Share This Page

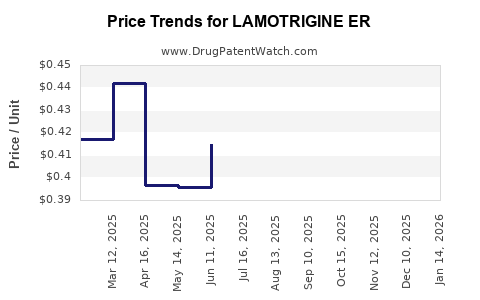

Drug Price Trends for LAMOTRIGINE ER

✉ Email this page to a colleague

Average Pharmacy Cost for LAMOTRIGINE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| LAMOTRIGINE ER 100 MG TABLET | 16714-0625-01 | 0.75311 | EACH | 2025-12-17 |

| LAMOTRIGINE ER 100 MG TABLET | 13668-0341-30 | 0.75311 | EACH | 2025-12-17 |

| LAMOTRIGINE ER 50 MG TABLET | 68382-0980-06 | 0.68458 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Lamotrigine ER

Introduction

Lamotrigine Extended Release (ER) is a long-acting formulation of the anticonvulsant and mood-stabilizing drug lamotrigine. Approved for epilepsy and bipolar disorder, Lamotrigine ER offers dosing convenience and enhanced patient adherence. As the pharmaceutical landscape evolves, understanding market dynamics and price trajectories for Lamotrigine ER is essential for stakeholders including manufacturers, healthcare providers, payers, and investors.

Market Overview

Indications and Clinical Use

Lamotrigine ER is indicated primarily for maintenance treatment of epilepsy and bipolar disorder. Its once-daily dosing regimen improves adherence, especially among chronic patients. The drug's favorable safety profile, particularly regarding cognitive and weight-related side effects, positions it favorably within its therapeutic classes.

Market Penetration and Competition

The global epileptic and bipolar disorder markets are mature with established treatments. However, Lamotrigine tracks strong market share due to its efficacy and tolerability. The introduction of ER formulations leverages prior brand recognition but contends with multiple generic equivalents, which significantly impact pricing strategies.

Major competitors include:

-

Branded formulations: Lamictal XR (sustained release), marketed by GlaxoSmithKline, which faces generic competition.

-

Generics: Multiple manufacturers produce generic lamotrigine ER, fostering price competition and presenting barriers to premium pricing.

Market Size and Growth Factors

According to IQVIA data, the global epilepsy market was valued at approximately $2.2 billion in 2022, growing at a compound annual growth rate (CAGR) of 4%-6%. The bipolar disorder segment, valued at roughly $4 billion worldwide, exhibits similar growth trends.

Key drivers include:

-

Increasing prevalence of epilepsy (~50 million cases globally) [1].

-

Rising bipolar disorder diagnoses, amplified by awareness and diagnostic improvements.

-

Longer treatment durations, emphasizing the importance of convenient formulations like ER.

-

Regulatory approvals expanding indications in emerging markets.

Market Dynamics and Regulatory Landscape

Regulatory Environment

Regulatory approvals for Lamotrigine ER align with evolving standards prioritizing bioequivalence and safety. In the U.S., the FDA approved generic versions following patent expirations, fostering price competition. Conversely, patent protections on branded formulations, such as Lamictal XR, restrict immediate generic entry, maintaining higher prices temporarily.

Patent and Exclusivity Periods

Lamotrigine ER's initial patents expired in many jurisdictions by 2021, enabling generic manufacturing. Secondary patents or exclusivity periods may temporarily delay full generic competition.

Pricing and Reimbursement Policies

Pricing strategies are driven by:

-

Market competition: Generics are priced approximately 20-80% lower than branded counterparts.

-

Reimbursement policies: Payers favor generics to reduce costs, compelling manufacturers of branded Lamotrigine ER to adjust prices accordingly.

-

Patient access programs: Insurers and pharmaceutical companies employ copay assistance and prior authorization to manage formulary preferences.

Price Projections

Historical Pricing Trends

-

Brand name (Lamictal XR): Historically priced at approximately $500-$700 per month (in the U.S.).

-

Generic Lamotrigine ER: Prices have decreased substantially since patent expiry, ranging from $50 to $150 per month depending on manufacturer and pharmacy discounts.

-

Impact of Market Entry: The proliferation of generics led to a pricing decline of approximately 50-70% within 2-3 years post-generic approval.

Future Price Trajectory

-

Short-term (1-2 years): Expect stabilization around $50-$100 per month for generics as market saturation occurs. Branded prices will remain significantly higher but may decline due to competitive pressures.

-

Medium to long-term (3-5 years): Prices are projected to decline further given ongoing generic proliferation, market commoditization, and healthcare system negotiations. Prices may stabilize near or below $50 per month for generics, with branded formulations potentially maintaining a premium for niche or branded preference.

-

Premium niche markets: In region-specific or specialty populations, branded formulations may retain higher prices due to physician or patient preferences, but overall market dominance of generics will suppress top-tier prices.

Geographical Variations

-

United States: Competitive generic landscape leads to lower prices. Payer negotiations and formulary restrictions influence substantial price erosion.

-

Europe: Similar trends, with some variations due to national reimbursement policies and drug regulation standards.

-

Emerging markets: Limited brand presence and higher dependency on generics lead to lower absolute prices, but affordability challenges persist.

Market Drivers and Constraints

Drivers:

-

Growing prevalence of target indications.

-

Preference for once-daily dosing formulations.

-

Favorable safety and tolerability profiles.

-

Patent expiries facilitating widespread generic entry.

Constraints:

-

Stringent regulatory requirements in certain jurisdictions.

-

Market saturation of generic options.

-

Price sensitivity among payers.

-

Potential development of novel formulations or alternative therapies.

Key Opportunities

-

Innovative formulations: Developing extended release or controlled-release versions with added benefits may command premium pricing.

-

Differentiation in niche markets: Pediatric or complex comorbidity populations may sustain higher prices.

-

Market expansion: Penetration into emerging markets could drive volume growth.

Conclusion

The market for Lamotrigine ER is characterized by significant price erosion driven by generic competition, with prices expected to stabilize at low levels over the next five years. While branded formulations will retain premium pricing in select contexts, overall financial gains depend on market share, regional dynamics, and formulary strategies. Stakeholders should strategically focus on niche markets, differentiation, and geographic expansion to maximize profitability.

Key Takeaways

-

Patent expirations have catalyzed extensive generic competition, leading to sharp price reductions for Lamotrigine ER globally.

-

Average generic prices are projected to stabilize between $20-$50 per month within 2-3 years, with branded prices remaining substantially higher.

-

Market growth will primarily depend on the expansion into emerging markets and patient adherence benefits.

-

Future pricing strategies should account for evolving payer policies, biosimilar and generic proliferation, and potential for value-added formulations.

-

Strategic positioning in niche segments and geographic markets offers opportunities to sustain revenue streams.

FAQs

1. How do patent expiries influence Lamotrigine ER pricing?

Patent expiries open markets to generic manufacturers, increasing competition and dramatically lowering prices, often within 1-3 years of patent expiry.

2. What factors could delay price declines for Lamotrigine ER?

Regulatory hurdles, patent litigations, limited generic manufacturing capacity, or restricted market access could slow price reductions.

3. Are there opportunities for branded Lamotrigine ER in the current market?

Yes, in regions with limited generic penetration, or through differentiation via formulation improvements or specific patient populations, branded products can command premium prices.

4. How does the availability of generics affect healthcare costs?

Generics significantly reduce treatment costs, improving affordability and access, but may influence profit margins for manufacturers of branded formulations.

5. What is the outlook for Lamotrigine ER in emerging markets?

While current prices are lower, increasing diagnosis rates and healthcare infrastructure investments suggest potential for volume growth, benefiting manufacturers capable of local manufacturing or partnerships.

Sources

[1] World Health Organization. Epilepsy Fact Sheet, 2022.

More… ↓