Share This Page

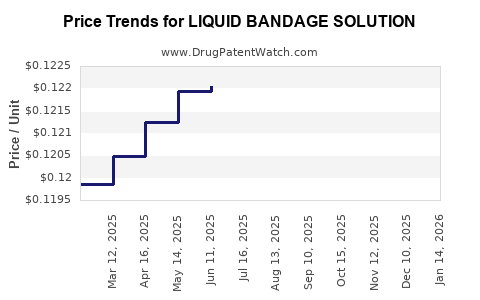

Drug Price Trends for LIQUID BANDAGE SOLUTION

✉ Email this page to a colleague

Average Pharmacy Cost for LIQUID BANDAGE SOLUTION

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LIQUID BANDAGE SOLUTION | 70000-0599-01 | 0.11824 | ML | 2025-12-17 |

| LIQUID BANDAGE SOLUTION | 70000-0599-01 | 0.11824 | ML | 2025-11-19 |

| LIQUID BANDAGE SOLUTION | 70000-0599-01 | 0.11887 | ML | 2025-10-22 |

| LIQUID BANDAGE SOLUTION | 70000-0599-01 | 0.11957 | ML | 2025-09-17 |

| LIQUID BANDAGE SOLUTION | 70000-0599-01 | 0.12082 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Liquid Bandage Solution

Introduction

Liquid bandage solutions have grown in prominence as advanced wound care products offering rapid healing, superior adhesion, and flexible protection. These topical adhesives have increasingly replaced traditional bandages in both consumer and clinical settings due to their ease of application, water resistance, and aesthetic advantages. As the market for wound care products expands, understanding the dynamics of the liquid bandage segment is essential for stakeholders aiming to capitalize on emerging opportunities.

Market Overview

The global wound care market is projected to reach approximately USD 22 billion by 2027, with a compound annual growth rate (CAGR) of around 4.8% from 2020 to 2027 [1]. Within this landscape, liquid bandage solutions are among the fastest-growing niches, driven by technological advancements, increasing consumer awareness, and rising prevalence of acute and chronic wounds.

Key drivers include:

- Consumer preference for minimally invasive, aesthetic wound care products.

- Growing incidence of injuries, surgeries, and chronic conditions like diabetes that predispose to wounds.

- Expansion of product portfolios by pharmaceutical and biotech companies.

Major players in this domain—such as 3M, Medline, and Smith & Nephew—are investing heavily in R&D to optimize formulations and expand indications.

Market Segmentation

By Application:

- Minor cuts and abrasions

- Surgical wounds

- Chronic ulcers

- Other (e.g., burns, dermatological conditions)

By End-User:

- Hospitals and clinics

- Retail pharmacies

- Direct-to-consumer online sales

- Dermatology clinics

Geographical Distribution:

- North America: Dominates due to high healthcare expenditure and consumer awareness.

- Europe: Growing adoption particularly among European dermatology and wound care providers.

- Asia-Pacific: Fastest growth driven by increasing healthcare infrastructure and rising chronic wounds.

Competitive Landscape

The market landscape features a mix of established pharmaceutical corporations and innovative startups. Innovative formulations—such as biocompatible, antimicrobial, and biodegradable liquid adhesives—are gaining popularity.

Top companies:

- 3M: Known for Tegaderm and advanced liquid adhesive formulations.

- Johnson & Johnson: Expanding through consumer and professional wound care brands.

- Smith & Nephew: Specializes in advanced wound management products.

- Innovative startups: Focused on bio-adhesives with enhanced healing properties.

The competitive edge hinges on product efficacy, safety profile, ease of use, and regulatory approval.

Price Dynamics and Projections

Current Pricing Landscape:

Presently, bulk purchasing of liquid bandage solutions (e.g., in hospital settings) ranges between USD 5 to USD 15 per 15-milliliter bottle, depending on formulation specifics and manufacturer. Consumer retail prices are slightly higher due to branding and packaging, typically between USD 10 to USD 20 for similar volumes.

Factors Influencing Pricing:

- Formulation complexity, including antimicrobial additives or bioactive components.

- Packaging innovations, such as single-use applicators.

- Regulatory compliance and certification status.

- Distribution channels and regional market conditions.

Projected Price Trends (2023–2030):

- Stability or slight decrease in unit prices expected in mature markets due to manufacturing scale efficiencies and increased market competition.

- Premium product lines, incorporating features like enhanced antimicrobial properties or bioadhesive technology, projected to command higher prices—up to USD 25–30 per 15 ml.

- Emergence of lower-cost alternatives in emerging economies could drive average market prices downward.

By 2030, the average retail price for a standard 15 ml liquid bandage solution is projected to hover around USD 12–16 globally, with regional variations. In high-income markets, prices may stabilize near USD 15–20, while in developing regions, competitive pricing could push costs below USD 10.

Market Entry and Pricing Strategy Implications

New entrants should consider:

- Differentiation through innovative formulations that address specific needs like antimicrobial resistance or enhanced flexibility.

- Competitive pricing strategies to penetrate cost-sensitive markets.

- Branding emphasizing efficacy and safety to command premium pricing where applicable.

Existing players benefit from leveraging economies of scale, broadening indications, and advancing formulation features to maintain or increase price points.

Challenges and Opportunities

Challenges:

- Stringent regulatory pathways across regions could delay market entry.

- Competition from traditional wound care products and generic alternatives.

- Price-sensitive markets requiring low-cost solutions.

Opportunities:

- Growing demand for aesthetic, minimally invasive wound care solutions.

- Expansion into emerging markets with increasing healthcare access.

- Innovation in bio-adhesives, including environmentally friendly and biodegradable options.

Regulatory and Reimbursement Considerations

Regulatory approvals influence pricing, especially in regions like the U.S. (FDA) and Europe (EMA). Companies with expedited approval pathways can better capitalize on early-mover advantages.

Reimbursement policies also impact pricing strategies, with insurance coverage influencing retail pricing in developed markets.

Conclusion

The liquid bandage solution market is poised for steady growth, driven by technological innovation and increasing wound care needs worldwide. Pricing will be shaped by formulation innovation, competitive pressures, regulatory landscapes, and regional economic factors. Strategic positioning around product differentiation and targeted market segments offers significant revenue opportunities for established and emerging players.

Key Takeaways

- The global liquid bandage market is expected to reach USD 2–3 billion by 2030, with consistent growth fueled by consumer demand and clinical application expansion.

- Current retail prices average USD 10–20 per 15 ml, with future prices stabilizing or slightly declining due to economies of scale and increased competition.

- Innovation in formulations and packaging will enable premium pricing segments, especially in developed markets.

- Cost-effective solutions remain essential for penetrating emerging markets.

- Regulatory approvals and reimbursement policies are critical factors influencing pricing strategies.

FAQs

1. What are the key factors driving demand for liquid bandage solutions?

Demand is driven by a preference for cosmetically appealing, quick-healing wound care products, increased injury and surgical rates, and advancements in adhesive technology offering water-resistant and flexible dressings.

2. How do regional markets differ in liquid bandage pricing?

In developed markets like North America and Europe, prices remain higher due to regulatory standards and consumer expectations, averaging USD 15–20 per 15 ml. In emerging economies, prices often fall below USD 10, driven by price sensitivity and local manufacturing.

3. What innovations are shaping the future of liquid bandage formulations?

Innovations include bio-adhesives with antimicrobial properties, biodegradable options, formulations optimized for sensitive skin, and environmentally friendly packaging solutions.

4. How significant is regulatory approval for pricing strategies?

Regulatory approval influences market access, formulation safety, and reimbursement potential, thereby impacting pricing. Fast-track approvals can enable premium pricing due to early market entry and perceived product superiority.

5. What strategies should new entrants consider to competitively price liquid bandages?

New entrants should focus on product differentiation, cost-efficient manufacturing, targeting underserved markets with lower price points, and offering value-added features that justify premium pricing in mature segments.

Sources:

[1] MarketWatch. "Wound Care Market Size, Share & Trends Analysis Report." 2022.

More… ↓