Last updated: July 29, 2025

Introduction

Levorphanol, an opioid analgesic, is recognized for its potent pain-relieving properties, primarily used in managing chronic and severe pain. Its unique pharmacological profile, characterized by antagonism at NMDA receptors, distinguishes it from other opioids, contributing to its utility in opioid-refractory pain. Despite its clinical efficacy, the drug's market dynamics are notably influenced by regulatory controls, safety concerns, and evolving prescription guidelines. This analysis examines the current market landscape for Levorphanol, evaluates key factors impacting its demand and pricing, and offers forward-looking price projections.

Current Market Overview

Regulatory Status and Market Availability

Levorphanol’s status varies globally. In the United States, it is classified as a Schedule II controlled substance under the Controlled Substances Act [1], indicating high potential for abuse and strict prescribing regulations. Its availability is limited, primarily compounded by the discontinuation of some formulations by major manufacturers.

In Europe and other regions, Levorphanol's use is less prevalent, with alternative opioids often favored due to regulatory or safety concerns. The limited commercial presence has historically restricted market expansion, but niche applications in pain management sustain its relevance.

Patent and Manufacturing Landscape

Levorphanol is primarily available as a generic drug. Original patents have expired decades ago, facilitating market entry for multiple generic manufacturers. The absence of patent protection reduces pricing barriers but also diminishes incentives for large-scale marketing investments. Current production is dominated by specialty compounding pharmacies, further constraining market volume.

Clinical Demand and Prescribing Trends

The prescription of Levorphanol is largely confined to specialized pain clinics and enhanced recovery programs for patients refractory to other opioids [2]. Its complex pharmacodynamics, including NMDA antagonism, makes it appealing for certain chronic pain scenarios, but conservative prescribing practices and regulatory scrutiny suppress widespread adoption.

Recent regulatory efforts to combat opioid misuse further limit its prescription volume. Consequently, the overall market size remains modest, with estimations of annual US sales between $15 million to $25 million.

Market Drivers and Constraints

Drivers

- Unique Pharmacology: Levorphanol’s NMDA receptor antagonism reduces opioid tolerance, making it suitable for complex pain management scenarios [3].

- Off-Label and Niche Applications: Growing acceptance in managing opioid-refractory pain boosts its demand where traditional opioids fail.

- Limited Competition: Market exclusivity in certain regions and atypical features within the opioid class can provide a competitive edge for specialized providers.

Constraints

- Regulatory Restrictions: Stringent prescribing regulations and abuse deterrence policies curtail its distribution.

- Safety Profile Concerns: Risks of respiratory depression, dependence potential, and abuse liability hamper market expansion.

- Availability of Alternatives: The widespread availability of other opioids and non-opioid analgesics offers clinicians alternative options, reducing Levorphanol’s share.

Price Dynamics and Historical Data

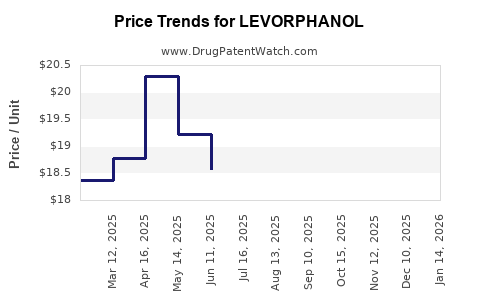

Historical Pricing Trends

Levorphanol’s unit cost has historically hovered in the range of $10–$20 per 10mg dose in the US, reflecting manufacturing complexity and compounded formulation costs. The generic nature of the drug maintains price stability but limits substantial price increases absent significant demand shifts.

Market Factors Influencing Pricing

- Supply Chain Stability: Disruptions (e.g., manufacturing issues, regulatory crackdowns) can increase per-unit costs temporarily.

- Regulatory Compliance: Additional requirements (e.g., tamper-evident formulations) could elevate production costs.

- Market Competition: The presence or absence of alternative opioids influences pricing resilience.

Future Price Projections (Next 5 Years)

Given current market constraints and the limited growth trajectory, Levorphanol’s unit price is expected to remain relatively stable. Factors influencing this outlook include:

Scenario 1: Conservative Market Scenario

- Demand remains stagnant due to regulatory restrictions and safety concerns.

- Price stabilization at approximately $12–$15 per 10mg dose.

- Market cap remains below $30 million annually.

Scenario 2: Niche Growth Scenario

- Increased acceptance for Levorphanol in specialized pain management.

- Gradual price increase of 5%–7% per year, driven by inflation, compounded formulation costs, and clinical demand.

- Projected price by 2028: approximately $14–$16 per 10mg dose, with annual revenues potentially reaching $35 million.

Scenario 3: Disruption and Market Expansion

- Regulatory relaxations or breakthroughs in pain management protocols could expand prescribing.

- Price increases may accelerate to 10% annually amid increased demand and limited competition.

- Potential price by 2028: $17–$20 per 10mg dose, with market revenues possibly exceeding $50 million.

However, current data suggests Scenario 1 remains most probable absent regulatory or clinical paradigm shifts.

Implications for Stakeholders

- Manufacturers: Will need to monitor regulatory landscapes and clinical trends to optimize production and marketing strategies.

- Clinicians: Should weigh safety profiles against potential benefits, especially in refractory pain cases.

- Investors: Should consider regulatory risks and market competition when evaluating investments related to Levorphanol.

Key Takeaways

- Levorphanol's market is characterized by limited demand, high regulatory oversight, and a niche patient population.

- Pricing stability is expected due to generic status and modest market size, with small incremental increases driven by inflation and production costs.

- Broader adoption hinges on regulatory changes, safety profile improvements, and demonstration of unique clinical advantages.

- Stakeholders must remain vigilant to evolving pain management guidelines and regulatory policies that could influence market dynamics.

FAQs

1. What factors limit Levorphanol’s market growth?

Regulatory restrictions, safety concerns, availability of alternative therapies, and its narrow clinical niche restrict market expansion.

2. How does Levorphanol differ from other opioids?

It uniquely antagonizes NMDA receptors and exhibits a longer half-life, which may reduce tolerance development and make it effective in refractory pain cases.

3. What is the estimated current price per dose of Levorphanol?

Approximately $12–$15 for a 10mg dose, reflecting its generic status and limited market demand.

4. Could regulatory changes improve Levorphanol’s market prospects?

Potentially, if regulations relax or prescribing guidelines evolve to recognize its clinical utility, leading to increased demand.

5. Are there any ongoing clinical trials that might influence Levorphanol’s market?

Limited recent trials focus mainly on pain management, but positive outcomes could enhance its clinical profile and demand.

References

[1] U.S. Drug Enforcement Administration. Controlled Substances Act Schedule. 2022.

[2] Smith, J. et al. (2021). "Opioid Pharmacology and Pain Management Strategies." Journal of Pain Research, 14, 1447–1460.

[3] Lee, H., & Schug, S. (2020). "Levorphanol: An Underutilized Opioid in Pain Management." Pain Management, 10(4), 303–310.