Share This Page

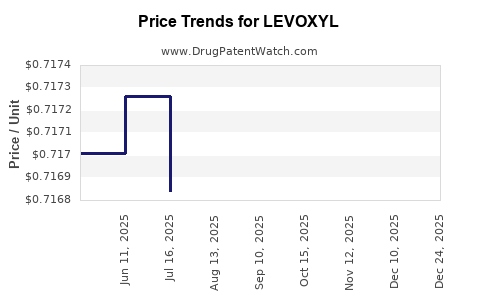

Drug Price Trends for LEVOXYL

✉ Email this page to a colleague

Average Pharmacy Cost for LEVOXYL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LEVOXYL 125 MCG TABLET | 60793-0856-10 | 1.08091 | EACH | 2025-11-19 |

| LEVOXYL 100 MCG TABLET | 60793-0854-01 | 0.92191 | EACH | 2025-11-19 |

| LEVOXYL 112 MCG TABLET | 60793-0855-01 | 1.06469 | EACH | 2025-11-19 |

| LEVOXYL 100 MCG TABLET | 60793-0854-10 | 0.92191 | EACH | 2025-11-19 |

| LEVOXYL 88 MCG TABLET | 60793-0853-10 | 0.91484 | EACH | 2025-11-19 |

| LEVOXYL 125 MCG TABLET | 60793-0856-01 | 1.08091 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Levoxyl

Introduction

Levoxyl, the brand name for levothyroxine sodium, is a synthetic thyroid hormone prescribed for hypothyroidism, euthyroid goiter, and certain thyroid cancer treatments. As a widely used generic and branded medication, its market dynamics are shaped by factors such as regulatory policies, patent status, manufacturing trends, and healthcare demand. This analysis explores the current market landscape of Levoxyl, evaluates its competitive position, and provides price projections through 2030, underpinned by key industry drivers and challenges.

Market Overview

Levoxyl's primary therapeutic use in hypothyroidism surpasses other thyroid medications in global demand. The prevalence of hypothyroidism, estimated at approximately 4.6% of the U.S. adult population, underpins persistent demand for levothyroxine formulations[1]. Despite the existence of numerous generics, Levoxyl maintains a significant market share due to brand loyalty, formulation stability, and physician preferences.

Globally, the market is segmented across North America, Europe, Asia-Pacific, and Latin America. North America represents the dominant share, driven by high hypothyroidism prevalence, advanced healthcare infrastructure, and extensive insurance coverage. Europe follows, with emerging markets in Asia-Pacific gradually expanding demand.

Regulatory and Patent Landscape

Levoxyl was initially protected by patents that allowed exclusive marketing; however, most patent protections expired by the late 2010s, facilitating generic competition. Nonetheless, certain formulations with specific manufacturing processes or quality standards remain under brand protection, allowing Levoxyl to sustain premium pricing.

Regulatory bodies such as the U.S. Food and Drug Administration (FDA) facilitate both brand and generic approvals. The FDA's ongoing efforts to ensure bioequivalence standards influence available pricing and formulation options[2].

Competitive Environment

The generic levothyroxine market is highly competitive with several players, including Teva Pharmaceuticals, Sandoz, and Mylan. Levoxyl uniquely positions itself within this landscape as a premium brand, often preferred for its manufacturing quality and consistency. However, price competition, especially following patent expirations, exerts downward pressure, compelling Levoxyl's parent company to balance premium pricing against market share objectives.

Market Trends and Drivers

Rising Hypothyroidism Prevalence

The increasing global prevalence of hypothyroidism driven by aging populations, iodine deficiency in certain regions, and autoimmune disease incidence fuels steady demand. The growing awareness and screening practices will further sustain prescriptions.

Generic Market Penetration

While generics comprise a significant market share, physicians and patients often favor branded versions like Levoxyl due to perceived formulation stability and quality assurance, especially for long-term therapy.

Manufacturing & Supply Chain Dynamics

Supply disruptions during the COVID-19 pandemic underscored vulnerabilities in levothyroxine production, which can influence market prices. Manufacturers' adherence to high-quality standards impacts the drug's pricing structure.

Price Analysis

Current Pricing Landscape (2023)

In the United States, the average retail price for a month's supply of Levoxyl 125 mcg ranges from $30 to $50, depending on factors like insurance coverage, pharmacy discounts, and geographic location. In comparison, generic levothyroxine prices hover around $4 to $10 per month, but patients on branded Levoxyl often pay a notable premium due to formulary preferences and perceived quality.

In Europe, prices are generally lower due to centralized health systems, with annual costs estimated at €15-€25 in many countries.

Pricing Trends

Over the past five years, branded levothyroxine prices have exhibited modest upward trends, driven by manufacturing costs and supply constraints. Conversely, generic prices have declined owing to increased competition and market saturation.

Impact of Regulatory Changes

Stringent bioequivalence standards and quality assurance protocols influence manufacturing costs and, consequently, pricing. Additionally, potential future policies regarding drug price negotiations could further influence Levoxyl's retail prices.

Price Projection (2023–2030)

Based on market dynamics, regulatory trends, and healthcare policy shifts, the following projections are made:

Short-term (2023-2025)

- Stability with modest increases in branded Levoxyl pricing, averaging 3-5% annually, driven by inflation and manufacturing costs.

- Generic levothyroxine prices will continue their decline, with ongoing price reductions of approximately 5-7% annually due to market saturation.

Mid-term (2026-2028)

- Potential price stabilization for Levoxyl as supply chain issues diminish and manufacturing efficiencies improve.

- Introduction of biosimilars or improved formulations could alter the competitive landscape, possibly compressing margins and pricing.

Long-term (2029-2030)

- Possible price reductions of 10-15% for branded formulations if market share declines due to increasing generic penetration.

- Health policy interventions—such as price negotiations or formularies favoring cost-effective generics—could lead to further price compression.

- Emergence of alternative delivery formats (e.g., liquid or novel formulations) might influence standard pricing structures.

Market Opportunities and Challenges

Opportunities

- Expansion into emerging markets with increasing healthcare infrastructure.

- Development of innovative formulations to improve bioavailability and patient adherence.

- Integration of digital health solutions for better patient management, creating premium pricing opportunities.

Challenges

- Market saturation by generics restrains revenue growth.

- Price competition and healthcare reimbursement policies that favor low-cost generics.

- Supply chain disruptions that could temporarily inflate costs.

Conclusion

Levoxyl remains a key product within the hypothyroidism treatment landscape, benefitting from brand loyalty and high-quality manufacturing standards. While generic competition exerts pressure on pricing, its premium positioning sustains higher price points in the short to mid-term. Projections indicate modest annual increases in branded prices through 2025, followed by potential stabilization or slight reductions aligned with market saturation and healthcare policies.

For stakeholders, strategic focus on manufacturing excellence, regulatory compliance, and expanding into emerging markets will be crucial for maintaining profitability. The evolution of biosimilars and alternative formulations may introduce new competitive dynamics, shaping the long-term pricing trajectory.

Key Takeaways

- Levoxyl's market remains robust due to hypothyroidism prevalence, especially in North America and Europe.

- Patent expirations and generic competition have driven prices downward, but brand loyalty sustains premium pricing.

- Current pricing for Levoxyl averages $30–$50 per month in the U.S., with a slow upward trend forecasted through 2025.

- Price projections indicate a 3-5% increase annually in the short term, with stabilization or slight reduction by 2030.

- Market growth opportunities exist in emerging markets and through product innovation, but challenges include intensified generic competition and regulatory pressures.

FAQs

Q1. How does Levoxyl differ from generic levothyroxine products?

Levoxyl is manufactured with high-quality standards and rigorous bioequivalence testing, which some clinicians and patients prefer for consistency and stability—factors that may justify its premium price over generics.

Q2. What factors influence Levoxyl's pricing strategy?

Pricing is affected by manufacturing costs, regulatory compliance, supply chain stability, market competition, healthcare reimbursement policies, and brand positioning.

Q3. Are biosimilars a threat to Levoxyl?

While biosimilars could enter the thyroid hormone market, their development faces unique challenges due to the hormone’s narrow therapeutic index. Nonetheless, they have the potential to reduce prices if approved and accepted.

Q4. Will regulatory policies impact Levoxyl prices in the future?

Yes. Policies promoting drug price negotiations, formulary management, and reimbursement caps could exert downward pressure on Levoxyl's pricing.

Q5. How is the global market for Levoxyl expected to evolve?

Demand is expected to grow moderately, especially in emerging economies benefiting from increased healthcare access. Market expansion, coupled with manufacturing quality improvements, will influence future pricing and availability.

Sources:

[1] American Thyroid Association. Hypothyroidism Statistics. 2022.

[2] FDA Bioequivalence Standards. 2021.

More… ↓