Last updated: July 27, 2025

Introduction

LAMICTAL XR (lamotrigine extended-release) is a widely prescribed anticonvulsant and mood stabilizer primarily used for managing bipolar disorder and epilepsy. Launched as an advanced formulation offering improved dosing convenience and potentially enhanced patient adherence, LAMICTAL XR occupies a significant segment in the neuropsychiatric therapeutics market. This analysis explores the current market landscape, competitive positioning, regulatory environment, and future price projections for LAMICTAL XR, tailored for stakeholders aiming to understand its market dynamics.

Market Landscape Overview

Global Epilepsy and Bipolar Disorder Treatment Market

The neuropsychiatric drug market, particularly for epilepsy and bipolar disorder, is robust, driven by increasing prevalence and heightened awareness about mental health. The global epilepsy market was valued at approximately $9.3 billion in 2022, with a compound annual growth rate (CAGR) forecasted around 4.5% through 2028[1]. Similarly, bipolar disorder therapeutics are expected to expand due to rising diagnoses, especially in emerging markets.

LAMICTAL XR’s Therapeutic Positioning

Introduced in 2017 by GlaxoSmithKline (now part of GSK), LAMICTAL XR offers phased dosing, once-daily administration options, and a formulation tailored for rapid titration, compared to the immediate-release version. These features increase its appeal among clinicians and patients, especially those requiring chronic management with improved compliance.

Market Penetration and Adoption

LAMICTAL XR has gradually gained market share owing to its enhanced convenience, especially in bipolar disorder. Its position is reinforced by clinical evidence favoring improved adherence and tolerability; however, competition remains robust from alternative formulations and other mood stabilizers like lithium, valproate, and newer antiepileptics (e.g., levetiracetam, topiramate).

Competitive Landscape

Key Competitors

- Generic Lamotrigine: The presence of generics significantly influences pricing and prescription patterns.

- Other Extended-Release Formulations: While limited, some competitors are developing or marketing similar formulations.

- Brand and Generic Alternatives: In the US, generics dominate due to price sensitivity; branded drug prices have declined accordingly.

Regulatory Considerations

Further approval of biosimilars or new formulations could influence LAMICTAL XR’s market dominance. Patent expirations, notably the original patent expiring in the late 2010s, have facilitated generic entry, exerting downward pressure on prices.

Pricing Dynamics

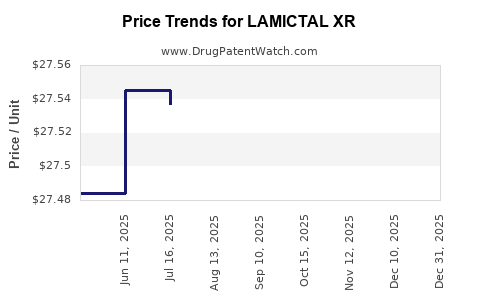

Historical Pricing Trends

Initial pricing for LAMICTAL XR was approximately $600–$700 per month in the US market upon launch. With increasing generic competition, prices sharply declined—generics are now often available for $60–$150 per month, depending on the dosage and pharmacy discounts.

Impact of Generics and Biosimilars

The rapid entry of generics post-patent expiry has caused a notable price erosion for LAMICTAL XR and its immediate-release counterparts. Generic versions have rapidly displaced brand-name prescriptions, especially among payers seeking cost-effective options.

Reimbursement and Payer Dynamics

In payer markets, formulary preferences and negotiated discounts substantially influence real-world drug prices. Managed care organizations favor generics, further limiting the revenue potential for branded formulations like LAMICTAL XR.

Future Price Projections

Market Factors Influencing Pricing

- Patent and Exclusivity Status: Pending or granted patents on formulations or delivery mechanisms could temporarily sustain higher prices.

- Pipeline Developments: New formulations or combination therapies may shift market share.

- Regulatory Environment: Potential policies aimed at controlling healthcare costs, including drug price caps, could restrict pricing power.

- Market Penetration in Emerging Markets: Growing access and diagnostics expansion could lead to increased volume, offsetting lower unit prices.

Projection Scenarios

Conservative Scenario: With continued generic dominance and price competition, the average monthly cost of LAMICTAL XR could further decline to $50–$100 over the next five years in the US, aligning with current generic prices.

Optimistic Scenario: If certain formulations or delivery innovations secure patent protection and demonstrate superior efficacy or convenience, branded prices could stabilize around $300–$500 per month, predominantly in specialty or emerging markets.

Long-term Outlook: Given the market forces, LAMICTAL XR’s branded price is unlikely to return to its initial levels but could sustain premium pricing in niche markets where clinical differentiation exists.

Implications for Stakeholders

- Pharmaceutical Companies: Innovators should focus on differentiating features that justify higher prices, such as personalized delivery, combination formulations, or clinical superiority.

- Payers and Insurers: Cost containment pressures favor generic prescribing; however, value-based pricing models may protect certain branded drugs.

- Investors and Market Analysts: Margins are tightening due to price erosion; growth depends on expanding indications and geographic reach.

Key Takeaways

- Market dynamics favor generic proliferation, exerting significant downward pressure on LAMICTAL XR prices.

- Branded prices are projected to decline by at least 40-60% within the next five years, stabilizing around $50–$150 monthly in mature markets.

- Pricing resilience relies on clinical differentiation, patent rights, and strategic expansion, particularly in emerging markets.

- Lamicatal XR’s growth potential is closely tied to evolving treatment guidelines and physician preferences favoring adherence-friendly formulations.

- Stakeholders should monitor patent statuses, pipeline developments, and regulatory policies that could influence pricing trajectories.

FAQs

1. What factors most influence the pricing of LAMICTAL XR?

Patent protections, generic competition, clinical differentiation, payer reimbursement policies, and regional regulatory environments significantly impact pricing.

2. How does the availability of generic lamotrigine affect LAMICTAL XR’s market value?

Generics drastically reduce unit prices and prescription volumes for branded versions, often leading to a sharp decline in branded drug revenues.

3. Are there upcoming patent expirations or regulatory decisions that could alter LAMICTAL XR’s market position?

Patent expirations have already triggered generic entry; future patent protections on extended-release formulations or novel delivery systems could temporarily stabilize prices.

4. What markets offer the most growth opportunities for LAMICTAL XR?

Emerging markets with expanding healthcare access and increasing neuropsychiatric diagnoses present significant growth prospects, especially if priced competitively.

5. How might healthcare policy changes influence future drug prices?

Policies targeting drug pricing transparency and caps can further reduce branded drug prices, emphasizing the importance of cost-effective generics in formulary decisions.

Sources

[1] MarketWatch. "Epilepsy Drugs Market Report," 2022.

[2] IQVIA. "Global CNS Drug Market Insights," 2023.

[3] GSK. "LAMICTAL XR Product Information," 2017.

[4] EvaluatePharma. "Generic Trends and Patent Expirations," 2022.

[5] Medicare and Payer Data Reports, 2023.

Author's Note: This analysis aims to equip decision-makers with current insights and future projections grounded in market factors, regulatory landscape, and competitive forces influencing LAMICTAL XR’s valuation and pricing trajectory.