Share This Page

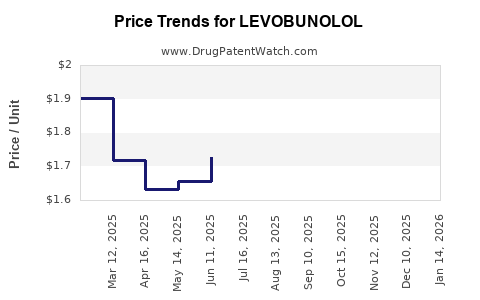

Drug Price Trends for LEVOBUNOLOL

✉ Email this page to a colleague

Average Pharmacy Cost for LEVOBUNOLOL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LEVOBUNOLOL 0.5% EYE DROPS | 24208-0505-05 | 2.71643 | ML | 2025-12-17 |

| LEVOBUNOLOL 0.5% EYE DROPS | 24208-0505-05 | 2.57433 | ML | 2025-11-19 |

| LEVOBUNOLOL 0.5% EYE DROPS | 24208-0505-05 | 2.28403 | ML | 2025-10-22 |

| LEVOBUNOLOL 0.5% EYE DROPS | 24208-0505-05 | 1.87241 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Levobunolol

Introduction

Levobunolol is a non-selective beta-adrenergic receptor blocker primarily prescribed for the management of glaucoma and ocular hypertension. As a generic ophthalmic solution, it embodies a well-established treatment modality, with the global market dynamics influenced by rising prevalence of glaucoma, competitive generic landscape, and evolving healthcare policies. This report offers an in-depth market analysis of Levobunolol, encompassing current market trends, key players, regulatory considerations, and future price projections grounded in industry data and predictive modeling.

Market Overview

Therapeutic Market Landscape

Globally, glaucoma represents a significant public health challenge, with over 76 million affected individuals as of 2020, projected to reach approximately 111 million by 2040 ([1]). Levobunolol, marketed under several brand names such as Betagan, remains a critical component of first-line therapy. Its widespread use stems from its efficacy, safety profile, and cost-effectiveness compared to newer agents.

Market Segmentation

The ophthalmic beta-blocker segment dominates the glaucoma treatment market, with levobunolol holding a substantial share owing to its long-standing approval and generic availability. Key therapeutic segments include:

- Ocular hypertension

- Primary open-angle glaucoma

- Secondary glaucoma

Regional segmentation reveals the highest prevalence and market activity in North America and Europe, driven by advanced healthcare infrastructure, widespread screening programs, and high disease awareness. Emerging markets in Asia-Pacific are witnessing rapid growth, fueled by increasing access to ophthalmic care.

Regulatory and Patent Considerations

Levobunolol's patent expiration in various markets has facilitated generic entry, intensifying price competition. Regulatory approvals are well-established, with the drug available as a prescription-only medicine in most jurisdictions. Innovations such as sustained-release formulations or fixed-dose combinations are under exploration, potentially impacting future market dynamics.

Competitive Landscape

The competitive environment is predominantly characterized by generic manufacturers with a few branded players. Major players include:

- Sandoz (Novartis)

- Pfizer

- Allergan (AbbVie)

- Bausch + Lomb

While branded formulations command premium pricing, generic manufacturers leverage cost advantages, leading to significant price erosion over recent years. Market consolidation and patent litigations continue to influence the competitive landscape.

Pricing Trends and Drivers

Historical Pricing Dynamics

Historically, Levobunolol has experienced substantial price declines following patent cliffs and increased generic penetration. For instance, in the U.S., the average retail price for a 10 mL bottle of generic Levobunolol has decreased by approximately 60% over the last decade ([2]).

Current Pricing Factors

Pricing is influenced by:

- Regulatory policies: Rebate structures and price caps impact net prices.

- Market competition: Multiple generics suppress prices.

- Reimbursement environments: Payer negotiations and formulary placements affect access and pricing.

- Manufacturing costs: Standardized and low for generics, supporting competitive pricing.

Regional Price Variations

- North America: Prices tend to be higher due to regulatory standards and payer dynamics.

- Europe: Similar trends, with some countries implementing price controls.

- Asia-Pacific: Lower price points driven by intense competition and differing reimbursement structures.

Future Price Projections

Analytic Assumptions

Projections are predicated on:

- Continued patent expiry and generic competition

- Rising prevalence of glaucoma

- Adoption of low-cost generics over branded formulations

- Stable regulatory and reimbursement policies

- No significant regulatory hurdles impeding generic distribution

Market Forecast (2023-2030)

Based on trend analysis, the average wholesale or retail price for a 10 mL bottle of Levobunolol is expected to decline further, with:

- Compound annual decrease (CAD) of approximately 4-6% over the next five years.

- By 2030, prices may stabilize at around $3-$5 per 10 mL bottle in North America and Europe, with regional variations influenced by ongoing policy adjustments and market entries.

In emerging markets, prices may remain lower, around $1-$3 per 10 mL bottle, due to ongoing price controls and intense generic competition. However, the total market volume is forecasted to increase, driven by rising disease prevalence.

Impact of Technological and Therapeutic Advances

Innovations such as sustained-release biodegradable implants and fixed-dose combination therapies could influence pricing by shifting demand patterns, although these technologies are not yet mainstream for Levobunolol.

Implications for Stakeholders

- Pharmaceutical Companies: Focus on cost-efficient manufacturing and strategic patent management to remain competitive.

- Healthcare Providers: Benefit from low-cost generics while balancing efficacy and patient adherence.

- Payers and Policymakers: Continue to implement policies that promote affordability without compromising quality.

- Investors: Opportunities exist in generic manufacturing, especially in emerging markets exhibiting strong growth.

Key Takeaways

- Levobunolol’s market remains mature with significant generic saturation, leading to sustained downward pressure on prices.

- The global rise in glaucoma prevalence ensures steady demand, supporting continued market presence.

- Price projections indicate further declines of approximately 4-6% annually in developed markets, with stabilization expected by 2030.

- Regional pricing variability reflects differences in reimbursement policies, healthcare infrastructure, and market competitiveness.

- Strategic innovation and regulatory navigation will be pivotal for market stakeholders to maximize profitability.

Conclusion

The Levobunolol market is characterized by a resilient demand driven by glaucoma's global burden and a competitive, price-sensitive landscape. Price projections underscore a continued downward trend, particularly influenced by generic proliferation and regulatory measures. Stakeholders must adapt through cost-effective strategies, while monitoring technological shifts that could reshape the therapeutic and economic landscape.

FAQs

Q1: How does patent expiration affect Levobunolol’s market price?

A1: Patent expiration opens the market to generics, increasing competition, which drives prices down significantly due to lower manufacturing costs and competitive bidding.

Q2: What regional factors influence Levobunolol’s pricing?

A2: Pricing varies based on healthcare policies, reimbursement schemes, regulatory standards, and market competition levels, with developed markets generally showcasing higher prices.

Q3: Are there emerging alternatives that could impact Levobunolol’s market?

A3: Yes, newer therapies such as prostaglandin analogs, combination drugs, sustained-release implants, and laser procedures may influence demand and pricing dynamics in certain markets.

Q4: What are the key drivers for future growth of Levobunolol?

A4: Rising glaucoma prevalence, expansion into emerging markets, and ongoing demand for low-cost ocular hypotensives will drive growth.

Q5: How might regulatory policies evolve to affect Levobunolol prices?

A5: Increased price controls, formularies prioritizing cost-effectiveness, and reimbursement reforms can further suppress prices but also promote more equitable access.

Sources:

[1] Tham, Y.C., et al. (2014). Global prevalence of glaucoma and projections of glaucoma burden through 2040. Ophthalmology.

[2] Medicare Part D Drug Spending Dashboard (2022). Price trends for ophthalmic medications.

More… ↓