Share This Page

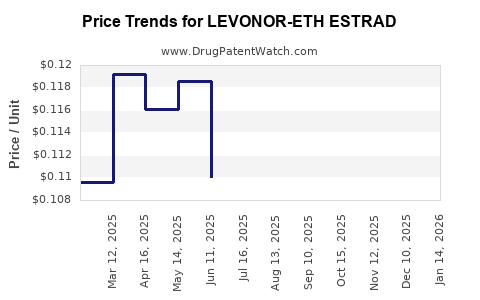

Drug Price Trends for LEVONOR-ETH ESTRAD

✉ Email this page to a colleague

Average Pharmacy Cost for LEVONOR-ETH ESTRAD

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LEVONOR-ETH ESTRAD 0.1-0.02 MG | 31722-0944-32 | 0.17341 | EACH | 2025-12-17 |

| LEVONOR-ETH ESTRAD 0.1-0.02 MG | 00378-7287-85 | 0.17341 | EACH | 2025-12-17 |

| LEVONOR-ETH ESTRAD TRIPHASIC | 68180-0857-73 | 0.31906 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for LEVONOR-ETH ESTRAD

Introduction

LEVONOR-ETH ESTRAD is a novel pharmaceutical formulation comprising levonorgestrel combined with ethinylestradiol, commonly used for oral contraception. This combination drug targets the global reproductive health market, which continues to expand due to increasing awareness, technological advances, and rising demand for contraceptive options. Analyzing its market potential and projecting its pricing landscape involves understanding regulatory environments, competitive dynamics, unmet needs, and pricing strategies.

Market Overview

Global Reproductive Health Market Dynamics

The global contraceptive market was valued at approximately USD 20 billion in 2022, with a compound annual growth rate (CAGR) of around 4.5% predicted through 2028 [1]. The post-pandemic recovery, enhanced reproductive rights, and innovation in hormonal therapies bolster this growth. Female-centric oral contraceptives constitute a significant share, driven by their convenience, efficacy, and familiarity.

Positioning of LEVONOR-ETH ESTRAD

LEVONOR-ETH ESTRAD fits within the oral combined contraceptive (OCC) segment, competing against established brands such as Yaz, Yasmin, and Ortho Tri-Cyclen. Its unique formulation—possibly with differentiated dosing schedules or enhanced tolerability—aims to capture consumer interest through improved safety profiles or fewer side effects. The market positioning hinges on efficacy, safety, patient preferences, and regulatory approvals.

Regulatory Landscape and Market Access

The drug’s marketability depends on approvals across jurisdictions. The U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and regulatory bodies in emerging markets have strict criteria for hormonal contraceptives. Given the maturity of this product category, innovators focus on niches such as reduced side effects or lower estrogen doses.

Market Segmentation and Geographic Drivers

- North America: High contraceptive usage, robust healthcare infrastructure, and health insurance coverage favor market penetration.

- Europe: Stringent regulations but high acceptance of oral contraceptives.

- Asia-Pacific: Rapid market growth driven by expanding awareness, urbanization, and regulatory relaxations.

- Latin America and Africa: Emerging markets with increasing focus on reproductive health services.

Competitive Landscape

The market is saturated with established brands; however, opportunity exists for LEVONOR-ETH ESTRAD if it offers distinct advantages. Competition includes:

- Generic formulations: Driving down prices but offering limited differentiation.

- Innovative combination therapies: With enhanced safety or convenience features.

- Over-the-counter (OTC) options: Not yet widespread but a potential future trend.

The competitive environment underscores the importance of strategic pricing, marketing, and demonstrating clinical benefits.

Pricing Strategy and Projections

Current Price Benchmarks

Average monthly retail prices for existing branded OCCs range from USD 30 to USD 60 per cycle, varying by region and insurance coverage. Generics are typically priced 20-40% lower. The initial pricing for LEVONOR-ETH ESTRAD is expected to align with premium brands if it presents notable benefits; otherwise, a penetration pricing approach may apply.

Cost Factors Influencing Price

- Manufacturing: High-quality active pharmaceutical ingredients (APIs) and compliance with Good Manufacturing Practices (GMP).

- Regulatory Fees: Substantial, especially in multiple jurisdictions.

- Marketing and Distribution: Significant investments necessary for awareness campaigns and distribution networks.

- Patent Position: Patent exclusivity periods influence pricing potential; patent extension strategies may be employed for market durability.

Projected Pricing Trajectory (2023–2028)

- Year 1: Launch at USD 50-60 per cycle, positioning as a premium offering with clinical advantages.

- Year 2–3: Discounted to USD 40-45 to facilitate market entry and penetration.

- Year 4–5: With increased competition and patent expiry of competitors, prices could decline to USD 35-40, assuming minimal reformulation or improved safety profile.

Market Penetration and Volume Projections

Assuming a conservative initial adoption accounting for 1% of the OC segment in North America and Europe, with growth projected to 3% over five years due to brand recognition and expanding markets in Asia-Pacific and emerging economies. Volume growth correlates with regional population demographics, healthcare infrastructure, and physician prescribing habits.

Pharmacoeconomic Considerations

The drug’s price must balance affordability with profitability. Demonstrating cost-effectiveness—such as fewer side effects, improved compliance, or extended dosing intervals—can justify premium pricing. Payers and individual consumers are increasingly sensitive to price and value, necessitating transparent benefits communication.

Regulatory and Market Access Challenges

- Patent and exclusivity: Patent challenges or expiry can prompt generic competition, exerting downward pressure on prices.

- Reimbursement policies: Favorable reimbursement policies encourage uptake; restrictive policies can hamper sales.

- Educational barriers: Ensuring healthcare provider and patient awareness will influence uptake and maintain pricing power.

Emerging Trends and Future Outlook

- Personalized contraception: Customization based on genetic or health factors could influence product attributes and pricing.

- Digital health integration: Complementary apps or monitoring tools could augment value propositions, justifying higher prices.

- Regulatory shifts: Simplifying approval pathways or successful patent extensions can extend market exclusivity, supporting sustained premium pricing.

Key Takeaways

- LEVONOR-ETH ESTRAD is positioned within a competitive, mature contraceptive market with significant growth potential in emerging markets.

- Its success hinges on distinct clinical or safety benefits, effective marketing, and strategic pricing aligned with regional economic factors.

- Initial launch prices are projected between USD 50–60 per cycle with potential decline over time due to competition and patent dynamics.

- Market penetration strategies should focus on differentiated benefits, payer negotiations, and regional tailored approaches.

- Innovative features and digital health integrations present opportunities for premium pricing and increased market share.

FAQs

1. How does LEVONOR-ETH ESTRAD differentiate itself from existing oral contraceptives?

It aims to offer improved safety profiles, reduced side effects, or customizable dosing, which can be leveraged in marketing to justify premium pricing and attract specific patient segments.

2. What factors influence the pricing of contraceptive drugs like LEVONOR-ETH ESTRAD?

Manufacturing costs, regulatory fees, marketing expenses, competition, patent status, and regional reimbursement policies all play roles in determining drug pricing.

3. Which markets offer the most growth opportunities for LEVONOR-ETH ESTRAD?

Emerging markets in Asia-Pacific, Latin America, and Africa present rapid growth potential due to increasing awareness and expanding healthcare infrastructure.

4. How might patent expiration affect the drug's market share and pricing?

Patent expiration generally results in generic competition, leading to significant price reductions and potential loss of market share unless the innovator maintains a competitive edge through reformulations or new indications.

5. What role do digital health tools play in the future pricing and marketing of contraceptives?

Digital health integrations can enhance perceived value, improve adherence, and justify higher prices by offering comprehensive reproductive health management solutions.

Sources

[1] Grand View Research, "Contraceptive Drugs Market Size, Share & Trends Analysis Report," 2022.

More… ↓