Last updated: July 27, 2025

Introduction

Lidocaine, a local anesthetic and antiarrhythmic agent, remains a staple in medical and pharmaceutical applications worldwide. As an active pharmaceutical ingredient (API), it’s employed across various formulations—including creams, patches, injections, and dental gels—serving both therapeutic and procedural needs. Understanding the market dynamics and pricing trajectory of lidocaine is crucial for stakeholders ranging from pharmaceutical companies and investors to healthcare policymakers.

Current Market Landscape

Global Market Overview

The global lidocaine market has experienced steady growth, driven by its longstanding clinical utility and expansion into new formulations and delivery systems. According to recent industry reports, the market was valued at approximately USD 600 million in 2022, with projections suggesting a compound annual growth rate (CAGR) of around 4–6% through 2028 [1].

Key factors influencing this growth include increasing demand for minimally invasive procedures, expansion in dermatological and dental applications, and the rising prevalence of chronic pain conditions. Additionally, the COVID-19 pandemic underscored the importance of local anesthetics in various diagnostic and treatment procedures, further bolstering market relevance.

Regional Insights

- North America: Dominates the market with a share exceeding 40%, attributed to high healthcare expenditure, regulatory approvals, and advanced clinical practices.

- Europe: The second largest market, propelled by a robust healthcare infrastructure and aging populations.

- Asia-Pacific: Exhibits the fastest CAGR, fueled by emerging healthcare sectors, increasing procedural volumes, and pharmaceutical manufacturing hubs, notably in China and India [2].

Market Segments & Applications

Lidocaine’s primary segments include:

- Topical formulations: Creams, gels, patches for localized pain management

- Injectable forms: For regional anesthesia and cardiac rhythm management

- Dental products: Gels, ointments

- Other: Transdermal systems, intravenous formulations

The increasing adoption of transdermal patches and innovative delivery systems is noteworthy as segment drivers.

Competitive Landscape

Major players include:

- Mylan (now part of Viatris)

- Sanofi

- Burdick, a division of Hospira

- Kyorin Pharmaceutical

- Teva Pharmaceutical Industries

The market has also seen entry by generic manufacturers leveraging patent expirations, which has significantly reduced prices and increased accessibility.

Regulatory & Patent Environment

Lidocaine is a generic drug with numerous biosimilar and generic formulations approved globally, reducing barriers to market entry but also exerting downward pressure on prices. Patent protections are limited, with most formulations dating back over a decade, facilitating widespread manufacturing and distribution.

Price Trends & Projections

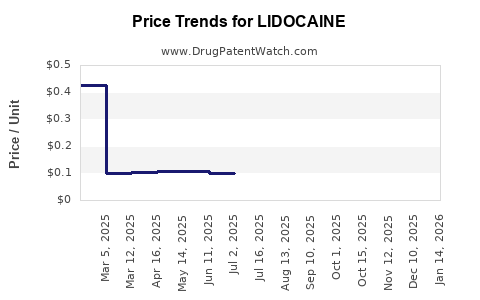

Historical Pricing

Over the past decade, the median price of lidocaine per gram has decreased by approximately 30-40%, primarily due to generic competition and manufacturing efficiencies. For instance, the cost of raw lidocaine API in bulk was approximately USD 10–15 per kilogram in 2012, falling to around USD 3–6 in 2022 [3].

Future Price Trajectory (2023–2030)

Based on current market conditions, competitive pressures, and technological advancements, the following key projections are anticipated:

- API pricing: Expect a stabilization at USD 2–4 per kilogram by 2025. As patent barriers are minimal, new entrants will sustain price competitiveness.

- Formulation costs: While raw API prices decline, formulation and manufacturing costs within the supply chain might experience slight increases due to stricter regulatory compliance and raw material quality enhancements.

Factors Influencing Price Dynamics

- Generic Competition & Market Saturation: With many manufacturers producing lidocaine, the proliferation of generics will sustain downward pricing pressure.

- Raw Material Availability: Petrochemical raw materials influence API pricing. Fluctuations in crude oil or raw material costs could temporarily impact prices.

- Regulatory Changes: Enhanced standards may elevate manufacturing costs but also confer market exclusivity to novel delivery systems.

- Technological Innovations: Development of sustained-release patches or biological formulations could introduce premium-priced variants, possibly affecting overall market prices.

Market Challenges & Opportunities

Challenges:

- Price erosion driven by generics.

- Regulatory pressures on manufacturing and quality controls.

- Supply chain disruptions, especially post-pandemic.

Opportunities:

- Innovation in delivery systems (e.g., transdermal patches, liposomal formulations).

- Expanding applications in veterinary medicine.

- Entry into emerging markets with growing healthcare infrastructure.

Strategic Implications for Stakeholders

Pharmaceutical companies should emphasize R&D in delivery innovations to differentiate products. Manufacturers can leverage cost efficiencies from emerging markets to maintain competitive pricing. Investors should monitor regional regulations and patent expirations, which influence pricing and market shares.

Key Takeaways

- The global lidocaine market is mature but growing steadily, with significant opportunities in innovative formulations.

- Competitive generic manufacturing has driven API prices downward, with stabilization expected in the mid-term.

- Market growth is primarily fueled by increasing procedural volumes, especially in Asia-Pacific and emerging markets.

- Price projections suggest API costs will stabilize around USD 2–4 per kilogram by 2025, maintaining a competitive environment.

- Stakeholders should consider technological innovation and regional expansion to capture value and mitigate pricing pressures.

FAQs

1. How does patent expiration affect lidocaine pricing?

Patent expirations facilitate generic entry, significantly reducing manufacturing costs and lowering market prices. With most lidocaine patents expired, the market predominantly comprises generics, exerting downward price pressures.

2. Will new delivery formulations influence lidocaine market prices?

Yes. Innovations such as sustained-release patches or targeted delivery systems may command premium prices, potentially offsetting generic price erosion in traditional formulations.

3. How have raw material costs impacted lidocaine pricing?

Fluctuations in petrochemical raw materials influence API costs. However, stabilized supply chains and alternative sourcing have mitigated volatility.

4. Is there potential for price increases due to regulatory changes?

Regulatory compliance costs may rise, but they are unlikely to significantly inflate market prices due to intense competition. In some cases, stringent standards can create barriers hindering new entrants.

5. What regional markets hold the most growth potential?

Emerging markets in Asia-Pacific and Latin America, driven by increasing healthcare access and procedural volume, offer substantial growth opportunities.

References

[1] MarketsandMarkets. “Lidocaine Market by Product (Injectable, Topical), Application (Anesthesia, Pain Management), End-user, Region—Global Forecast to 2028.” 2022.

[2] Grand View Research. “Lidocaine Market Size, Share & Trends Analysis Report by Product, Application, Region, and Segment Forecasts, 2023–2030.” 2023.

[3] ICIS Chemical Business. “API Pricing Trends and Market Dynamics,” 2022.