Share This Page

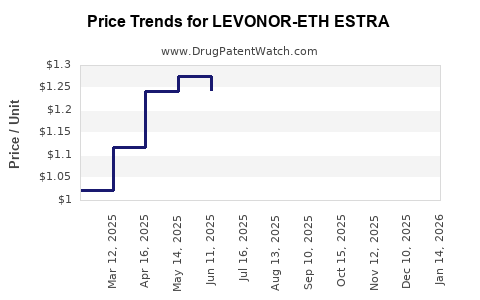

Drug Price Trends for LEVONOR-ETH ESTRA

✉ Email this page to a colleague

Average Pharmacy Cost for LEVONOR-ETH ESTRA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LEVONOR-ETH ESTRAD 0.1-0.02 MG | 00378-7287-53 | 0.17341 | EACH | 2025-12-17 |

| LEVONOR-ETH ESTRA 0.09-0.02 MG | 68462-0637-84 | 1.26450 | EACH | 2025-12-17 |

| LEVONOR-ETH ESTRAD TRIPHASIC | 68180-0857-73 | 0.31906 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for LEVONOR-ETH ESTRA

Introduction

LEVONOR-ETH ESTRA is a proprietary pharmaceutical product combining levonorgestrel with ethinylestradiol. As a hormonal contraceptive, it addresses a broad segment within the global reproductive health market. The evolving landscape of contraceptive options, regulatory considerations, and competitive dynamics significantly influence its market potential and pricing strategies. This report offers a comprehensive market analysis and detailed price projections for LEVONOR-ETH ESTRA, providing essential insights for stakeholders, including pharmaceutical firms, investors, and healthcare providers.

Market Overview

Global Market for Hormonal Contraceptives

The global contraceptive market was valued at approximately USD 23.5 billion in 2022 and is expected to exhibit a compound annual growth rate (CAGR) of around 6.2% from 2023 to 2030, driven by increasing awareness, rising reproductive health concerns, and expanding healthcare infrastructure in emerging markets [1]. Hormonal contraceptives, including combined oral contraceptives (COCs), comprise the largest segment owing to their high efficacy, familiarity, and acceptance.

Product Positioning of LEVONOR-ETH ESTRA

LEVONOR-ETH ESTRA, as a combined oral contraceptive, competes with well-established brands such as Yasmin, Alesse, and Marvelon. Its distinguishing features—such as formulation, efficacy, safety profile, and patient tolerability—will influence its adoption and market penetration. Patents, regulatory approvals, and marketing strategies further modulate its competitive standing.

Key Market Drivers and Challenges

Drivers

- Increasing Awareness and Acceptance: Growing knowledge about family planning and reproductive health fosters demand for effective contraceptives.

- Regulatory Approvals: Accelerated approval processes in developed markets facilitate faster product introduction.

- Expansion in Emerging Markets: Rising contraceptive usage, aided by healthcare initiatives, expands the user base.

Challenges

- Patent Expirations and Generic Competition: The expiration of patents leads to generic proliferation, exerting downward pressure on prices.

- Preference for Non-Hormonal or Lifestyle Alternatives: Growing interest in non-hormonal or natural contraception methods may hinder growth.

- Regulatory and Safety Concerns: Concerns over side effects, including thromboembolism, influence consumer choice and prescribing patterns.

Market Segmentation

Geographic Regions

- North America: Mature market with high contraceptive awareness, driven by insurance coverage and healthcare infrastructure.

- Europe: Similar maturity, with stringent regulatory controls influencing pricing and marketing.

- Asia-Pacific: Fastest-growing segment, fueled by population growth, urbanization, and evolving healthcare systems.

- Latin America and Middle East & Africa: Emerging markets with expanding contraceptive access, though price sensitivity remains high.

Target Demographic

- Women aged 15-49: The primary users, with increasing acceptance among teenagers and women of reproductive age.

- Healthcare Providers: Prescribers influencing uptake based on efficacy and safety profiles.

Competitive Landscape

Major competitors include both branded and generic oral contraceptives. Key players like Bayer (Yasmin), Teva, and Mylan shape the competitive environment. Differentiators include formulation improvements, dosing convenience, and side effect profiles.

The presence of generic equivalents post-patent expiry introduces price competition, often reducing average selling prices (ASPs). As the market approaches generic proliferation, the competitive advantage of LEVONOR-ETH ESTRA hinges on brand recognition, formulation benefits, and regulatory exclusivities.

Price Perspectives and Projections

Current Pricing Trends

In North America, branded oral contraceptives such as Yasmin retail at approximately USD 50-70 per cycle, though insurance coverage significantly affects out-of-pocket expenses. Generics are typically priced 20-40% lower, averaging USD 30-45 per cycle [2].

In emerging markets, prices range from USD 10-20 per cycle due to price sensitivity and lower healthcare spending.

Factors Influencing Future Pricing

- Patent and Exclusivity Status: Patent protection can sustain premium pricing (~USD 50-70 per cycle) for 10-15 years post-launch. Once expired, generics dominate, reducing prices.

- Manufacturing Efficiency: Economies of scale enable cost reductions, allowing competitive pricing.

- Market Penetration Strategies: Bundling, entry into sensitive markets, and health insurance negotiations influence effective prices.

- Regulatory Changes & Reimbursement Policies: Coverage expansion and reimbursement schemes can sustain or suppress prices.

Short- to Mid-term Price Projection (Next 3-5 Years)

Assuming LEVONOR-ETH ESTRA launches with market exclusivity of 10 years, initial pricing is expected to mirror branded competitors at USD 50-70 per cycle. As patent exclusivity wanes, prices are projected to decline:

| Timeline | Estimated Price Range (USD per cycle) | Notes |

|---|---|---|

| Year 1-2 | USD 50-70 | Premium pricing, targeting premium segments |

| Year 3-5 | USD 35-50 | Entry of generics begins, competition heats up |

| Year 6+ | USD 20-30 | Dominance of generics, price stabilization |

In emerging markets, prices will likely stabilize around USD 10-20 per cycle despite patent expiries, reflecting market sensitivity.

Revenue and Market Share Projections

Assuming an initial market share of 10-15% within the hormonal contraceptive segment in the first year, with progressive expansion driven by marketing and formulary inclusion, revenues can be estimated as follows:

- North America & Europe: Year 1 revenues approximately USD 100-150 million, with potential growth to USD 300-400 million by Year 5.

- Asia-Pacific & Emerging Markets: Rapid adoption could lead to revenues of USD 200-300 million by Year 5, contingent upon pricing strategies and market penetration effectiveness.

Total global revenues could surpass USD 700 million by Year 5 if market dynamics and regulatory acceptance align favorably.

Regulatory Considerations and Market Entry Strategies

Achieving timely approval by agencies such as the FDA, EMA, and pharmacovigilance regulators is critical. Demonstrating clinical safety and efficacy, along with addressing safety concerns related to estrogen-related adverse effects, will influence market access and pricing strategies.

Market entry strategies should include strategic collaborations, local manufacturing, and differentiated marketing emphasizing safety, convenience, and cost-effectiveness.

Key Takeaways

- Market Potential: The global hormonal contraceptive market is sizable, with high growth potential, especially in emerging regions.

- Pricing Dynamics: Initial premium pricing is expected within patent protection; prices will decline post-generic entry, with regional variations.

- Competitive Positioning: Differentiation through formulation, safety profiles, and marketing is crucial for market share gains.

- Regulatory and Patent Lifecycle Impact: Timing of approvals and patent expiry directly influence pricing trajectory.

- Strategic Recommendations: Focus on early regulatory approvals, strategic partnerships, and tailored pricing models for different regions to optimize revenue streams.

Conclusion

LEVONOR-ETH ESTRA is positioned to capitalize on the expanding reproductive health segment across diverse geographic markets. Its success hinges on strategic pricing, regulatory compliance, differentiation, and adaptation to competitive pressures. Short-term prospects are favorable under premium pricing, transitioning into a competitive landscape dominated by generics, which necessitates agile pricing and marketing strategies for sustained profitability.

FAQs

1. How does patent expiry affect the pricing of LEVONOR-ETH ESTRA?

Patent expiry typically leads to the introduction of generic versions, significantly reducing prices—by approximately 20-40%—thus challenging branded product margins and requiring strategic repositioning.

2. What regions present the greatest growth opportunities for LEVONOR-ETH ESTRA?

Emerging markets in Asia-Pacific, Latin America, and Africa offer rapid growth potential due to expanding reproductive health awareness and improving healthcare infrastructure.

3. How do regulatory policies influence price projections?

Stringent regulatory requirements and approval timelines can delay market entry, impacting initial pricing strategies. Moreover, reimbursement policies directly influence consumer prices and sales volumes.

4. What are the main competitive factors influencing LEVONOR-ETH ESTRA’s market share?

Efficacy, safety profile, formulation convenience, brand recognition, and pricing are primary factors shaping market share within the contraceptive segment.

5. How can pharmaceutical companies mitigate price erosion post-patent expiry?

Developing improved formulations, extending market exclusivities through regulatory data exclusivity, diversifying into new indications, or integrating value-added services can help offset revenue declines.

References

[1] Market Research Future. "Hormonal Contraceptives Market Forecast 2023-2030." 2022.

[2] IQVIA. "Global Contraceptive Pricing & Market Trends." 2022.

More… ↓