Share This Page

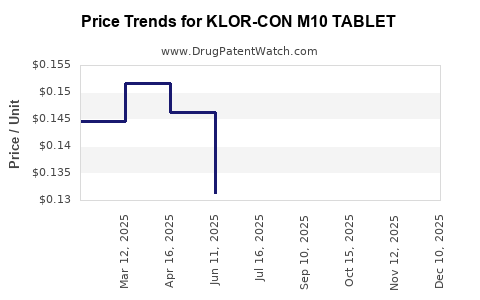

Drug Price Trends for KLOR-CON M10 TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for KLOR-CON M10 TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| KLOR-CON M10 TABLET | 00245-5317-90 | 0.11633 | EACH | 2025-12-17 |

| KLOR-CON M10 TABLET | 00245-5317-01 | 0.11633 | EACH | 2025-12-17 |

| KLOR-CON M10 TABLET | 00245-5317-11 | 0.11633 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for KLOR-CON M10 Tablet

Overview of KLOR-CON M10 Tablet

KLOR-CON M10 Tablet is a brand of oral potassium chloride supplements primarily indicated for treating and preventing hypokalemia. As a combination product, it typically contains potassium chloride alongside other ingredients such as magnesium, designed to aid in correcting electrolyte imbalances. The drug addresses a critical niche, especially among certain patient populations, including those with chronic kidney disease, heart failure, or those on diuretic therapy.

Understanding the market dynamics and price trajectories of KLOR-CON M10 requires examining the broader oral electrolyte supplement segment, regulatory landscape, manufacturing factors, and competitive positioning.

Market Scope and Segment Analysis

Global Market Context

The global electrolyte supplement market, including potassium chloride products, is projected to grow at a compounded annual growth rate (CAGR) of approximately 7% from 2021 to 2028, driven by an increasing prevalence of electrolyte imbalance conditions [1]. The rising incidence of chronic diseases such as hypertension, heart failure, and renal impairments underscores the sustained demand for oral electrolyte repletion therapies.

Regional Market Dynamics

-

United States: Leading due to established healthcare infrastructure, high prevalence of electrolyte disturbances, and a robust pharmaceutical supply chain. The market is further driven by aging demographics and hospital outpatient services.

-

Europe: Growth supported by aging populations and stringent cardiovascular management protocols. Regulatory frameworks are tightly controlled, affecting market entry and pricing strategies.

-

Asia-Pacific: Expected to exhibit the fastest growth rate owing to rising healthcare investments, expanding pharmaceutical markets, and increasing awareness of electrolyte imbalances.

-

Emerging Markets: Countries like Brazil, Russia, and India represent untapped potential, though market penetration is moderated by cost considerations and supply chain challenges.

Market Players and Competition

The market features several key players, including:

- Pfizer: Offers traditional potassium chloride oral supplements.

- Mylan (now part of Viatris): Provides generic formulations.

- GSK: Known for branded electrolyte products.

- Local Generic Manufacturers: Increasingly expanding their portfolios in emerging markets.

KLOR-CON M10 positions itself as a trusted brand within hospitals and outpatient settings, often favored for its proven efficacy and reliable formulation.

Regulatory and Patent Landscape

KLOR-CON M10, as a formulation of potassium chloride, is generally off-patent, especially in mature markets. Patent protections for its unique formulation or delivery mechanisms may expire, enabling generic manufacturing and pricing competition. Regulatory compliance with agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) is critical for market access.

Approval pathways vary by region but typically require demonstrating bioequivalence and manufacturing quality. Patents on specific formulations or delivery devices, if any, could temporarily constrain generics' market entry.

Pricing Structure and Trends

Historical Pricing Trends

- United States: Brand-name versions like KLOR-CON M10 typically retail in the range of $50–$80 per 100-tablet bottle, reflecting premium positioning, especially when sold in hospital or pharmacy settings.

- Generics: Prices can fall by 40–70%, with average costs approximately $15–$30 per 100-tablet supply.

- Insurance Reimbursement: Coverage levels influence consumer out-of-pocket expenses and thereby affect demand elasticity.

Pricing Drivers

- Manufacturing Costs: Active pharmaceutical ingredient (API) costs, formulation expenses, and quality assurance influence retail prices.

- Market Competition: The entry of generics depresses prices, with intensified pricing wars evident in mature markets.

- Regulatory Environment: Stringent regulation can inflate development costs, which may be reflected in initial pricing but tends to decrease as patent protections expire.

- Supply Chain Factors: Distribution logistics, especially in emerging markets, impact final retail prices.

Price Projections (2023–2030)

Short-Term (2023–2025)

Anticipate stable or declining prices driven by increased generic competition. In established markets:

- Brand Name: Slight decline of 2–4% annually; primarily driven by market saturation.

- Generics: Price erosion of 7–10% annually, reflecting competitive pressures.

In emerging markets, prices are likely to stabilize or decrease modestly due to supply chain improvements and increased importation.

Medium to Long-Term (2026–2030)

- Patent Expiry Effect: As patent protections for branded formulations lapse, generic versions will dominate, with prices dropping further.

- Market Penetration: Broader adoption in developing nations could stabilize prices due to volume growth, despite unit price declines.

- Potential Innovations: New formulation delivery systems (e.g., chewables or microencapsulated forms) might sustain premium pricing temporarily.

Overall, a projected average price decrease of 15–30% across regions over this period is plausible, with costs converging towards $10–$20 per 100-tablet supply in most markets.

Market Drivers and Constraints

Drivers

- Rising chronic disease burden.

- Expanding healthcare infrastructure.

- Increased awareness of electrolyte management.

- Growing generic pharmaceutical manufacturing capacity.

Constraints

- Stringent regulatory hurdles.

- Price control policies in regions like Europe and parts of Asia.

- Competition from other electrolyte formulations and intravenous therapies.

- Potential market saturation in mature markets.

Conclusion

KLOR-CON M10 Tablet benefits from a well-established therapeutic niche, with steady demand driven by the global rise in electrolyte imbalance-related conditions. Its market is characterized by intense generic competition, particularly in mature regions, leading to downward price pressures. The long-term outlook suggests continued price erosion, balanced by expanding markets and potential formulation innovations. Strategic positioning, regulatory compliance, and cost management will be critical for market players seeking to maintain profitability.

Key Takeaways

- The global electrolyte supplement market is poised for steady growth, with potassium chloride products like KLOR-CON M10 at its core.

- Pricing is heavily influenced by generic competition, regulatory frameworks, and regional market maturity.

- Short-term prices are stable but trending downward; long-term projections indicate a 15–30% reduction in average wholesale costs.

- Expansion into emerging markets offers growth avenues, though pricing strategies must adapt to local economic conditions.

- Innovation in delivery mechanisms and formulations could provide differentiation and sustain premium pricing segments.

FAQs

1. What factors influence the price of KLOR-CON M10 Tablet?

Primarily, manufacturing costs, market competition (particularly generics), regulatory requirements, and regional economic conditions affect pricing. Patent expirations also lead to reduced prices over time.

2. How does the patent landscape impact the market for KLOR-CON M10?

Patent protection for specific formulations or delivery devices delays generic entry, maintaining higher prices temporarily. Once patents expire, generic manufacturers enter, driving prices down.

3. What is the expected trend in KLOR-CON M10 prices over the next five years?

Prices are expected to decrease by around 15–30%, mainly due to increased generic competition and market saturation, especially in mature markets.

4. Which regions are most promising for growth in the potassium chloride supplement market?

Emerging markets in Asia-Pacific and Latin America offer significant expansion opportunities due to increasing healthcare infrastructure and awareness.

5. How can pharmaceutical companies maintain profitability amid declining prices?

By innovating with formulations and delivery systems, expanding into new markets, reducing manufacturing costs, and leveraging differentiated branding strategies.

Sources

- Grand View Research, "Electrolyte Supplements Market Size, Share & Trends Analysis," 2022.

More… ↓