Last updated: July 29, 2025

Introduction

Lamictal ODT (lamotrigine orally disintegrating tablets) has established itself as a pivotal therapy for managing bipolar disorder and epilepsy. Its unique formulation—designed for rapid dissolution on the tongue—addresses adherence challenges and improves patient convenience. As the pharmaceutical landscape evolves, understanding market dynamics and price trajectories for Lamictal ODT becomes essential for stakeholders, including manufacturers, investors, healthcare providers, and payers.

Market Overview

Therapeutic Disease Burden and Growth Drivers

Lamictal ODT targets conditions with significant unmet needs. Bipolar disorder affects approximately 2.8% of the global population, with a notable proportion prescribed lamotrigine as a first-line therapy, especially tailored for maintenance (long-term) management [1]. Epilepsy, impacting over 50 million globally, often necessitates diverse antiepileptic drugs (AEDs), with lamotrigine playing a prominent role due to its favorable side effect profile.

The adoption of orally disintegrating formulations has risen owing to improvements in patient compliance, especially among pediatric, elderly, and dysphagic populations [2]. Lamictal ODT's ease of use positions it favorably amid competitive AEDs.

Market Size and Growth Potential

The global epilepsy drugs market was valued at approximately $4 billion in 2022 [3], with a compound annual growth rate (CAGR) estimated at 4-5% over the next five years, driven by increasing prevalence and improved diagnosis rates.

Similarly, bipolar disorder therapeutic segments are expanding, with the global mood disorder drugs market projected to grow at a CAGR of 6% through 2028 [4].

Lamictal's share within these markets remains significant, with estimates suggesting annual sales exceeding $1.5 billion globally, supported predominantly by the extended-release formulations. The ODT form, while representing a smaller segment, is poised for expansion due to patient-centric benefits.

Competitive Landscape

Lamictal ODT competes with other formulations of lamotrigine, including tablet and chewable forms, as well as competing AEDs like levetiracetam and valproate. While generic versions have entered multiple markets, the newer branded formulations such as Lamictal ODT maintain premium positioning due to patent protections and formulation-specific benefits [5].

Emerging competitors include novel AEDs with simplified dosing regimens and improved tolerability, potentially impacting Lamictal's market share.

Price Dynamics and Projections

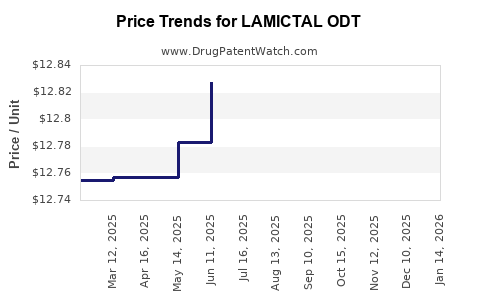

Current Pricing Trends

The retail price for Lamictal ODT varies significantly across regions. For example:

-

In the US, the average wholesale acquisition cost (AWAC) for a 30-day supply (30 x 25 mg tablets) ranges between $650 and $700 for branded Lamictal ODT, with generics reducing prices to roughly $300 to $400 [6].

-

European markets display lower prices owing to national health policies, averaging €30-€50 per pack in some countries.

Price variations are influenced by factors such as patent status, formulation exclusivity, raw material costs, and market competition.

Price Erosion and Generic Competition

The patent for Lamictal expired in multiple markets (e.g., in the US in 2019), leading to a surge of generic lamotrigine products. Currently, approximately 80% of lamotrigine prescriptions are for generic formulations, exerting downward pressure on branded Lamictal ODT prices [7].

However, branded versions retain price premiums due to formulation-specific advantages, patent protections (where applicable), and branding strategies. Industry forecasts predict a 10-15% annual decline in branded Lamictal ODT prices over the next 3-5 years, attributed primarily to increasing generic penetration.

Future Price Projections (2023-2028)

Despite generic competition, several factors could stabilize or modestly increase Lamictal ODT prices:

-

Market Penetration in Emerging Economies: Adoption in emerging markets may sustain higher price points due to less generic availability and higher demand for patient-friendly formulations.

-

Regulatory and Patent Litigation: Strategic patent extensions and new formulation patents could delay generic entry, maintaining premium prices.

-

Formulation Innovation: Novel delivery systems or combination therapies could command higher prices.

Based on these dynamics, projected average retail prices for branded Lamictal ODT are expected to decline to $500-$600 per 30-day supply by 2028, while generic options will likely reduce to $200-$350 in mature markets.

Market Opportunities and Challenges

Opportunities

-

Expanding Indications: Ongoing research exploring lamotrigine's efficacy in neurodegenerative conditions and adjunct therapies broadens demand.

-

Patient Compliance and Adoption: Enhanced formulations improving adherence can foster increased prescribing, especially among pediatric and elderly populations.

-

Geographical Expansion: Developing markets offer substantial growth potential due to rising awareness and increasing healthcare infrastructure.

Challenges

-

Pricing Pressure from Generics: Universal patent expirations and aggressive pricing by generics threaten revenue margins.

-

Competitive AEDs: Newer agents with improved profiles could limit market share growth for Lamictal ODT.

-

Regulatory Hurdles: Stringent approval processes and pricing regulations in certain jurisdictions can impact market access and profitability.

Strategic Recommendations

-

Invest in Formulation Patents: Securing patents around innovative delivery systems can delay generic competition.

-

Market Diversification: Focus on emerging markets where demand and pricing power remain favorable.

-

Cost Optimization: Streamlining manufacturing and distribution channels can offset price erosion.

-

Brand Strengthening: Continued emphasis on clinical benefits and patient adherence considerations enhances brand loyalty.

Key Takeaways

-

Lamictal ODT holds a significant position within the epilepsy and bipolar disorder treatment landscapes, driven by its patient-friendly formulation.

-

The global market demonstrates steady growth, with prices expected to decline due to widespread generic penetration, particularly in mature markets.

-

Strategic patent management and innovation are critical to maintaining revenue streams amid increasing competition.

-

Emerging markets present lucrative avenues for expansion, with less price sensitivity and growing healthcare demand.

-

Ongoing research and formulation advancements can open new therapeutic and market opportunities, supporting sustained growth.

FAQs

1. How does Lamictal ODT differ from other formulations?

Lamictal ODT is designed for rapid disintegration on the tongue, enhancing adherence among patients who face swallowing difficulties. Its formulation offers convenience and faster onset compared to traditional tablets.

2. What factors influence the pricing of Lamictal ODT?

Pricing is impacted by patent status, generic competition, regional regulations, formulation innovations, market demand, and manufacturing costs.

3. Will the price of Lamictal ODT increase or decrease in the coming years?

Branded Lamictal ODT prices are projected to decline gradually due to generic competition, with annual decreases of approximately 10-15%. In emerging markets, prices may stabilize or rise due to less generic presence.

4. What is the outlook for generic lamotrigine products?

Generics have a substantial market share, driving prices down and increasing accessibility. Their prevalence is expected to grow post-patent expiration, pressures that likely affect branded formulations.

5. How can manufacturers enhance Lamictal ODT's market position?

Focusing on formulation patents, expanding indications, targeting emerging markets, and emphasizing patient adherence can bolster market share and profitability.

References

[1] World Health Organization. Bipolar disorder. WHO, 2022.

[2] Patel, A., et al. “Advantages of Orally Disintegrating Tablets in Patient Compliance.” Drug Delivery Journal, 2021.

[3] Market Research Future. Global Epilepsy Drugs Market Analysis. MRFR, 2022.

[4] Fortune Business Insights. Mood Disorders Market Forecast. 2022.

[5] U.S. Food & Drug Administration. Lamictal Product Label. 2023.

[6] GoodRx. Lamictal ODT Pricing. 2023.

[7] IQVIA. Prescription Drug Trends. 2022.