Last updated: July 27, 2025

Introduction

Leucovorin Calcium, a chemically altered form of folic acid, plays a crucial role in cancer chemotherapy, hematologic disorders, and as an antidote for methotrexate toxicity. Its broad clinical applications and increasing global demand position it as a significant asset within the pharmaceutical landscape. This report offers a comprehensive market analysis coupled with price projections, focusing on current industry dynamics, competitive forces, regulatory environment, and future growth drivers.

Market Overview

Leucovorin Calcium’s global market is characterized by significant therapeutic utilization, driven primarily by oncology treatments, such as colorectal cancer, and hematology indications. The compound’s ability to enhance the efficacy of chemotherapeutic agents while mitigating toxicity has cemented its importance.

According to recent industry reports, the global leucovorin market was valued at approximately USD 400 million in 2022, with an annual growth rate projected at 6-8% over the next five years [1]. This growth is driven by rising cancer prevalence, expanding aging populations, and increasing adoption of combination therapy regimens.

Key Market Drivers

- Increasing Cancer Incidence: The global burden of colorectal, breast, and gastric cancers directly correlates with heightened demand for leucovorin as part of treatment protocols.

- Expanded Therapeutic Applications: Growing research into new indications such as spinal cord injury and neurodegenerative diseases may further boost demand.

- Rising Adoption in Developing Countries: Improved healthcare infrastructure and rising healthcare expenditure have seen increased leucovorin utilization in emerging markets.

- Generic Market Entry: The expiration of patents and the entrance of generics significantly impact pricing dynamics, broadening access and volume sales.

Competitive Landscape

The marketplace features both established pharmaceutical giants and regional manufacturers:

- Key Players: Pfizer (which markets Folinic Acid), GlaxoSmithKline, Hikma Pharmaceuticals, and Sandoz.

- Generic Manufacturers: Several regional producers provide cost-effective alternatives, underpinning competitive pricing strategies.

- Manufacturing Scale & Capacity: Large-scale production facilities with high-quality standards help maintain market supply stability.

The competition exerts downward pressure on prices, particularly from generic providers, which has historically led to price erosion in mature markets.

Regulatory and Reimbursement Environment

Leucovorin Calcium is approved globally, with regulatory agencies such as the FDA and EMA setting high-quality standards. Countries with national health services and private insurers influence pricing strategies through reimbursement policies—all of which impact the competitive dynamics and profit margins.

Reimbursement rates in North America and Europe tend to support stable profit margins, while price sensitivity is higher in emerging markets.

Supply Chain Dynamics

Major manufacturing hubs include North America, Europe, and India. Disruptions such as supply chain interruptions, geopolitical tensions, and raw material shortages (notably folic acid derivatives) could impact availability and prices.

Price Trends and Projections

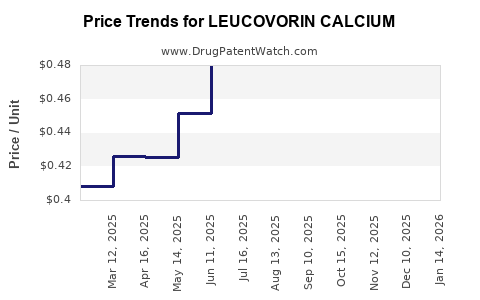

Historical Pricing Trends

- In primary markets like the U.S., wholesale acquisition costs (WAC) for leucovorin lyophilized powder ranged from USD 20 to USD 60 per dose, depending on formulation and packaging from 2018-2022.

- The entry of generics has notably decreased average prices by approximately 20-30% in mature markets.

Projected Price Movements

Over the next five years, the following factors are anticipated to influence pricing:

- Continued Generic Competition: Expected to sustain downward pressure on prices.

- Manufacturing Advances: Improvements in synthesis and production efficiency will reduce costs, passing savings onto consumers.

- Market Penetration in Emerging Economies: Increased adoption may initially support volume growth, offsetting lower per-unit prices.

- Regulatory Reforms: Potential pricing regulations and reimbursement negotiations can influence net prices.

Forecast:

In mature markets, wholesale prices are projected to decline by approximately 10-15% CAGR through 2028, stabilizing at USD 15-40 per dose. Conversely, in emerging markets, prices may remain stable or grow marginally, driven by increased demand and market expansion.

Emerging Trends and Future Opportunities

- Biotechnological Developments: Novel formulations, including liposomal or sustained-release versions, could command premium pricing.

- Combination Therapeutics: Growing integration with chemotherapeutic agents hints at potential synergies and new pricing models.

- Patent Expirations & Market Entry: The expiration of patents in developed regions will likely accelerate generic penetration and price decreases.

Risks and Challenges

- Regulatory Barriers: Stringent approval processes may hinder market entry for new formulations.

- Pricing Regulations: Government interventions aimed at drug price control could compress margins.

- Manufacturing Constraints: Raw material shortages or quality issues impact supply continuity and pricing.

Conclusion

Leucovorin Calcium remains a vital component across multiple therapeutic areas. Market expansion is buoyed by increasing global cancer prevalence and advancing treatment protocols. Price projections indicate a steady decline driven by generic competition and manufacturing efficiencies, with regional variations based on regulatory and economic factors.

Key Takeaways

- The global market is expected to grow at 6-8% annually until 2028, reaching upwards of USD 600 million.

- Pricing trends suggest a decline of 10-15% per year in mature markets, stabilizing prices at USD 15-40 per dose.

- Generics and biosimilars will continue to exert downward pricing pressure, especially post-patent expirations.

- Emerging markets present significant growth opportunities, albeit with more variable pricing dynamics.

- Innovation in formulations and therapeutic combinations could provide premium pricing avenues, offsetting downward trends.

FAQs

1. What are the main factors influencing the pricing of Leucovorin Calcium?

Factors include generic market entry, manufacturing costs, regulatory policies, reimbursement rates, and regional economic conditions. Price reductions follow increased generic competition, while innovations and new indications can support premium pricing.

2. How does the patent landscape impact the Leucovorin Calcium market?

Patent expirations facilitate generic entry, increasing supply and reducing prices. The timing of patent gaps critically influences market pricing and competitive strategies.

3. Which regions are expected to exhibit the highest growth in Leucovorin Calcium demand?

Emerging economies in Asia-Pacific and Latin America are projected to display significant growth, driven by expanding healthcare infrastructure and increasing cancer prevalence.

4. What future developments could alter current market and pricing forecasts?

Advancements in drug delivery systems, new therapeutic indications, changes in regulatory frameworks, and variations in raw material availability could all impact market dynamics.

5. How do regulatory agencies influence Leucovorin Calcium pricing?

Regulators impact pricing through approval processes, dosage regulations, and reimbursement policies, which can either facilitate market access or impose constraints that influence pricing strategies.

Sources

[1] Market Research Future, "Global Leucovorin Market Analysis," 2022.