Last updated: July 28, 2025

Introduction

Lidocaine Hydrochloride (HCl), a widely used local anesthetic and antiarrhythmic agent, has maintained its prominence across multiple medical disciplines for decades. Its versatile applications range from local anesthesia in surgical procedures to management of cardiac arrhythmias, cementing its position as an essential drug within healthcare systems globally. This report comprehensively examines the current market landscape for Lidocaine HCL, advances in manufacturing and formulations, market dynamics including key drivers and challenges, and provides price projections grounded in current trends and external factors influencing its valuation.

Market Overview

Lidocaine HCl's global market encompasses extensive applications across hospitals, clinics, and pharmaceutical manufacturing. As of 2022, the drug's market size is estimated at approximately USD 300-400 million, with expected growth driven by increasing procedural volumes, aging populations, and expanding indications, especially in pain management and cardiology. The drug's essential status is reflected in its inclusion in World Health Organization's Essential Medicines List, underscoring its vital role in healthcare.

Market Drivers

-

Rising procedural and surgical volumes: The increasing frequency of minor and major surgeries globally sustains demand for local anesthetics like Lidocaine, especially in outpatient and minimally invasive procedures.

-

Aging populations: Demographic shifts toward older populations augment the prevalence of cardiac arrhythmias and chronic pain conditions, compelling higher usage of Lidocaine HCl.

-

Advances in Drug Formulations: Development of novel formulations, such as controlled-release patches and injectable depots, enhances therapeutic efficacy and patient compliance, fostering market expansion.

-

Regulatory approvals: Continuous approval for new indications or formulations by agencies like the FDA fosters broader usage and availability.

Market Challenges

-

Generic Competition: The mature status of Lidocaine HCl means intense price competition from numerous generic manufacturers, exerting downward pressure on prices.

-

Price Sensitivity and Healthcare Economics: Cost constraints in emerging markets dampen price growth potential, particularly where procurement is regulated or reliant on government tenders.

-

Alternative Technologies: Innovations such as liposomal formulations or alternative local anesthetics may threaten market share.

Regional Market Dynamics

-

North America: Leading contributor, driven by high procedural volumes, advanced healthcare infrastructure, and substantial R&D investment into drug delivery innovations. The U.S. market forms the largest segment, with an estimated contribution exceeding 40% of global sales.

-

Europe: The second largest market, with mature healthcare systems and stringent regulatory standards promoting high-quality formulations.

-

Asia-Pacific: Fastest-growing segment due to expanding healthcare access, increasing procedural rates, and rising pharmaceutical manufacturing capabilities. Countries like China and India are pivotal in supply chain and generic productions.

-

Emerging Markets: Latin America, Africa, and the Middle East present growth opportunities but face pricing and regulatory challenges.

Manufacturing Trends and Innovation

Manufacturers focus on cost-effective synthesis, quality control, and formulation innovations. Liposomal encapsulation of Lidocaine is gaining traction, providing prolonged anesthesia with reduced systemic toxicity. Such innovations may, in the long term, command premium pricing and open new markets.

Price Dynamics and Projections

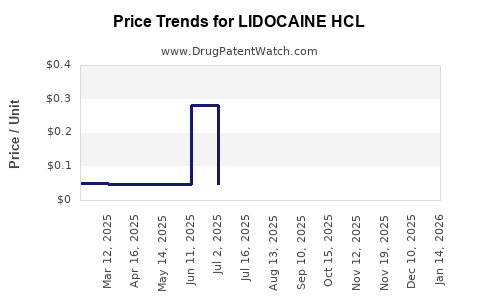

Current market prices for wholesale Lidocaine HCl can vary significantly based on formulation, purity, and procurement channel. Typical wholesale costs range from USD 0.10 to 0.30 per milliliter for injectable solutions. Contract manufacturing and bulk procurement reduce unit costs further.

Forecasting future prices involves assessing supply-demand dynamics, manufacturing costs, regulatory landscape, and patent status. Since most formulations are generic, price erosion is a notable trend. However, innovations like controlled-release patches or liposomal formulations tend to carry a premium.

Price Projection (2023-2030)

-

Short-term (2023-2025): Prices are expected to remain relatively stable owing to fixed supply chains. Slight declines (2-4%) may occur due to intensified generic competition and market saturation.

-

Mid-term (2026-2028): Introduction and adoption of novel formulations could stabilize or increase prices, especially if these formulations demonstrate improved efficacy or safety profiles. Price escalation of 3-6% annually is plausible in niche segments.

-

Long-term (2029-2030): Price stabilization or mild increase may occur in high-value formulations, while traditional generics continue to decline at a 2-3% annual rate, mainly driven by manufacturing cost reductions and increased competition.

External Factors Influencing Prices

-

Regulatory Changes: Stricter quality standards may marginally increase manufacturing costs, thereby influencing pricing.

-

Raw Material Availability: Fluctuations in chemical raw materials prices, especially amides or related precursors, impact manufacturing economics.

-

Global Supply Chain Dynamics: Disruptions, such as those caused by geopolitical conflicts or pandemics, may temporarily inflate prices.

-

Environmental and Sustainability Measures: Implementation of greener manufacturing practices could alter cost structures.

Market Entry and Competitive Strategy

New entrants must strategically navigate saturated markets dominated by established generic producers. Focus on differentiating through formulation innovation or supply chain efficiencies offers competitive advantages. Partnerships with healthcare providers and engagement in regional tenders are crucial for expansion.

Key Takeaways

-

The Lidocaine HCl market remains robust due to its essential medical applications, but saturation and intense competition exert downward pressure on prices.

-

Innovation in drug delivery, such as controlled-release formulations and liposomal encapsulation, can command higher prices and extend market reach.

-

The next five years will likely see stable or modestly declining prices for traditional formulations, with premium niche products experiencing moderate price increases.

-

Regional disparities exist; North America and Europe dominate current markets, whereas Asia-Pacific presents rapid growth opportunities.

-

External factors—including regulatory policies, raw material costs, and supply chain stability—will continue to influence pricing and market dynamics.

FAQs

-

What factors influence the pricing of Lidocaine HCl in different regions?

Regional pricing determinants include manufacturing costs, regulatory standards, market competition, procurement channels, and healthcare infrastructure. High regulation and quality requirements in North America and Europe tend to maintain higher prices, whereas emerging markets experience lower prices driven by price sensitivity and quantity-based tenders.

-

How do formulation innovations impact Lidocaine HCl market prices?

Innovative formulations like liposomal or controlled-release products typically justify higher prices due to their enhanced efficacy, safety profile, and convenience. These products also create new market segments, potentially increasing overall revenue streams.

-

What is the outlook for generic vs. branded Lidocaine HCl products?

The market is predominantly generic, pressuring prices downward, especially in mature markets. Branded or patented formulations, often with delivery advantages, can sustain higher prices but face challenges from generic competition post-patent expiry.

-

Are there upcoming regulatory or patent expirations that could affect price trends?

Most formulations of Lidocaine HCl have long-standing patents or are off-patent, facilitating widespread generic manufacturing. New delivery formulations may be patent protected, allowing for price premiums until patent expiry.

-

How might global supply chain disruptions influence Lidocaine HCl availability and pricing?

Supply chain disruptions, whether due to geopolitical tensions or public health crises, can constrain raw material supply, increase manufacturing costs, and create temporary price spikes or shortages, impacting overall market stability.

References

[1] MarketsandMarkets. "Local Anesthetics Market by Product." 2022.

[2] WHO. "List of Essential Medicines," 20th Edition, 2017.

[3] Allied Market Research. "Lidocaine Market Analysis," 2021.

[4] U.S. Food and Drug Administration (FDA). Drug approvals and guidelines, 2022.

[5] Industry Reports. "Pharmaceutical Packaging and Formulation Innovations," 2023.