Last updated: July 27, 2025

Introduction

LANTUS (insulin glargine) stands as one of the most prominent long-acting basal insulins used globally to manage diabetes mellitus, especially Type 1 and Type 2. Since its approval by the FDA in 2000, LANTUS has solidified its position in the diabetic treatment landscape, underpinning a substantial market segment. This report offers a comprehensive overview of market dynamics and forecasts future pricing trajectories for LANTUS.

Market Overview

Global Market Size and Growth Trends

The global insulin market is projected to reach approximately USD 39 billion by 2027, growing at a compound annual growth rate (CAGR) of around 7% from 2022 to 2027. LANTUS, as a flagship product within basal insulins, commands a significant share—estimated around 35-40% in the long-acting insulin segment[1].

Diabetes prevalence is escalating worldwide, fueled by urbanization, sedentary lifestyles, and increased obesity rates. The International Diabetes Federation (IDF) estimates over 537 million adults were living with diabetes in 2021, a figure anticipated to reach 643 million by 2030. This burgeoning incidence directly correlates with heightened demand for insulin therapies like LANTUS.

Market Players and Competitive Landscape

LANTUS has faced competition from biosimilars and alternative long-acting insulins, including:

- Basaglar (insulin glargine, Lilly/Biocon)

- Semglee (insulin glargine, Mylan)

- Tresiba (insulin degludec, Novo Nordisk)

- Toujeo (insulin glargine U-300, Sanofi)

The entry of biosimilars has intensified market competition, leading to pricing pressures and increased accessibility. Nonetheless, LANTUS retains brand loyalty owing to its established safety profile and clinical familiarity.

Market Drivers and Challenges

Drivers

- Rising prevalence of diabetes globally

- Preference for basal insulin therapy over complex regimens

- Improved insulin delivery devices increasing adherence

- Expanding insurance coverage and reimbursement policies

Challenges

- Patent expirations leading to biosimilar competition

- Price sensitivity in emerging markets

- Stringent regulatory pathways for biosimilars

- Patient concerns about injection frequency and side effects

Price Trends and Revenue Dynamics

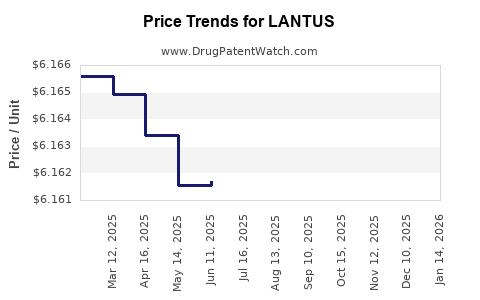

Historical Pricing Patterns

LANTUS's initial pricing in the early 2000s was significantly higher than biosimilar counterparts. Over time, prices have seen fluctuations driven by market competition, healthcare reforms, and negotiations. In the U.S., list prices for LANTUS hovered around USD 250-300 per 10 mL pen as of 2022, with actual prices often discounted through rebates and insurance negotiations[2].

Patent and Biosimilar Impact

Following patent expiration in 2015, biosimilar versions entered key markets like the European Union and the U.S., exerting downward pressure on LANTUS’s price. For instance, biosimilar insulins in the U.S. have been priced approximately 15-25% below the branded LANTUS, leading to an erosion of revenues.

Future Price Projections (2023–2030)

Factors Influencing Future Pricing

- Market penetration of biosimilars: As biosimilar uptake increases, proprietary prices are expected to decline.

- Regulatory policies: Governments prioritizing affordability may enforce price caps or encourage biosimilar use.

- Technological advances: Improved delivery devices and formulations could justify premium pricing or conversely, lead to price reductions for less innovative options.

Projected Trends

- Short to medium term (2023–2025): Prices for LANTUS are anticipated to decline by 10-15% in mature markets due to biosimilar competition and payer negotiations.

- Long-term (2026–2030): Stabilization or further decline, potentially reaching USD 150-200 per 10 mL pen in the U.S. and Europe as biosymmetric options become more prevalent and healthcare systems emphasize cost containment.

Emerging Market Outlooks

In emerging markets like India, China, and Brazil, the price erosion may be more pronounced, driven by local biosimilar manufacturing, price control policies, and affordability initiatives. LANTUS’s premium pricing may diminish sharply, impacting revenue streams.

Implications for Stakeholders

- Pharmaceutical Companies: Continual innovation, such as concentrated formulations or once-weekly insulins, can sustain margins.

- Healthcare Providers: Emphasize biosimilar adoption to optimize budgets.

- Patients: Gains access through lower-cost biosimilar options, increasing treatment adherence.

- Investors: Focus on biosimilar portfolio growth and R&D pipelines as key to future profitability.

Conclusion

LANTUS remains a cornerstone in basal insulin therapy, but its market share and pricing are increasingly challenged by biosimilars and evolving healthcare policies. While current prices exhibit modest declines, long-term projections suggest a gradual depreciation driven by biosimilar proliferation, patent expirations, and market pressures.

Strategic adaptation through innovation and market expansion, especially in emerging economies, will be crucial for sustaining revenue.

Key Takeaways

- The global insulin market is poised for sustained growth, driven by rising diabetes prevalence.

- LANTUS commands a significant share but faces declining prices due to biosimilar competition.

- Short-term price reductions of approximately 10-15% are expected, with further declines probable by 2030.

- Market dynamics vary across regions; emerging markets may see more aggressive price erosion.

- Stakeholders must prioritize biosimilar integration and innovation to maintain profitability.

FAQs

1. How has biosimilar entry affected LANTUS’s market share?

Biosimilar insulins like Basaglar and Semglee have captured a portion of the market, leading to increased competition and contributing to a decline in LANTUS’s market share in both established and emerging regions.

2. What are the main factors influencing LANTUS’s future price trajectory?

Patent expirations, biosimilar availability, regulatory policies, healthcare reimbursement reforms, and advances in insulin formulations critically impact future pricing.

3. Are biosimilars considered as effective as LANTUS?

Yes, biosimilars approved by regulatory agencies such as the FDA and EMA demonstrate comparable efficacy and safety profiles, facilitating their acceptance in clinical practice.

4. How do regional differences affect LANTUS pricing?

In developed markets, prices are influenced by insurance negotiations and reimbursement policies, resulting in moderate reductions. Conversely, in emerging markets, government regulations and local biosimilar manufacturing often lead to sharper price declines.

5. What strategies can pharmaceutical firms deploy to sustain LANTUS revenues?

Firms can innovate with new formulations (e.g., ultra-long-acting insulins), expand into new markets, and develop complementary digital health solutions to enhance patient adherence and justify premium pricing.

References

- [1] International Diabetes Federation. IDF Diabetes Atlas, 10th Edition, 2021.

- [2] IQVIA Institute. "The Growing Cost of Diabetes," 2022.