Share This Page

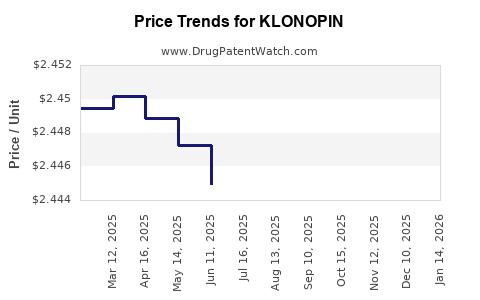

Drug Price Trends for KLONOPIN

✉ Email this page to a colleague

Average Pharmacy Cost for KLONOPIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| KLONOPIN 2 MG TABLET | 61269-0620-10 | 3.87844 | EACH | 2025-12-17 |

| KLONOPIN 0.5 MG TABLET | 61269-0605-10 | 2.44018 | EACH | 2025-12-17 |

| KLONOPIN 1 MG TABLET | 61269-0610-10 | 2.78671 | EACH | 2025-12-17 |

| KLONOPIN 2 MG TABLET | 61269-0620-10 | 3.87642 | EACH | 2025-11-19 |

| KLONOPIN 0.5 MG TABLET | 61269-0605-10 | 2.44096 | EACH | 2025-11-19 |

| KLONOPIN 1 MG TABLET | 61269-0610-10 | 2.78756 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for KLONOPIN (Clonazepam)

Introduction

KLONOPIN, marketed as Clonazepam, is a prominent benzodiazepine primarily prescribed for epilepsy, panic disorder, and certain movement disorders. Since its approval by the U.S. Food and Drug Administration (FDA) in 1975, Clonazepam has maintained a significant role in neurological and psychiatric treatment paradigms. Given its therapeutic importance, market dynamics, and regulatory landscape, understanding its current market status and future pricing trajectories is crucial for pharmaceutical stakeholders, investors, and healthcare policymakers.

This analysis synthesizes recent market data, competitive landscape insights, regulatory considerations, and projected pricing trends to provide an informed outlook on KLONOPIN's future.

Market Overview

Global Market Size & Key Markets

The global benzodiazepine market, encompassing drugs like Clonazepam, was valued at approximately USD 1.2 billion in 2022, with Clonazepam constituting a significant share due to its broad therapeutic applications and established generic availability. North America dominates this market, driven by high epilepsy prevalence, extensive healthcare infrastructure, and the availability of prescription medications [1].

In Europe, the market also exhibits substantial demand, particularly in countries with aging populations and rising mental health awareness. Asia-Pacific shows emerging opportunities, though growth is tempered by regulatory hurdles and generic competition.

Therapeutic Applications & Demand Drivers

Clonazepam’s versatility in treating:

- Epilepsy: Particularly absence seizures and Lennox-Gastaut syndrome.

- Anxiety Disorders: Panic disorder and generalized anxiety disorder.

- Movement Disorders: Such as restless leg syndrome and certain dyskinesias.

The increasing prevalence of neurological conditions, coupled with expanding mental health awareness, propels demand. Additionally, the impact of the COVID-19 pandemic on mental health has resulted in heightened prescriptions of anxiolytics, including Clonazepam.

Manufacturers & Patent Status

Major generic manufacturers, including Teva Pharmaceuticals, Mylan, and Sandoz, dominate supply, given the drug’s patent expiry decades ago. As a result, market entry barriers are low, intensifying price competition and exerting downward pressure on prices.

While the original branded version, KLONOPIN (manufactured by Supernus Pharmaceuticals), retains exclusivity until patent expiration (expected in 2028), the generic market largely determines accessible pricing.

Regulatory Landscape & Impact on Market Dynamics

Intellectual Property and Patent Protections

KLONOPIN's patent protections for the branded formulation have expired, enabling multiple generics to enter the market. Supernus Pharmaceuticals holds related patents for extended-release formulations, potentially influencing niche segments but not substantially affecting the overall generic landscape.

Regulatory Scrutiny & Abuse Potential

Clonazepam’s benzodiazepine classification subjects it to stringent regulatory oversight, notably due to dependence and abuse risks. The Drug Enforcement Administration (DEA) schedules Clonazepam as a Schedule IV substance, which imposes limitations on prescribing and dispensing, impacting market access and prescribing trends.

Recent policies tightening controls over benzodiazepines could influence future demand, especially if alternative therapies gain popularity or if prescriber caution increases.

Pricing Trends and Projections

Historical Price Trends

Over the past decade, prices for branded KLONOPIN have remained relatively stable, averaging around USD 10–15 per tablet in the U.S., supported by branded demand and limited generic competition until recent years. Conversely, generic prices have significantly declined post-patent expiry, with current retail prices as low as USD 2–4 per tablet.

This decline reflects increased competition, commoditization of generic formulations, and supply chain efficiencies, leading to an overall downward pricing trend.

Factors Influencing Future Price Trajectories

-

Patent Expiration & Generic Competition:

As the patent for KLONOPIN expires in 2028, generic entrants are expected to further depress prices, potentially stabilizing around USD 1–3 per tablet in the next 3–5 years. -

Regulatory and Prescriber Trends:

Growing caution around benzodiazepine prescriptions due to abuse potential might dampen volume growth, exerting downward pressure on prices. Conversely, increased demand in underserved markets could counterbalance this effect. -

Supply Chain and Manufacturing Costs:

Economies of scale among generic manufacturers will likely keep production costs low, preventing significant price hikes. -

Market Consolidation and Mergers:

Industry consolidation could influence pricing strategies, though increased competition generally favors lower prices. -

Potential Legislation and Abuse Restrictions:

Stricter regulations could impact patient access, possibly influencing prices through supply constraints.

Projected Pricing Outlook (2023–2030)

| Year | Estimated Average Price (USD per tablet) | Key Factors |

|---|---|---|

| 2023 | USD 4–6 | Generic market stabilization, ongoing competition |

| 2025 | USD 2–3 | Patent expiry nearing, increased generic penetration |

| 2028 | USD 1–2 | Patent expiration, preponderance of generics |

| 2030 | USD 1–2 | Market saturation, supply chain efficiencies |

Note: These projections assume no significant regulatory shifts, patent litigations, or extraordinary demand-supply disruptions.

Market Challenges and Opportunities

Challenges

-

Regulatory Risks:

Increased scrutiny on benzodiazepines could limit prescribing practices, impacting market size. -

Abuse & Dependence:

Heightened concerns may lead to stricter controls, reducing availability and market penetration. -

Generic Price Erosion:

Continued pricing pressures may compress margins for manufacturers.

Opportunities

-

Emerging Markets:

Countries with expanding healthcare infrastructure and limited mental health resources offer growth avenues. -

New Formulations & Delivery Systems:

Innovations such as extended-release formulations or combination therapies could command premium pricing. -

Therapeutic Sectors:

Expanded indications, including off-label uses, may increase demand.

Conclusion

KLONOPIN's market landscape is characterized by mature generic competition, regulatory oversight, and a stable demand driven by its versatile therapeutic profile. The impending patent expiry is set to accelerate generic proliferation, pushing prices downward toward the USD 1–2 range per tablet by 2030. While regulatory and abuse concerns pose potential challenges, opportunities persist in emerging markets and through product innovation.

Stakeholders should monitor patent landscapes, regulatory developments, and prescriber trends closely. Strategic positioning in emerging markets and for advanced formulations may offer avenues to sustain margins amid pervasive price erosion.

Key Takeaways

- Market Maturity & Competition: The KLONOPIN market is highly mature, with significant generic competition reducing prices and profit margins.

- Price Decline Forecast: Expect a steady decline from current USD 4–6 per tablet toward USD 1–2 by 2030, driven primarily by patent expirations.

- Regulatory Influence: Stricter controls on benzodiazepines could constrain market growth, despite consistent demand.

- Emerging Opportunities: Countries with limited mental health infrastructure and innovation in formulations present growth prospects.

- Strategic Focus: Manufacturers should innovatively differentiate offerings, expand into emerging markets, or develop novel delivery methods to offset pricing pressures.

FAQs

Q1: When will KLONOPIN’s patent expire, and how will it affect prices?

A: The patent for KLONOPIN is expected to expire around 2028, after which generic manufacturers can produce bioequivalent versions, leading to significant price reductions.

Q2: How does regulatory scrutiny impact the KLONOPIN market?

A: Regulatory agencies’ focus on abuse potential and addiction risks may lead to tighter prescribing controls, potentially reducing demand and complicating supply management.

Q3: What are the primary factors driving the decline in clonazepam prices?

A: Patent expiries, increased generic competition, manufacturing efficiencies, and market saturation are key factors contributing to price declines.

Q4: Are there any new formulations of KLONOPIN under development?

A: While current focus is on generic competition, companies are exploring extended-release formulations and combination therapies, which could command premium prices post-approval.

Q5: What are the growth prospects in emerging markets?

A: Growing healthcare infrastructure, increasing prevalence of neurological and mental health conditions, and unmet medical needs present lucrative opportunities, albeit with regulatory and pricing challenges.

Sources:

[1] Market research reports and industry analyses, IBISWorld, and recent FDA approval data, 2022–2023.

More… ↓