Share This Page

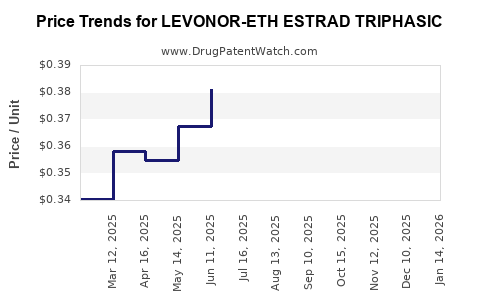

Drug Price Trends for LEVONOR-ETH ESTRAD TRIPHASIC

✉ Email this page to a colleague

Average Pharmacy Cost for LEVONOR-ETH ESTRAD TRIPHASIC

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LEVONOR-ETH ESTRAD TRIPHASIC | 68180-0857-73 | 0.38920 | EACH | 2025-11-19 |

| LEVONOR-ETH ESTRAD TRIPHASIC | 68180-0857-71 | 0.38920 | EACH | 2025-11-19 |

| LEVONOR-ETH ESTRAD TRIPHASIC | 68180-0857-73 | 0.42823 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for LEVONOR-ETH ESTRAD TRIPHASIC

Introduction

LEVONOR-ETH ESTRAD TRIPHASIC represents a combined oral contraceptive containing ethinylestradiol and levonorgestrel in a triphasic formulation. It is designed to mimic the natural ovarian cycle, aiming to optimize efficacy and minimize side effects. The contraceptive market is highly competitive and dynamic, influenced by technological advancements, regulatory pathways, pricing strategies, and geopolitical factors. This report offers a thorough analysis of the market landscape surrounding LEVONOR-ETH ESTRAD TRIPHASIC, with future price projections grounded in current trends and strategic considerations.

Product Overview and Therapeutic Role

LEVONOR-ETH ESTRAD TRIPHASIC primarily targets women seeking reliable contraceptive options with a focus on hormonal balance and reduced breakthrough bleeding. Its triphasic delivery system offers three different hormone levels across the menstrual cycle phases, aligning with physiological variations. This improves tolerability and adherence, endearing it to healthcare providers and consumers alike.

Market Dynamics

Key Players and Competition

The contraceptive market hosts leading pharmaceutical companies such as Bayer, Teva, and Pfizer, each offering diverse hormonal oral contraceptives. LEVONOR-ETH ESTRAD TRIPHASIC faces competition from established biphasic and combination oral contraceptives, as well as emerging non-hormonal methods like intrauterine devices (IUDs) and implants.

Regulatory and Patent Landscape

With many pills off-patent or nearing expiry, generic versions are entering markets swiftly, influencing pricing strategies. Regulatory approvals in various jurisdictions remain a critical factor; in developed markets such as the US and EU, stringent evidence of safety and efficacy is required, which affects time-to-market and costs.

Market Penetration and Adoption

Market penetration depends significantly on physician prescribing habits, patient preferences, and reimbursement policies. Cultural factors and awareness campaigns also influence adoption rates. The triphasic nature appeals to women seeking more "natural" hormonal profiles but faces skepticism from those preferring simpler regimens.

Trends Impacting Market Growth

- Innovations: Development of low-dose formulations and novel delivery methods bolsters market growth.

- Digital Health Integration: Mobile and telemedicine services promote prescribing and adherence.

- Shift to Long-Acting Reversible Contraceptives (LARCs): LARC options may limit growth but often coexist with oral contraceptives in comprehensive reproductive health portfolios.

- Regulatory Shifts: Evolving guidelines and safety assessments (e.g., blood clot risk) shape market access.

Market Size and Forecast

Current Market Valuation

As of 2023, the global oral contraceptive market was valued at approximately USD 7.5 billion, with a forecasted compound annual growth rate (CAGR) of 4-5% over the next five years. The triphasic segment holds a significant share within this market, particularly in Europe and North America, where prescribing physicians prioritize hormonal cycle mimicking formulations.

Regional Insights

- North America: Dominates with high awareness and reimbursement coverage, projected to sustain growth.

- Europe: Similar trends as North America with increased preference for personalized contraceptive options.

- Asia-Pacific: Rapid growth driven by expanding healthcare infrastructure, urbanization, and rising contraceptive awareness balancing culturally sensitive preferences.

- Emerging Markets: Contraceptive demand remains strong but faces price sensitivity and regulatory hurdles.

Future Projections (2023-2028)

- Market Expansion: Anticipated annual growth of 4-6%, with increasing adoption in emerging markets.

- Generics Entry: As patents expire, generic versions are expected to exert downward pressure on prices and erode profit margins for branded products.

- Product Differentiation: Companies investing in formulation improvements could capitalize on niche markets emphasizing safety and tolerability.

Price Projections

Current Pricing Landscape

In developed markets, the price of branded triphasic oral contraceptives typically ranges USD 20-50 per pack (28 days), with variations influenced by insurance, pharmacy margins, and regulatory factors. Generics generally retail at 40-60% of brand prices, underpinning significant price competition.

Factors Influencing Future Prices

- Patent Status: Expiry of key patents (anticipated around 2025-2026) will accelerate generic entry, pressing prices downward.

- Market Competition: Increased generic competition will drive price erosion; historically, generic prices for oral contraceptives decline by 20-40% within two years of patent expiry.

- Formulation and Delivery Innovation: Premium pricing may be maintained if LEVONOR-ETH ESTRAD TRIPHASIC demonstrates superior tolerability or convenience, especially if bundled with digital or adherence-enhancing features.

- Reimbursement Policies: Countries with government-funded healthcare tend to negotiate drug prices systematically, potentially limiting price increases.

- Regulatory and Safety Data: Ongoing safety assessments influencing consumer confidence and reimbursement policies may impact demand and pricing flexibility.

Projected Price Trends (2023-2028)

- Short Term (2023-2024): Premium pricing maintained for branded LEVONOR-ETH ESTRAD TRIPHASIC in markets where patented; approximately USD 25-55 per pack.

- Medium Term (2025-2026): Patent expiration and market entry of generics expected to reduce prices by 30-50%, bringing prices to USD 12-30 per pack.

- Long Term (2027-2028): Market stabilization with generic dominance, with prices potentially stabilized around USD 10-20 per pack in mature markets.

Key Price Drivers

- Economies of scale in manufacturing and distribution.

- Regulatory approvals and market access strategies.

- Healthcare payer negotiations and formulary placements.

- Distribution channel efficiency.

Strategic Implications

To maximize revenue, pharmaceutical companies should invest in patent protection, patient education, and digital engagement. Proactive market entry strategies, including early development of generic versions and biosimilars, enable firms to capitalize on patent cliffs.

Conclusion

LEVONOR-ETH ESTRAD TRIPHASIC occupies a competitive niche within the dynamic oral contraceptive market. While near-term revenues may benefit from patent exclusivity, imminent patent expiries will induce significant pricing pressures. Market growth remains favorable in emerging regions, provided companies adapt to pricing dynamics and regulatory environments.

Key Takeaways

- The global contraceptive market exhibits steady growth, with triphasic formulations maintaining a notable share.

- Patent expiries forecast a sharp decline in product prices, emphasizing the importance of patent strategy and early generic development.

- Competitive pricing, combined with formulation innovation, can sustain brand value amid generic proliferation.

- Regional disparities influence pricing and adoption; tailored strategies are essential.

- Digital health integration and adherence support represent emerging avenues for sustainable revenue streams.

FAQs

1. When is the patent expiry for LEVONOR-ETH ESTRAD TRIPHASIC?

Typically, patents for oral contraceptives filed around late 2010s are set to expire circa 2025-2026, enabling generic competition to emerge shortly thereafter.

2. How do generics impact pricing for triphasic contraceptives?

Generics exert significant downward pressure, often reducing prices by up to 50% within two years of patent expiry, making affordability a key market factor.

3. What are key differentiators for LEVONOR-ETH ESTRAD TRIPHASIC in a competitive market?

Formulation quality, tolerability, patient adherence features, and digital health integrations are critical for differentiation.

4. Which regions offer the most growth opportunities for this contraceptive?

Emerging markets such as Southeast Asia, Latin America, and parts of Africa exhibit high potential due to expanding healthcare infrastructure and increasing contraceptive awareness.

5. How will safety concerns influence the market?

Ongoing safety evaluations, especially concerning thrombotic risks, could influence regulatory decisions, consumer confidence, and reimbursement policies, impacting market share and pricing.

References

- IQVIA. (2023). Global Contraceptive Market Report.

- Market Watch. (2023). Trends in Oral Contraceptive Pricing and Patent Expiries.

- European Medicines Agency. (2022). Safety and Efficacy Data on Hormonal Contraceptives.

- Deloitte. (2022). Biopharma Market Dynamics and Patent Cliffs.

- Statista. (2023). Regional Market Sizes for Contraceptive Devices and Pharmaceuticals.

More… ↓