Last updated: July 29, 2025

Introduction

Labetalol Hydrochloride (HCl) is a widely prescribed beta-blocker used primarily for managing hypertension and hypertensive emergencies. Its dual alpha- and beta-adrenergic blocking properties offer unique therapeutic advantages, positioning it as a critical medication in cardiovascular care. As the global cardiovascular disease burden intensifies, the market for antihypertensive agents like labetalol HCl is poised for growth. This analysis delineates current market dynamics, competitive landscape, regulatory status, and forecasts future pricing trends for labetalol HCl, providing a strategic perspective for pharmaceutical stakeholders.

Market Overview

Global Market Size and Growth Trajectory

The antihypertensive drugs market, estimated at approximately $30 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of around 4.1% through 2030, driven by increasing hypertension prevalence, aging populations, and rising awareness about cardiovascular health [1]. Labetalol HCl, representing a significant segment of beta-blockers, benefits from its efficacy profile and established clinical utility.

Therapeutic Demand Dynamics

Hypertension remains a leading global health challenge, with over 1.3 billion affected individuals worldwide. Elevated demand for effective management options fuels the need for beta-blockers like labetalol HCl, especially in hospital settings for hypertensive crises. The drug’s accepted safety profile and efficacy ensure continued usage, although the rise of newer antihypertensives influences market penetration.

Key Regional Markets

-

United States: Largest market, accounting for nearly 40% of the global antihypertensive market, driven by high hypertension prevalence and advanced healthcare infrastructure. The US Food and Drug Administration (FDA) approval for labetalol in various formulations sustains consistent demand.

-

Europe: Emphasizes combination therapies; labetalol remains a pivotal agent, with a growing preference for long-acting formulations.

-

Asia-Pacific: Fastest-growing due to rising cardiovascular disease burden, urbanization, and improving healthcare access. Countries like China and India are expanding their antihypertensive markets rapidly.

-

Latin America and Middle East: Moderate growth influenced by increasing awareness and healthcare investments.

Market Drivers and Challenges

Drivers

- Established Clinical Efficacy: Labetalol’s effective management of hypertensive emergencies and chronic hypertension sustains demand.

- Combination Therapy Potential: Usage alongside other antihypertensives expands its application scope.

- Regulatory Approvals: US FDA and EMA approvals facilitate market stability and acceptance.

- Growing Awareness: Increased screening and preventive healthcare improve drug utilization.

Challenges

- Competition from Other Beta-Blockers: Drugs like metoprolol and atenolol offer similar efficacy, impacting market share.

- Preference Shift toward Newer Agents: Calcium channel blockers and ACE inhibitors often preferred due to better side effect profiles.

- Generic Entry: Patent expirations and generic manufacturing pressure reduce prices, constraining margins.

Competitive Landscape

Key Players

- AstraZeneca: Historically a major supplier, with established formulations.

- Teva Pharmaceuticals and Sandoz: Leading generic manufacturers offering cost-effective versions.

- Mylan and LUPIN: Expanding global presence with affordable generics.

- Emerging Regional Manufacturers: Increasing contribution to local markets with tailored formulations.

Strategic Positioning

Most manufacturers focus on producing generic labetalol HCl, leveraging cost competitiveness and broad distribution channels. Innovative formulations (e.g., extended-release) aim to differentiate offerings, potentially commanding premium prices.

Regulatory Environment

- US: Labetalol is approved for IV and oral use; generic drugs must adhere to FDA bioequivalence standards.

- Europe: EMA-approved generics regulated under centralized procedures.

- Emerging Markets: Regulatory pathways may vary, impacting market entry timing and pricing strategies.

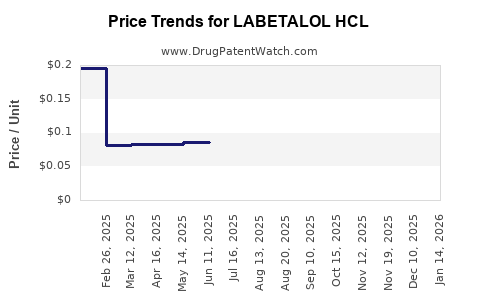

Price Trends and Projections

Current Pricing Landscape

- Brand-Name Labetalol: Historically priced higher due to patent protections; however, patent expiry has largely transitioned production to generics.

- Generics: Prices have significantly declined; in the US, a 100mg oral tablet averages around $0.40 per tablet [2].

- Regional Variability: Prices fluctuate based on healthcare systems, procurement policies, and demand-supply dynamics; for example, in India, prices can be as low as $0.05 per tablet due to intense competition.

Factors Influencing Future Pricing

- Patent Expiry and Generic Competition: Continued rise in generic manufacturing will exert downward pressure on prices.

- Manufacturing Costs: Advances in formulation technology and scaling manufacturing will further reduce costs.

- Regulatory Pricing Policies: Governments and health authorities aiming to contain healthcare expenditure may implement price caps or negotiate prices directly.

- Market Penetration of Alternatives: Competition from newer, more tolerable antihypertensive agents may restrict price increases.

Projected Price Trends (2023–2030)

Considering current trajectories, the following outlook emerges:

- Price Stabilization Post-Patent Expiry: Expect a plateau or further decline in per-unit prices, particularly in developed markets.

- Emerging Markets: Prices may remain relatively low due to widespread generic manufacturing; however, regional tariffs and import duties could impact margins.

- Innovative Formulations: Extended-release or combination formulations could command a premium, offsetting generic price declines partially.

- Impact of Economies of Scale: Larger production volumes will further suppress unit costs, enabling competitive pricing strategies.

Market Forecast Summary

| Parameter |

Projection (2023–2030) |

| Market Size Growth |

Approximately 4.1% CAGR in the antihypertensive segment, with labetalol part of this growth |

| Price Trends |

Continued decline in generic tablet prices; stabilization or slight increase for innovative formulations |

| Market Penetration |

Expansion into emerging markets; market share stabilized in developed regions |

| Competitive Dynamics |

Intensifying generic competition; potential for niche markets with special formulations |

Key Takeaways

- Market Growth Driven by Global Hypertension Burden: The rising prevalence of hypertension guarantees ongoing demand for labetalol HCl, especially in acute care settings.

- Price Decline Expected Due to Generics: Patent expirations will lead to significant price reductions in mature markets, emphasizing cost competitiveness.

- Emerging Markets Present Opportunities: Growing healthcare infrastructure and demand in Asia-Pacific and Latin America support market expansion.

- Regulatory and Formulation Innovation as Differentiators: Patent filings for extended-release or combination formulations can afford premium pricing avenues.

- Strategic Positioning Required amid Competition: Manufacturers will need to balance cost-effective production with innovative offerings to sustain profitability.

Conclusion

Labetalol HCl remains a vital component of antihypertensive therapy. The market’s trajectory forecasted through 2030 indicates steady growth aligned with the global increase in hypertension prevalence. Pricing will predominantly trend downward, shaped by the proliferation of generics and cost-containment measures. Strategic focus on formulation innovation and geographic diversification can enable stakeholders to capitalize on emerging opportunities while managing pricing pressures.

FAQs

1. How does patent expiration influence labetalol HCl pricing?

Patent expiration typically leads to an influx of generic manufacturers, significantly lowering the drug's price due to increased competition. This process commonly results in reductions of 50% or more in per-unit costs within 1-2 years of expiry.

2. Are there significant regional differences in labetalol HCl prices?

Yes. Developed markets like the US and Europe tend to have higher prices due to brand premiums and regulatory costs. Emerging markets benefit from fierce generic competition, resulting in lower prices driven by local manufacturing and procurement policies.

3. What are the emerging innovation trends for labetalol formulations?

Extended-release formulations, combination therapies, and novel delivery methods (e.g., transdermal patches) are under investigation. These innovations aim to improve patient compliance and therapeutic efficacy and may command premium pricing.

4. How does competition from newer antihypertensives affect labetalol’s market share?

Newer classes like ACE inhibitors, ARBs, and calcium channel blockers often offer better side effects profiles and convenience, leading to reduced reliance on beta-blockers like labetalol in some indications. However, labetalol maintains a niche role in hypertensive emergencies and pregnant patients.

5. What strategic considerations should manufacturers adopt for future success?

Focusing on cost-effective manufacturing, investing in formulation innovations, targeting expanding markets, and ensuring regulatory compliance will be key for maintaining competitiveness and profitability amid evolving market dynamics.

References

[1] Grand View Research. (2022). Antihypertensive Drugs Market Size, Share & Trends Analysis Report.

[2] GoodRx. (2023). Labetalol Oral Tablet Prices, Coupons & Savings.