[1] GlobalData. (2022). Antihypertensive Drugs Market Overview.

[2] U.S. Food and Drug Administration (FDA). (2023). Drug Approvals and Patent Status.

[3] IQVIA. (2022). Healthcare Market Trends and Drug Utilization Data.

[4] IMS Health. (2021). Generic Drug Market Analysis.

[5] World Health Organization. (2022). Global Cardiovascular Disease Statistics.

More… ↓