Share This Page

Drug Price Trends for LATUDA

✉ Email this page to a colleague

Average Pharmacy Cost for LATUDA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LATUDA 60 MG TABLET | 63402-0306-30 | 45.42666 | EACH | 2025-12-17 |

| LATUDA 120 MG TABLET | 63402-0312-30 | 67.59300 | EACH | 2025-12-17 |

| LATUDA 80 MG TABLET | 63402-0308-30 | 45.29899 | EACH | 2025-12-17 |

| LATUDA 20 MG TABLET | 63402-0302-30 | 45.32873 | EACH | 2025-12-17 |

| LATUDA 40 MG TABLET | 63402-0304-30 | 45.35757 | EACH | 2025-12-17 |

| LATUDA 60 MG TABLET | 63402-0306-30 | 45.38740 | EACH | 2025-11-19 |

| LATUDA 120 MG TABLET | 63402-0312-30 | 67.57935 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for LATUDA (Lurasidone)

Introduction

LATUDA (lurasidone) is an atypical antipsychotic developed by Sunovion Pharmaceuticals, primarily indicated for schizophrenia and bipolar depression. Approved by the FDA in 2010 [1], LATUDA’s unique pharmacological profile and expanding therapeutic approvals have positioned it as a significant contender within the competitive antipsychotic market. This analysis explores the current market landscape, competitive positioning, regulatory dynamics, and future price projections of LATUDA, offering insights for industry stakeholders.

Market Overview

Market Size and Growth

The global antipsychotic market is estimated to reach approximately USD 16 billion by 2027, growing at a CAGR of 3–5% [2]. Major markets include the United States, Europe, and emerging economies in Asia-Pacific. LATUDA’s market share is notable among atypical antipsychotics, supported by its favorable side effect profile compared to first-generation antipsychotics.

Therapeutic Landscape

LATUDA’s primary indications encompass:

- Schizophrenia (FDA-approved in 2010)

- Bipolar depression (FDA-approved in 2019 for bipolar I depression)

The drug’s mechanism—partial agonism at dopamine D2 and serotonin 5-HT1A receptors and antagonism at 5-HT2A receptors—provides a favorable efficacy and tolerability profile [3].

Competitive Positioning

LATUDA faces competition from:

- Aripiprazole (AbbVie’s Abilify)

- Risperidone (Risperdal)

- Olanzapine (Zyprexa)

- Quetiapine (Seroquel)

- Brexpiprazole (Rexulti)

While these competitors dominate heavily, LATUDA’s lower risk of metabolic side effects offers a compelling advantage, particularly in patient populations vulnerable to weight gain and metabolic syndrome.

Market Penetration and Key Drivers

Brand Strength and Prescribing Trends

LATUDA’s prescription volume has increased steadily, driven by:

- Broadened FDA approvals, including bipolar depression

- Preference among clinicians for its metabolic safety profile

- Growing awareness and adoption in schizophrenia and bipolar disorder management

Insurers’ formulary placements and pricing strategies contribute significantly to accessible market penetration.

Regulatory and Patent Landscape

Sunovion's patent protections for LATUDA extend into the late 2020s, with patent litigations and biosimilar developments influencing pricing dynamics. Patent expirations elsewhere could introduce biosimilar competition, pressuring prices [4].

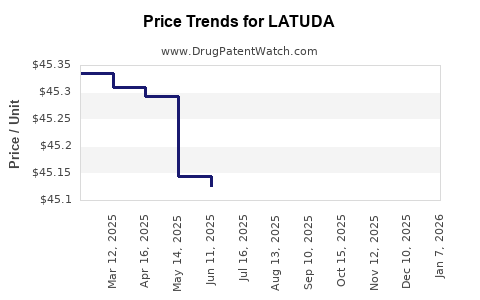

Pricing Trends and Projections

Current Pricing

The average wholesale price (AWP) for LATUDA is approximately USD 2,000–2,500 per month per patient, depending on dosage and region [5]. Discounts, rebates, and insurance negotiations substantially influence net prices, with actual patient costs often lower.

Factors Influencing Future Prices

Key factors include:

- Patent Expiry and Biosimilar Entry: Potential patent expiry for LATUDA increases competitive pressure, likely leading to significant price reductions.

- Generic and Biosimilar Development: Entry of generics could decrease prices by 30–70%, aligning with trends observed in other atypical antipsychotics.

- Market Demand and Prescribing Behavior: Increased adoption driven by expanding indications sustains demand, slightly moderating downward price pressure.

- Regulatory Decisions: Rapid approval and acceptance of biosimilars or similar agents could accelerate price erosion.

Price Projection Scenarios

- Optimistic Scenario: Pending patent protections hold through 2025; prices stabilize at current levels with minimal downward pressure.

- Moderate Scenario: Patent expiry around 2025–2026 leads to a 30–50% decrease in prices within two years post-expiry.

- Pessimistic Scenario: Early biosimilar competition emerges through legal challenges or regulatory pathways, prompting a 50–70% price reduction within 1–2 years post-approval.

Based on historical trends in the antipsychotic market, a median projection suggests that LATUDA’s average price will decline by approximately 40–50% within five years following patent expiration, reaching USD 1,000–1,250 per month.

Market Opportunities and Risks

Opportunities

- Expansion into Emerging Markets: Growing mental health awareness can expand LATUDA’s global footprint.

- New Indications: Investigating adjunct or new psychiatric indications can sustain revenue streams, especially if approval pathways are streamlined.

- Oral and Long-Acting Formulations: Development of alternative formulations could enhance adherence and market share.

Risks

- Generic Competition: Accelerated patent cliffs could erode margins.

- Pricing and Reimbursement Pressures: Payers’ push for cost containment can limit price increases.

- Market Saturation: Limited incremental demand growth for existing indications constrains upside.

Regulatory and Patent Landscape Dynamics

Patent protections for LATUDA extend into the late 2020s, with the last statutory expiry around 2027 in the U.S. [6]. Patent challenges or reformulation strategies by competitors could precipitate earlier generic entry. The regulatory environment increasingly favors biosimilars and generic alternatives, further pressuring prices.

Key Takeaways

- Market Positioning: LATUDA maintains a strong market position fueled by its favorable side effect profile and expanding indications.

- Competitive Risk: Patent expirations and biosimilar developments pose substantial threats to pricing power.

- Price Trends: Expect a significant downward adjustment post-patent expiry, with a conservative median estimate of 40–50% price reduction within five years.

- Strategic Focus: Companies should monitor patent landscapes, pursue indication expansion, and optimize formulary placements to maximize revenue stability.

- Emerging Opportunities: Growth in emerging markets and formulation innovations can mitigate downward pressures and sustain profitability.

FAQs

1. When is LATUDA’s patent set to expire, and how will it impact pricing?

LATUDA’s primary patents are expected to expire around 2027 in the U.S., which could lead to generic and biosimilar entries, significantly reducing prices by approximately 40–70% over subsequent years.

2. How does LATUDA compare to other atypical antipsychotics in terms of pricing?

While LATUDA’s current monthly price exceeds USD 2,000, it offers a favorable side effect profile, justifying higher costs. Post-patent expiry, generic versions are likely to be priced at 50–70% lower.

3. Are there opportunities for LATUDA beyond schizophrenia and bipolar depression?

Yes, ongoing research and label expansions into other psychiatric and neurological indications offer growth avenues, enhancing long-term market viability.

4. What market factors could influence LATUDA’s future price trajectory?

Patent timelines, regulatory decisions, biosimilar approval processes, insurance reimbursement policies, and clinician prescribing behaviors all shape future pricing.

5. How can Sunovion or other manufacturers mitigate revenue declines post-patent expiry?

Developing alternative formulations, expanding indications, penetrating emerging markets, and negotiating favorable formulary placements are critical strategies.

References

[1] U.S. Food & Drug Administration. “FDA approves Latuda for schizophrenia.” 2010.

[2] Grand View Research. “Antipsychotic Drugs Market Size & Trends.” 2022.

[3] Data on LATUDA’s mechanism from Sunovion’s product labeling.

[4] PatentScope, World Intellectual Property Organization. Patent status of LATUDA.

[5] Drugs.com. LATUDA pricing information.

[6] Orange Book, FDA. Patent and exclusivity data for LATUDA.

This comprehensive market analysis aims to inform strategic decision-making concerning LATUDA pricing and positioning in a dynamic pharmaceutical landscape.

More… ↓