Last updated: July 27, 2025

Introduction

Lisdexamfetamine, marketed primarily under the brand name Vyvanse, is a widely prescribed psychostimulant used in the treatment of Attention Deficit Hyperactivity Disorder (ADHD) and Binge Eating Disorder (BED). As a prodrug of dextroamphetamine, lisdexamfetamine offers a unique pharmacokinetic profile, leading to its preference among clinicians for certain patient populations. This analysis examines the current market landscape, competitive positioning, pricing trends, and future price projections, providing actionable insights for stakeholders in the pharmaceutical and investment sectors.

Market Overview

Global Market Size and Growth Dynamics

The global ADHD medication market was valued at approximately USD 14.4 billion in 2022 and is projected to grow at a CAGR of 4-6% through 2030 [1]. The increasing diagnosis rates, driven by heightened awareness and expanding pediatric and adult populations, underpin this growth. Lisdexamfetamine holds a significant market share within this space, primarily in North America, which accounts for over 70% of the total ADHD medication revenue.

Regulatory and Reimbursement Trends

Regulatory approval for lisdexamfetamine has been robust, with FDA approval in 2007 for ADHD in children aged 6–12 and subsequently for BED in adults. Reimbursement schemes favor branded formulations due to patent protections, although these protections are gradually eroding. Insurance coverage remains favorable, especially in the U.S., supporting consistent prescribing patterns.

Competitive Landscape

Lisdexamfetamine faces competition from other stimulant and non-stimulant agents such as methylphenidate (e.g., Concerta, Ritalin), dexmethylphenidate (Focalin), and non-stimulants like atomoxetine and viloxazine. Generics launched post-patent expiry have intensified competition, exerting downward pressure on prices. However, Vyvanse's differentiated pharmacokinetics and patent protections until at least 2023 (with ongoing patent disputes) sustain its market dominance.

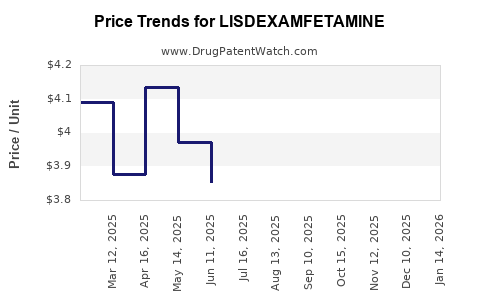

Pricing Dynamics

Brand vs. Generic Pricing

Prior to patent expiration, Vyvanse's wholesale acquisition cost (WAC) averaged $330-$380 per month for a typical dosage. Post-generic entry, prices declined significantly, with generics priced approximately 40-60% lower, around $150-$200 monthly. Brand premiums persist in certain segments due to perceived efficacy, formulation stability, and prescriber preferences.

Pricing Influences

- Patent Protections: Patents provide a substantial pricing advantage for the brand; loss of exclusivity introduces price competition.

- Formulation Innovations: Extended-release formulations and abuse-deterrent features sustain value propositions.

- Market Penetration of Generics: Increased generic availability has driven down market prices but has also created a price ceiling for future increases.

- Reimbursement Policies: Payer negotiations, prior authorization requirements, and formulary placements influence net prices.

Future Price Projections

Post-Patent Expiry Trends

Historical patterns suggest that after patent expiry, brand drug prices drop by an average of 35-50%, plateauing as market share stabilizes among generics and biosimilars. For lisdexamfetamine, prices are expected to decline to approximately $100-$150 retail for a similar dosage window within 12-24 months after generic market entry.

Market Penetration of Generics and Biosimilars

The current pipeline indicates multiple generic entrants anticipated by late 2023, following patent challenges by Teva Pharmaceuticals. These generics will exert continued downward pressure, with prices potentially decreasing further by 2025 to $80-$100. Innovative formulations with abuse-deterrent properties are unlikely to command premium prices outside of niche markets.

Off-Label and Adjunct Use Impact

Growing off-label use in cognitive enhancement and psychiatric indications could stabilize demand, partially mitigating price erosion. However, reimbursement and regulatory scrutiny may limit price increases in these segments.

Potential Regulatory and Policy Influences

Legislation favoring bioequivalence and generic substitution in key markets will reinforce price reductions. Conversely, new formulations with improved delivery mechanisms or combination therapies could sustain higher prices within certain patient subgroups.

Strategic Implications for Stakeholders

- Pharmaceutical Companies: Innovation in formulations and delivery systems is essential to maintain margins. Patents and exclusivity periods are critical leverage points.

- Investors: Anticipate price declines post-generic launch; focus on firms with robust pipeline portfolios and innovation capacity.

- Payers and Providers: Emphasize formulary management and negotiation to access cost-effective therapies without compromising efficacy.

Key Market Opportunities

- Biosimilar and Generic Competition: Entry of multiple generics is inevitable; early market share capture is competitive advantage.

- New Indications: Expanding approved uses beyond ADHD and BED can sustain demand and pricing.

- Patient-Centric Formulations: Long-acting, abuse-deterrent, or combination products can command premium pricing.

Conclusion

Lisdexamfetamine remains a cornerstone in ADHD pharmacotherapy, with a robust market driven by clinical efficacy and patient preference. However, impending patent expiries and increasing generic competition forecast substantial price reductions over the next 2-3 years. Stakeholders must strategically adapt, leveraging innovation and regulatory insights to sustain profitability.

Key Takeaways

- The global lisdexamfetamine market is poised for significant price declines, with generics entering by late 2023.

- Brand prices currently range from USD 330-$380 monthly, expected to fall below USD 100-$150 post-generic entry.

- Market growth will be sustained by expanding indications and off-label use, albeit with upside limitations due to pricing pressures.

- Innovation in formulations and delivery mechanisms will be necessary for brands to sustain premium pricing.

- Market entrants should prioritize differentiated products and strategic patent positioning to optimize revenue streams.

FAQs

1. When will lisdexamfetamine's patent protections expire, allowing generics to enter the market?

Patent protections are expected to expire in late 2023 or early 2024, depending on jurisdiction and patent extensions, paving the way for multiple generic entrants [2].

2. How have prices for lisdexamfetamine changed since patent expiry?

Following patent challenges and generic launches, prices typically declined by 40-60%, with current generics retailing approximately USD 150-$200 per month, down from roughly USD 330-$380 for brand-name Vyvanse.

3. Can branded lisdexamfetamine maintain market share post-generic entry?

While some prescribers and patients may prefer branded formulations for their consistency, price competitiveness and insurance formularies favor generics, challenging brand dominance.

4. Are biosimilars or alternative formulations likely to impact the lisdexamfetamine market?

Given lisdexamfetamine's chemical nature, biosimilars are not applicable; however, alternative sustained-release or abuse-deterrent formulations could fragment the market, offering niche premium products.

5. What strategies should pharmaceutical companies adopt in this evolving landscape?

Investing in formulation innovation, exploring new therapeutic indications, and securing patent protections on delivery systems are essential strategies to sustain revenue and competitive edge.

References

[1] Market Research Future. (2023). Global ADHD Market Outlook.

[2] U.S. Patent and Trademark Office. (2022). Patent Expiration and Generic Entry Timeline for Vyvanse.