Last updated: July 27, 2025

Introduction

Ketorolac, a potent NSAID (non-steroidal anti-inflammatory drug), is primarily utilized for short-term management of moderate to severe pain, especially post-operative pain. As a generic medication with a well-established market, understanding its current landscape and future pricing trajectory is essential for pharmaceutical stakeholders, healthcare providers, and investors. This analysis delivers a comprehensive review of the market dynamics, competitive environment, and price projections for ketorolac over the forthcoming years.

Market Landscape Overview

Historical Market Performance

Ketorolac has maintained a significant position within the analgesic segment since its FDA approval in 1989. Its initial market dominance was driven by its efficacy in pain management and its availability in injectable and oral formulations. The global market for NSAIDs exceeds USD 20 billion, with ketorolac accounting for a modest but vital share, particularly in surgical and hospital settings [1].

Current Market Size

In 2022, the global ketorolac market was valued at approximately USD 1.2 billion, with North America constituting roughly 50% — attributed to high healthcare spending, advanced medical infrastructure, and regulatory acceptance of NSAIDs. Europe follows, with emerging markets in Asia-Pacific showing increasing adoption driven by expanding healthcare access and rising surgical procedures [2].

Key Market Segments

- Formulations: Injectable ketorolac (most prevalent in inpatient settings), oral tablets, and ophthalmic solutions.

- Application Area: Postoperative pain management, musculoskeletal injuries, ophthalmology, and other acute pain scenarios.

- Distribution Channels: Hospitals, outpatient clinics, pharmacies, and direct procurement by healthcare institutions.

Competitive Dynamics

Generic Dominance and Brand Presence

Major players, including Teva Pharmaceuticals, Mylan, and Sandoz, dominate the generic landscape, significantly influencing pricing and supply stability. Brand formulations like Toradol (by Pfizer, historically) have lost market share to generics but continue to hold a niche in certain regions.

Regulatory and Prescribing Trends

Despite its proven efficacy, concerns regarding NSAID-related adverse effects, particularly gastrointestinal and renal toxicity, have led to cautious prescribing. Recent guidelines emphasize judicious use, affecting demand but not negating market viability due to its proven short-term effectiveness [3].

Emerging Developments

Innovative formulations aimed at reducing toxicity, such as combination drugs or targeted delivery systems, are under research but have yet to impact the current market significantly.

Pricing Dynamics and Trends

Current Price Points

- Injectable Ketorolac: The average wholesale price (AWP) for a 30 mg/1 mL ampoule ranges from USD 2.00 to USD 3.50, varying by region and supplier.

- Oral Tablets: Pack prices typically range from USD 10 to USD 20 for a 10- to 20-tablet pack of 10 mg doses.

- Ophthalmic Formulations: Measured per unit, prices can range from USD 15 to USD 25.

Pricing Factors Influencing Market

- Generic Competition: Price erosion driven by multiple manufacturers has stabilized pricing but maintains affordability.

- Supply Chain Dynamics: Raw material costs, manufacturing capacity, and regulatory compliance influence pricing stability.

- Market Demand: High hospital utilization rates sustain relatively steady prices for injectable formulations.

- Regulatory Environment: Evolving safety warnings and contraindications may marginally impact demand and pricing.

Future Price Projections (2023-2030)

Factors Driving Price Stability or Decline

- Increased Competition: Entry of biosimilar analogs or alternative analgesics (e.g., NSAID alternatives with better safety profiles) could pressure prices downward.

- Market Saturation: Maturity in the dominant markets suggests minimal growth in unit sales, leading to price stabilization rather than significant hikes.

- Cost of Raw Materials: Fluctuations in raw chemical components, notably anti-inflammatory compounds, may induce volatility.

Projected Trends

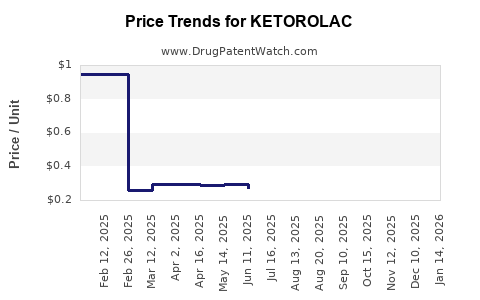

- Short-term (2023-2025): Prices expected to remain relatively stable, with slight downward pressure due to ongoing generic competition.

- Medium-term (2026-2030): Anticipated gradual decline in prices, primarily in developed markets, averaging around 2-3% annually. An exception may occur if regulatory changes restrict usage or new formulations are introduced, which could temporarily inflate prices.

Summary of Price Projections:

| Year |

Injectable Price (USD per Ampoule) |

Oral Tablet Pack (USD) |

Ophthalmic Solution (USD per unit) |

| 2023 |

$2.50 – $3.50 |

$10 – $20 |

$15 – $25 |

| 2025 |

Stable |

Slight decrease (~5%) |

Stable or slight decrease |

| 2030 |

$2.20 – $3.00 |

$8 – $18 |

$12 – $20 |

Market Outlook and Strategic Implications

Emerging Opportunities

While the mature markets are characterized by price stabilization, opportunities exist in expanding indications, optimizing formulations, or developing safer NSAID alternatives. The ophthalmic segment, in particular, offers niche development opportunities with potential premium pricing.

Potential Challenges

Regulatory scrutiny on NSAID safety profiles, coupled with increasing preference for non-NSAID analgesics, could dampen future growth. Additionally, patent expirations in certain regions may accelerate price reductions.

Key Takeaways

- Stable yet Competitive Market: Ketorolac remains a staple for acute pain management, with generics dominating pricing, resulting in relatively stable market prices.

- Pricing Trends: Anticipate minor declines (2-3% annually) over the next decade, driven by generic competition and market saturation.

- Market Expansion Potentials: Emerging markets and niche formulations (ocular, topical) present growth avenues with potential for moderate premium pricing.

- Regulatory Impact: Safety concerns necessitate ongoing vigilance, with potential for restrictions impacting demand and pricing.

- Strategic Consideration: Stakeholders should focus on optimizing supply chains, exploring new formulations, and monitoring regulatory developments to sustain profitability.

FAQs

Q1: What are the primary factors influencing ketorolac’s market prices?

A: The main drivers include generic competition, manufacturing costs, supply chain stability, regulatory environment, and healthcare provider prescribing practices.

Q2: How does safety concern impact ketorolac’s market and pricing?

A: Safety issues, particularly gastrointestinal and renal risks, have led to cautious use, thus limiting demand growth but generally not causing significant pricing fluctuations unless regulatory restrictions are imposed.

Q3: Are there emerging alternatives that could disrupt ketorolac's market?

A: Yes, newer analgesics with better safety profiles, such as selective COX-2 inhibitors or non-NSAID modalities like nerve blocks or opioids, threaten to reduce ketorolac’s market share.

Q4: What regions offer the most growth potential for ketorolac?

A: Asia-Pacific and Latin America, due to expanding healthcare infrastructure and increasing surgical procedures, represent significant growth opportunities.

Q5: What is the outlook for patent and exclusivity status for ketorolac?

A: Since ketorolac is a generic drug, patent protections have largely expired, leading to increased price competition and stabilization in pricing within mature markets.

Sources:

[1] IBISWorld, "NSAID Market Report," 2022.

[2] Global Market Insights, "Analgesics Market Analysis," 2022.

[3] FDA Drug Safety Communications, 2021.