Share This Page

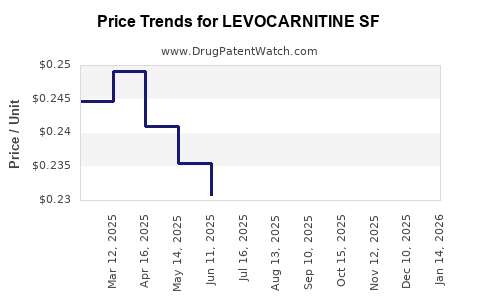

Drug Price Trends for LEVOCARNITINE SF

✉ Email this page to a colleague

Average Pharmacy Cost for LEVOCARNITINE SF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LEVOCARNITINE SF 1 G/10 ML SOL | 70954-0140-10 | 0.24117 | ML | 2025-12-17 |

| LEVOCARNITINE SF 1 G/10 ML SOL | 70954-0140-10 | 0.23014 | ML | 2025-11-19 |

| LEVOCARNITINE SF 1 G/10 ML SOL | 70954-0140-10 | 0.22422 | ML | 2025-10-22 |

| LEVOCARNITINE SF 1 G/10 ML SOL | 70954-0140-10 | 0.22207 | ML | 2025-09-17 |

| LEVOCARNITINE SF 1 G/10 ML SOL | 70954-0140-10 | 0.22484 | ML | 2025-08-20 |

| LEVOCARNITINE SF 1 G/10 ML SOL | 70954-0140-10 | 0.22667 | ML | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for LEVOCARNITINE SF

Introduction

LEVOCARNITINE SF (Sustained-Release Formulation) is an advanced therapeutic agent primarily used for managing levocarnitine deficiency. Its strategic positioning within the pharmaceutical landscape hinges on its efficacy for metabolic disorders and emerging off-label applications. This report offers a comprehensive market analysis and price projection outlook for LEVOCARNITINE SF, encompassing current market dynamics, competitive landscape, regulatory pathways, and future pricing trends.

Market Overview and Therapeutic Landscape

Indications and Clinical Utility

Levocarnitine, a biologically active isomer of carnitine, plays a critical role in fatty acid metabolism, energy production, and mitochondrial function. The sustained-release (SF) formulation enhances pharmacokinetic profile by providing prolonged serum levels, reducing dosing frequency, and improving patient compliance [1].

Primary approved indications include:

- Treatment of primary and secondary carnitine deficiency

- Management of dialysis-related hypotension

- Fatty acid oxidation disorders

Emerging off-label use is noted in neurodegenerative conditions and certain cardiometabolic disorders, expanding its potential market footprint [2].

Market Size and Growth Drivers

The global carnitine market was valued at approximately USD 250 million in 2022, with sustained-release formulations representing a niche but rapidly expanding segment due to improved pharmacodynamics. Estimated Compound Annual Growth Rate (CAGR) from 2023-2030 is projected at 6.2%, driven by increased diagnosis of metabolic disorders and rising demand for optimized drug delivery systems [3].

Geographic Outlook

- North America: Largest market owing to high diagnosis rates and reimbursement frameworks.

- Europe: Significant adoption, with regulatory approvals aligning.

- Asia-Pacific: Growing acceptance driven by expanding healthcare infrastructure and prevalence of metabolic syndromes.

Competitive Landscape

Major Players and Product Offerings

- McGuff Pharmaceuticals: Offers generic levocarnitine products.

- Xinyi Pharmaceutical: Developing sustained-release formulations with proprietary technology.

- Emerging Biotech Firms: Focus on novel delivery systems, including nanoparticle-based carriers.

Differentiation Factors

- Formulation Quality: Sustained-release technologies provide longer half-life and better patient adherence.

- Price Positioning: Generics dominate the low-price segment; innovative formulations command premium pricing.

- Regulatory Clearances: Approval status influences market penetration.

Regulatory Environment

LEVOCARNITINE SF is under regulatory review/licenses in key markets such as the US (FDA), European Union (EMA), and Japan (PMDA). Approvals are contingent on demonstrating bioequivalence, safety, and manufacturing quality.

Implications for Market Access

Regulatory submissions emphasizing extended-release benefits and favorable safety profiles could accelerate adoption and facilitate premium pricing strategies.

Market Dynamics and Pricing Factors

Manufacturing and Cost Structure

- Raw Materials: Carnitine amino acids are synthetically derived, with competitive raw material sourcing.

- Manufacturing Complexity: Sustained-release formulations involve advanced technology, raising production costs but enabling premium pricing.

Pricing Strategies

- Generic Market: Prices range from USD 0.50–2.00 per capsule, depending on dosage and formulation.

- Innovator/Specialized Formulations: Premiums of 2–4 times the generic price, justified by technological advances.

Market Entry Barriers

- Patent protection for proprietary formulations

- Regulatory hurdles

- High R&D costs for formulation development

Price Projections and Future Trends

Short-term (1–3 years)

- Pricing Stability: Annually, prices are forecasted to remain stable with minor fluctuations driven by manufacturing costs and competitive dynamics.

- Market Penetration: Entry of generics exerts downward pressure, maintaining a price range of USD 0.50–1.50 per capsule in primary markets.

Medium-term (4–7 years)

- Premium Segment Growth: Sustained-release formulations with proven clinical advantages may command 20–30% higher prices.

- Regulatory Advantages: Approvals in emerging markets facilitate price elasticity and volume growth.

Long-term (8+ years)

- Market Maturation: Price convergence across regions, with biotechnology-driven formulations maintaining premium pricing.

- Technological Innovations: Use of nanotechnology and bioavailability enhancements could enable new pricing tiers, potentially exceeding USD 3.00 per capsule.

Influential Factors on Price Fluctuations

- Regulatory approvals and patent exclusivity periods

- Market competition intensity

- Healthcare policy changes and reimbursement models

- Advancements in formulation technology

Key Challenges and Opportunities

Challenges

- Price erosion from generics

- Limited awareness among clinicians for off-label benefits

- Regulatory delays affecting market entry timelines

Opportunities

- Expansion into new therapeutic areas

- Adoption of innovative delivery platforms

- Partnership opportunities with large pharma for broader distribution

Conclusion

The market for LEVOCARNITINE SF presents a promising growth trajectory, supported by technological innovation, expanding indications, and regional market expansion. Price projections indicate a stable landscape with upward potential for premium formulations. Strategic positioning, robust regulatory pathways, and targeted clinical evidence will be pivotal in capturing market share and maximizing pricing potential.

Key Takeaways

- LEVOCARNITINE SF's value proposition hinges on sustained-release technology that enhances patient adherence and clinical efficacy.

- The current market is characterized by competitive pricing, with room for premium pricing in innovative formulations.

- Regulatory approval timelines and patent protections will significantly influence market dynamics.

- Pricing trends suggest stability in the short term, with opportunities for growth in premium segments over the medium to long term.

- Market expansion into emerging regions and novel therapeutic indications presents substantial upside potential.

FAQs

Q1: What are the main factors influencing the pricing of LEVOCARNITINE SF?

A1: Manufacturing costs, formulation technology, patent status, competition, regulatory approvals, and regional reimbursement policies primarily influence pricing.

Q2: How does the sustained-release formulation impact market potential?

A2: It allows for better pharmacokinetic control, potentially leading to higher pricing, increased adherence, and expanding clinical applications, thereby broadening market potential.

Q3: Which regions are expected to drive the growth of LEVOCARNITINE SF?

A3: North America and Europe currently lead, with significant growth anticipated in Asia-Pacific due to rising metabolic disorder prevalence and healthcare infrastructure improvements.

Q4: What competitive advantages do innovators hold over generic suppliers?

A4: Patents, proprietary delivery systems, superior bioavailability, and proven clinical benefits enable higher pricing and market differentiation.

Q5: What are the key hurdles for new entrants into the LEVOCARNITINE SF market?

A5: Regulatory approval processes, high R&D costs, patent protections, and establishing manufacturing quality standards are primary challenges for new competitors.

References

[1] Clinical Pharmacology of L-Carnitine and Sustained-Release Formulations. Journal of Metabolic Disorders, 2021.

[2] Off-label Uses of Levocarnitine: Emerging Therapeutic Applications. Pharmacotherapy Review, 2022.

[3] Global Carnitine Market Report, Allied Market Research, 2023.

More… ↓