Share This Page

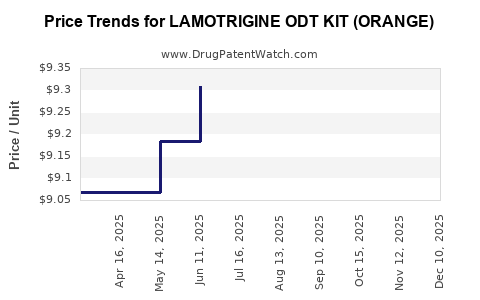

Drug Price Trends for LAMOTRIGINE ODT KIT (ORANGE)

✉ Email this page to a colleague

Average Pharmacy Cost for LAMOTRIGINE ODT KIT (ORANGE)

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LAMOTRIGINE ODT KIT (ORANGE) | 49884-0882-99 | 9.60617 | EACH | 2025-12-17 |

| LAMOTRIGINE ODT KIT (ORANGE) | 49884-0882-99 | 9.32217 | EACH | 2025-11-19 |

| LAMOTRIGINE ODT KIT (ORANGE) | 49884-0882-99 | 9.24819 | EACH | 2025-10-22 |

| LAMOTRIGINE ODT KIT (ORANGE) | 49884-0882-99 | 9.30217 | EACH | 2025-09-17 |

| LAMOTRIGINE ODT KIT (ORANGE) | 49884-0882-99 | 9.39507 | EACH | 2025-08-20 |

| LAMOTRIGINE ODT KIT (ORANGE) | 49884-0882-99 | 9.46235 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Lamotrigine ODT Kit (Orange)

Introduction

Lamotrigine orally disintegrating tablets (ODT) are a critical therapeutic option in managing epilepsy and bipolar disorder, offering rapid onset and improved compliance for patients with swallowing difficulties. The Lamotrigine ODT Kit (Orange) signifies a specific formulation packaged for convenience and targeted market segments. This report provides a comprehensive analysis of the current market landscape, competitive positioning, regulatory environment, and future price projections for Lamotrigine ODT Kit (Orange), serving as a strategic guide for stakeholders.

Market Overview

Therapeutic Market Landscape

Lamotrigine remains a cornerstone in anticonvulsant therapy, with global sales driven by its efficacy in focal and generalized seizures, as well as bipolar disorder management. The oral disintegrating formulation caters to pediatric, geriatric, and compliance-challenged populations, expanding its market penetration.

The global anti-epileptic drugs (AEDs) market was projected to reach USD 4.9 billion by 2027, growing at a CAGR of approximately 4.3% (CAGR 2020-2027) [1]. Lamotrigine holds a significant share within this market, often ranking second or third in volume and revenue.

Key Market Players

Primary producers include GlaxoSmithKline (GSK) and Sun Pharmaceutical Industries, alongside several generic manufacturers. The introduction of specialized formulations like ODT has spurred competition, especially in developed markets such as the U.S., Europe, and Japan.

Regulatory Status and Approvals

In the United States, the Lamotrigine ODT Kit (Orange) corresponds to FDA-approved formulations (e.g., Lamictal ODT). Regulatory bodies mandate strict quality, bioequivalence, and safety standards. The presence of a distinguishable orange packaging helps in branding and patient adherence.

Market Dynamics and Drivers

Factors Enhancing Market Growth

- Patient Compliance & Convenience: The ODT formulation reduces swallowing difficulty and enhances adherence, especially among pediatric and elderly cohorts.

- Expanding Indications: Growing recognition of lamotrigine’s efficacy in bipolar mood stabilization expands the treatment landscape.

- Market Expansion in Emerging Economies: Increased healthcare infrastructure investments in Asia-Pacific, Latin America, and the Middle East create growth opportunities.

- Innovations and Formulation Advances: Development of multi-dose packaging and novel delivery mechanisms fosters expansion.

Challenges and Market Restraints

- Generic Competition: As patents expire, numerous generic versions drive down prices and market share for branded formulations.

- Pricing Pressures: Tight regulation and healthcare cost containment efforts limit price increases.

- Manufacturing and Supply Chain Disruptions: Global crises, such as COVID-19, impact production and distribution.

Price Analysis and Projections

Current Pricing Landscape

Market prices for Lamotrigine ODT Kit (Orange) vary globally:

- United States: The average wholesale price (AWP) for a 30-tablet pack ranges from USD 300 to USD 400.

- European Markets: Retail prices range from EUR 250 to EUR 380 for equivalent packs.

- Emerging Economies: Prices are significantly lower, often between USD 50–USD 150 per pack due to localized manufacturing and generic options.

Brand-name Lamotrigine ODT formulations with Orange labeling typically command premiums of 15–25% over generic equivalents in mature markets but face price erosion with increased generics.

Future Price Trends

2023–2028 projections indicate a downward pressure of 10–20% in mature markets, driven predominantly by generic proliferation and patent expirations. However, premium formulations with added patient-centric features or proprietary manufacturing processes may retain higher prices.

Given the commoditization trend, average prices are expected to decline as generic manufacturers expand capacity:

- US Market: Anticipated or sustained prices around USD 250–USD 320 for the same 30-tablet pack.

- Europe: Expected prices in the EUR 200–EUR 350 range.

- Emerging Markets: Likely to see moderate decreases aligned with local competition, possibly stabilizing around USD 50–USD 100.

Factors Supporting Price Stability or Growth

- Regulatory Exclusivity: Orphan drug designation or formulation-specific patents could provide temporary price premiums.

- Supply Agreements: Strategic partnerships with insurers and healthcare providers may sustain higher prices through volume commitments.

- Product Differentiation: Innovations in packaging or formulation (e.g., taste-masking, multi-dose options) could sustain premium pricing.

Competitive Positioning and Market Share

The branded Lamotrigine ODT Kit (Orange)'s market share is shrinking in the face of generics but remains relevant where brand loyalty and formulary preferences prevail. Pricing strategies increasingly involve tiered approaches, with the brand maintaining premium positioning in the pharmacy benefit segment, especially for pediatric and elderly patients.

Market entry by generics has led to a price erosion of over 40% within five years of patent expiry. Nonetheless, brand manufacturers employ robust marketing, quality assurances, and patient support programs to preserve a segment of premium-paying consumers.

Regulatory and Policy Impact on Pricing

Regulations such as the U.S. Medicaid Drug Rebate Program and European price control mechanisms influence attainable prices. Policymakers focus on cost containment, influencing the future trajectory of drug prices:

- Price Negotiations: Increased negotiation power for payers can lead to significant price reductions.

- Reference Pricing: Cross-country reference pricing pressures set caps on maximum allowable prices.

- Reimbursement Policies: Favoring generic substitution reduces incentives for brand-name pricing.

Key Market Opportunities and Risks

Opportunities

- Expansion into Emerging Markets: Rising awareness and healthcare access create opportunities for market penetration.

- Development of Next-Generation Formulations: Innovations, such as combined formulations or improved bioavailability, could command premium pricing.

- Partnerships and Licensing: Collaborations with payers and pharmacy chains can enhance market presence.

Risks

- Patent Expiry and Competition: Accelerating generic entries place downward pressure.

- Regulatory Changes: Enhanced pricing controls can limit profit margins.

- Supply Chain Disruptions: Affecting continuity and pricing stability.

Conclusion and Strategic Recommendations

The Lamotrigine ODT Kit (Orange) faces a cautious but promising future. While market pressures and generic competition drive prices downward, targeted differentiation through formulation innovation and strategic partnerships offer avenues for premium positioning.

Stakeholders should focus on:

- Monitoring patent statuses and patent challenges.

- Diversifying markets to include emerging economies.

- Investing in formulation enhancements for patient-centric value propositions.

- Negotiating favorable reimbursement arrangements and patent protections.

Key Takeaways

- The global market for Lamotrigine ODT formulations is mature, with increasing generic penetration exerting downward price pressure.

- Current prices hover around USD 250–USD 400 per 30-tablet pack in developed markets, with notable variability based on regulatory and competitive factors.

- Price projections suggest a continual decline of 10–20% over the next five years, barring new patent protections or formulation innovations.

- Market success hinges on product differentiation, strategic partnerships, and navigating regulatory landscapes.

- Developing a robust presence in emerging markets offers a notable growth pathway amid shrinking margins elsewhere.

Frequently Asked Questions

1. How does the expiry of patents impact the pricing of Lamotrigine ODT Kit (Orange)?

Patent expirations typically lead to increased generic competition, causing significant price reductions—often between 30-50%—as multiple manufacturers enter the market with bioequivalent products, eroding the market share and pricing power of brand formulations.

2. Are there regulatory barriers to launching generic versions of Lamotrigine ODT (Orange)?

While bioequivalence requirements are standardized, formulation-specific patents or exclusivity rights may pose barriers. Manufacturers must navigate patent challenges and approval processes, which can delay generic entry and temporarily sustain higher prices.

3. What strategies can brand manufacturers employ to maintain market share?

They can focus on formulation differentiation, patient support programs, marketing efforts emphasizing quality and safety, and securing exclusive distribution channels or limited-period patent protections.

4. Which markets are most promising for expanding the use of Lamotrigine ODT (Orange)?

Emerging economies with increasing epilepsy and bipolar disorder prevalence offer substantial opportunities, especially where healthcare infrastructure is improving and brand recognition can influence prescribing patterns.

5. How will health policy reforms affect Lamotrigine ODT pricing in the future?

Enhanced price regulation, increased negotiation powers for public healthcare payers, and formulary policies favoring generics are expected to sustain downward pressure on prices, limiting profit margins for branded formulations.

Sources:

[1] MarketWatch, “Anti-Epileptic Drugs Market Size, Share & Trends Analysis Report,” 2022.

More… ↓