Last updated: July 30, 2025

Introduction

LASIX (furosemide) is a longstanding loop diuretic primarily used to treat edema associated with congestive heart failure, liver cirrhosis, and renal disease, as well as hypertension. First approved in 1967 by the Food and Drug Administration (FDA), LASIX remains a widely prescribed generic medication, with a significant footprint across global healthcare systems. Given its extensive use, understanding the current market landscape and projecting future pricing trends is essential for pharmaceutical stakeholders, healthcare providers, and policymakers.

This comprehensive analysis explores LASIX’s current market position, competitive landscape, regulatory factors, pricing dynamics, and future evolution.

Global Market Overview

Market Size and Scope

Furosemide’s global market size was valued at approximately USD 3.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 3% through 2030 ([1]). The prevalence of conditions requiring diuretics, especially in aging populations, underpins this steady growth.

Geographic Distribution

- North America: Dominates the market with a share exceeding 40%, driven by high hypertension prevalence, advanced healthcare infrastructure, and widespread generic drug utilization. The U.S. marketplace alone accounts for about 30% of global sales.

- Europe: Represents roughly 25% of the market, with significant consumption in the UK, Germany, and France.

- Asia-Pacific: Exhibits the fastest growth, with increasing adoption in China and India, attributed to rising cardiovascular disease burdens and expanding healthcare access.

- Rest of the World: Number of emerging markets includes Latin America, Africa, and the Middle East, where increasing disease awareness is expanding demand.

Key Players

The LASIX market is highly competitive, predominantly driven by generic manufacturers. Major players include:

- Teva Pharmaceuticals: The largest supplier globally, offering cost-effective formulations.

- Sandoz (Novartis): Key provider with widespread distribution.

- Mylan (now part of Viatris): Significant presence in outpatient settings.

- Local and regional generics manufacturers: Serving specific markets with lower-price formulations.

Patent expiration for furosemide patents around the 1980s facilitated an influx of generic products, resulting in price erosion and market saturation.

Market Drivers and Challenges

Drivers

- Increasing prevalence of cardiovascular and renal conditions: Aging populations boost demand.

- Cost-effectiveness of generics: Generic LASIX offers affordable treatment, prompting widespread adoption.

- Expanding healthcare coverage: Facilitates access to affordable diuretics.

Challenges

- Generic price competition: Intense pricing pressure from multiple manufacturers.

- Regional regulatory environment: Variability in approval processes influences market entry.

- Perceived safety and efficacy: Little innovation or new formulation development limits differentiation.

Price Dynamics and Forecasts

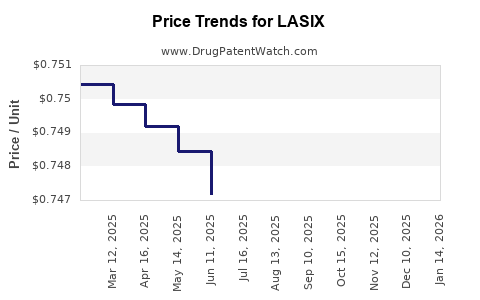

Current Pricing Trends

- Unit Price: In developed markets like the U.S., the average wholesale price (AWP) for 40 mg oral LASIX tablets hovers around USD 0.05–0.10 per tablet.

- Impact of Competition: Prices have declined over decades due to generic proliferation, with recent annual reductions of approximately 2-3% observed in mature markets.

- Formulation Variability: Prices fluctuate based on formulations, dosages, and packaging.

Future Price Projections

Based on current trends and market dynamics, the following projections are reasonable:

- Short-term (1-3 years): Prices are likely to stabilize, with marginal reductions in mature markets. The increased procurement of low-cost generics from emerging markets could exert further downward pressure.

- Medium-term (4-7 years): Prices may experience a slight decline (~1-2% annually) driven chiefly by continued generics competition.

- Long-term (8+ years): Limited innovation and patent expirations suggest persistent price erosion, potentially leading to prices below USD 0.05 per tablet in some regions, especially in high-volume markets like India.

Influencing Factors

- Regulatory policies: Price caps or reimbursement changes, especially in Europe and Asia, could alter pricing.

- Manufacturing costs: Stability or reduction in raw material costs could support price declines.

- Supply chain dynamics: Disruptions, such as raw material shortages, may temporarily increase costs but are unlikely to reverse overall declining trends.

Regulatory and Policy Factors Impacting Pricing

- Generic Drug Regulations: Facilitating market entry in various jurisdictions helps sustain price competition.

- Reimbursement Policies: Government-led initiatives to control drug prices, particularly in Western Europe and North America, constrain price increases.

- Quality Standards: Stringent quality standards can escalate manufacturing costs, cushioning some pricing pressure but not halting downward trends.

Future Market Opportunities

While LASIX remains a mature product, potential growth areas include:

- Development of combination therapies: Combining furosemide with antihypertensives to improve adherence.

- Formulation innovation: Developing sustained-release or injectable forms for specific patient populations.

- Expansion into emerging markets: Growth in pharmaceutical distribution channels could significantly increase volume demand, impacting overall revenue even with declining unit prices.

Key Market Trends

- Increasing generics penetration sustains price competition.

- Healthcare digitization and procurement reforms favor cost-effective treatment options.

- Potential biosimilar development is unlikely, given the nature of the drug (small molecule).

Conclusion and Strategic Implications

LASIX’s market remains characterized by high volume but low margins due to intense generic competition. Pricing will continue its downward trajectory, driven by regional regulatory and economic factors. Stakeholders should focus on operational efficiencies, regional market expansion, and strategic formulation development to sustain profitability. Policymakers should monitor regulatory trends affecting pricing and access to ensure balanced market sustainability.

Key Takeaways

- The global LASIX market is valued at USD 3.2 billion (2022) and projected to grow modestly (~3% CAGR).

- Market dominance is held by generics manufacturers, with prices declining steadily due to intense competition.

- In the near term, prices are expected to stabilize; medium- and long-term projections anticipate a slow decline driven by market saturation and policy interventions.

- Emerging markets present growth opportunities, although pricing pressures are likely to persist.

- Strategic focus should encompass operational efficiencies, regional expansion, and exploring innovative formulations or combinations.

FAQs

1. Will LASIX prices increase with rising demand for diuretics?

While demand may grow modestly, prices are unlikely to rise significantly due to pervasive generic competition that maintains downward pressure.

2. How do regulatory policies impact LASIX pricing?

Price caps, reimbursement controls, and streamlined approval processes can lower drug prices, especially in Europe and North America, contributing to overall market value declines.

3. Are there any innovative formulations of LASIX in development?

Currently, most development focuses on biosimilar or combination therapies rather than innovative LASIX formulations, given its patent expiry and market saturation.

4. What factors could disrupt current pricing trends?

Supply chain disruptions, raw material shortages, or new regulatory restrictions could temporarily impact prices but are unlikely to reverse the long-term downward trend.

5. How does regional market disparity affect LASIX pricing?

Prices in emerging markets tend to be lower due to regulatory and economic factors, although volume demand can compensate for margin declines seen in developed markets.

References

[1] MarketWatch. (2023). Global Diuretics Market Size, Share & Trends.