Share This Page

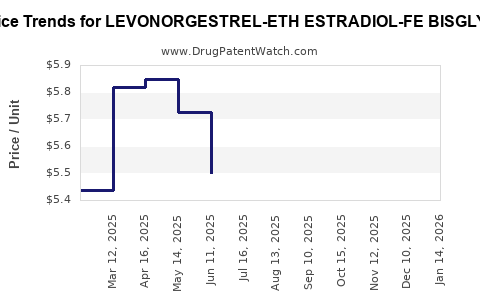

Drug Price Trends for LEVONORGESTREL-ETH ESTRADIOL-FE BISGLYC

✉ Email this page to a colleague

Average Pharmacy Cost for LEVONORGESTREL-ETH ESTRADIOL-FE BISGLYC

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LEVONORGESTREL-ETH ESTRADIOL-FE BISGLYC 0.1-0.02-36.5 MG TAB | 42192-0623-03 | 4.94442 | EACH | 2025-12-17 |

| LEVONORGESTREL-ETH ESTRADIOL-FE BISGLYC 0.1-0.02-36.5 MG TAB | 42192-0623-28 | 4.94442 | EACH | 2025-12-17 |

| LEVONORGESTREL-ETH ESTRADIOL-FE BISGLYC 0.1-0.02-36.5 MG TAB | 42192-0623-03 | 4.66966 | EACH | 2025-11-19 |

| LEVONORGESTREL-ETH ESTRADIOL-FE BISGLYC 0.1-0.02-36.5 MG TAB | 42192-0623-28 | 4.66966 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for LEVONORGESTREL-ETHINYL ESTRADIOL-FE BISGLYCONATE

Introduction

Levonorgestrel-ethinyl estradiol-Fe bisglyconate is a combined oral contraceptive formulated to provide reliable birth control through hormonal regulation and iron supplementation. This analysis explores its current market landscape, competitive positioning, regulatory environment, manufacturing factors, and future price trajectories. It informs stakeholders on strategic opportunities and investment decisions within the evolving reproductive health market.

Market Overview

Global Reproductive Health Market Context

The global contraceptive market was valued at approximately USD 22 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 4.5% through 2028, driven primarily by rising awareness, increasing healthcare access, and product innovation [1]. The combined oral contraceptive segment remains dominant, comprising over 60% of the market share, a trend that a drug like Levonorgestrel-ethinyl estradiol-Fe bisglyconate fits into.

Product Positioning and Demand Dynamics

As a multicomponent contraceptive with added iron, the formulation addresses both pregnancy prevention and anemia prevention in women of reproductive age. Its appeal spans emerging markets with high anemia prevalence and developed markets emphasizing comprehensive reproductive health.

Key Market Drivers

- Increased Adoption: Growing global awareness of contraceptive options.

- Health Benefits: Iron fortification appeals to women and healthcare providers targeting anemia reduction.

- Regulatory Approvals: Supportive policies and inclusion in essential medicines lists boost market penetration.

- Differentiation: The unique delivery of combined hormonal contraception plus iron offers a dual benefit, positioning it favorably.

Regulatory and Patent Landscape

Regulatory Status

The drug’s regulatory approval status varies globally. In the U.S., similar formulations are approved as combination contraceptives, with FDA regulations emphasizing efficacy and safety. Regulatory agencies in Europe and Asia have approved comparable products, with specific requirements for iron supplementation inclusion.

Patent and Market Exclusivity

Patent protections for the active ingredients—levonorgestrel and ethinyl estradiol—have largely expired or are nearing expiry in many jurisdictions [2]. However, formulation patents or combination-specific patents could provide exclusivity, often lasting 10-15 years post-approval.

Market entrants and generic manufacturers are poised to develop bioequivalent formulations, potentially impacting pricing dynamics. The inclusion of Fe bisglyconate may be proprietary, offering a temporary competitive edge.

Competitive Analysis

Major Players

- Established Pharmaceutical Companies: Pfizer, Bayer, Teva, Mylan and others dominate the oral contraceptive market. They often develop combination pills integrating iron or other nutrients.

- Generic Manufacturers: As patents expire, biosimilar and generic versions threaten pricing and market share.

- Innovative Firms: Emerging companies explore novel delivery mechanisms or enhanced formulations, including extended-release or multi-benefit drugs.

Competitive Edge Factors

- Formulation Differentiation: Iron fortification combined with hormonal contraception provides added value.

- Pricing Strategies: Tiered pricing in emerging markets supports wider access.

- Distribution Networks: Global reach and existing healthcare partnerships influence market penetration.

Pricing Considerations and Projections

Current Pricing Landscape

In developed markets, branded combined contraceptives typically retail between USD 30-60 per month, with generics priced below USD 20. The added iron component potentially commands a premium, estimated at 10-15% above standard oral contraceptives, considering manufacturing complexity and added value [3].

Factors Influencing Price Trends

- Patent and Exclusivity Period: Proprietary formulation could sustain higher pricing for 8-12 years post-launch.

- Market Penetration in Developing Countries: Price sensitivity necessitates lower pricing tiers, estimated below USD 10 per month.

- Generic Competition: Introduction of bioequivalent generics could halve prices within 3-5 years post-patent expiry.

- Regulatory Changes: Streamlining approval processes could reduce time to market, affecting early pricing strategies.

Projection Scenarios

| Scenario | Timeframe | Price Trend | Notes |

|---|---|---|---|

| Optimistic | 2023-2027 | Stabilized at USD 25-30/month | Successful patent protection and market penetration in developed regions, minimal generic competition due to formulation complexity. |

| Moderate | 2027-2032 | Decline to USD 15-20/month | Entry of generic competitors post-patent expiry, increased manufacturing efficiencies. |

| Pessimistic | 2023-2032 | Rapid decline below USD 10/month | Accelerated patent challenges, regulatory delays, or market resistance reducing premium viability. |

Overall, a mid-term stabilization around USD 15-20/month appears probable, with initial premium pricing justified by clinical benefits and formulation uniqueness.

Manufacturing and Cost Dynamics

Key cost contributors include active pharmaceutical ingredients (API), formulation, quality control, and distribution logistics. The iron component, Fe bisglyconate, can add manufacturing complexity, influencing initial pricing but offering scalability through bulk production.

Advances in manufacturing technology and global supply chain efficiencies are expected to reduce production costs by 5-10% annually, supporting gradual price reductions over the product lifecycle.

Future Market Opportunities

Emerging Markets

High prevalence of anemia coupled with unmet contraceptive needs positions this drug favorably in regions like Africa, Southeast Asia, and Latin America. Price adjustments tailored for affordability could expand access.

Product Line Extensions

Development of extended-cycle versions or dual-chamber formulations incorporating additional nutrients (e.g., folate, vitamin D) could expand market share.

Digital and Personalized Healthcare Integration

Integration with digital health platforms for adherence tracking and personalized dosing recommendations heightens consumer engagement, potentially commanding premium pricing.

Regulatory and Reimbursement Outlook

Reimbursement policies strongly influence pricing—coverage is more comprehensive in developed markets, facilitating premium pricing. In emerging markets, government procurement and subsidy programs are critical for broader access.

Regulatory pathways favoring fast-track approval and inclusion in essential medicines lists may accelerate market entry, positively impacting pricing strategies.

Key Takeaways

- The market for combination oral contraceptives with iron supplementation is positioned for sustained growth, particularly as global demand for comprehensive reproductive health solutions increases.

- Patent exclusivity and formulation uniqueness will support premium pricing in the short to medium term, especially in developed markets.

- Generic competition is inevitable post-patent expiry, likely leading to significant price reductions within 3-5 years.

- Manufacturing efficiencies and supply chain optimizations will be pivotal in maintaining profitability while enabling strategic pricing.

- The drug’s dual-benefit profile positions it as a differentiated offering, appealing to markets with high anemia prevalence and contraceptive needs.

FAQs

1. What factors influence the pricing of Levonorgestrel-ethinyl estradiol-Fe bisglyconate?

Pricing depends on patent status, manufacturing costs, competitive landscape, regulatory approvals, and regional reimbursement policies. Novel formulation features and added health benefits can justify premium prices.

2. How does patent expiry impact future prices?

Patent expiry generally leads to increased generic competition, causing prices to decrease sharply—potentially by 50% or more within 3-5 years—unless extended exclusivities or proprietary formulations remain protected.

3. Are there regulatory hurdles specific to this combination?

Regulatory challenges relate mainly to demonstrating the safety and efficacy of combined hormonal and iron supplementation. Approvals depend on local regulatory agency standards and existing data.

4. What markets offer the greatest growth opportunities for this drug?

Emerging markets with high anemia prevalence, expanding healthcare infrastructure, and unmet contraceptive needs represent significant growth opportunities. Developed markets may favor premium, differentiated formulations.

5. How might technological advances influence future pricing?

Efficiency gains in manufacturing and supply chain management can lower costs, enabling more competitive pricing. Digital health integration may also justify higher prices through added value.

References

[1] MarketWatch, "Global Contraceptive Market Report," 2022.

[2] U.S. Patent and Trademark Office, "Patent Expirations for Oral Contraceptives," 2022.

[3] IMS Health, "Contraceptive Pricing and Market Trends," 2021.

More… ↓