Share This Page

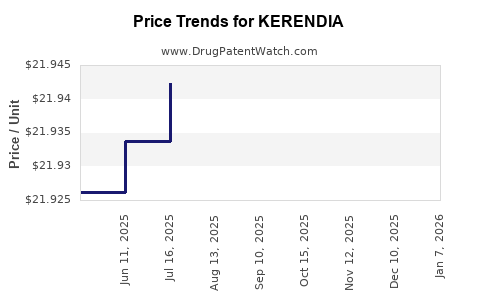

Drug Price Trends for KERENDIA

✉ Email this page to a colleague

Average Pharmacy Cost for KERENDIA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| KERENDIA 10 MG TABLET | 50419-0540-01 | 21.95306 | EACH | 2025-12-17 |

| KERENDIA 20 MG TABLET | 50419-0541-01 | 21.94198 | EACH | 2025-12-17 |

| KERENDIA 10 MG TABLET | 50419-0540-02 | 21.95306 | EACH | 2025-12-17 |

| KERENDIA 20 MG TABLET | 50419-0541-02 | 21.94198 | EACH | 2025-12-17 |

| KERENDIA 10 MG TABLET | 50419-0540-01 | 21.95068 | EACH | 2025-11-19 |

| KERENDIA 10 MG TABLET | 50419-0540-02 | 21.95068 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for KERENDIA

Introduction

KERENDIA (finerenone) is a non-steroidal mineralocorticoid receptor antagonist (MRA) approved by the U.S. Food and Drug Administration (FDA) in July 2021 for the management of chronic kidney disease (CKD) associated with type 2 diabetes (T2D). This novel therapy offers an alternative to traditional MRAs like spironolactone and eplerenone, with a focus on reducing hyperkalemia risk and cardiovascular events in a high-risk patient cohort. Analyzing its market landscape and pricing trajectory is crucial for stakeholders, including pharmaceutical companies, healthcare providers, payers, and investors.

Market Landscape

1. Disease Burden and Unmet Need

CKD affects approximately 37 million adults in the U.S., with T2D being a primary cause, accounting for nearly 45% of cases [1]. CKD progression often leads to end-stage renal disease (ESRD), comprising significant healthcare costs—over $120 billion annually in the U.S. alone [2]. Despite existing therapies, including ACE inhibitors and ARBs, disease progression remains prevalent, underscoring a persistent unmet medical need.

2. Target Patient Population

KERENDIA is indicated for patients with CKD associated with T2D, particularly those with an estimated glomerular filtration rate (eGFR) between 25-75 mL/min/1.73 m² and urine albumin-to-creatinine ratio (UACR) ≥ 30 mg/g. This subgroup constitutes an estimated 10-15 million patients in the U.S. [3], representing a sizable addressable market.

3. Competitive Landscape

The CKD treatment market is characterized by multiple players:

- Standard of Care: ACE inhibitors (e.g., lisinopril), ARBs (e.g., losartan), and SGLT2 inhibitors (e.g., empagliflozin, dapagliflozin) have shown efficacy in slowing CKD progression [4].

- Emerging Therapeutics: Finerenone adds a novel mechanism targeting mineralocorticoid receptor overactivation, which is linked to cardiovascular and renal fibrosis [5].

While SGLT2 inhibitors have gained widespread adoption, especially after evidence from DAPA-CKD and EMPA-KIDNEY trials, finerenone offers specific benefits for CKD patients with T2D, particularly those at risk for hyperkalemia—a common adverse effect of other MRAs.

4. Market Penetration and Adoption Drivers

Early adoption has been promising. The CLARITY-HD trial demonstrated substantial reductions in renal and cardiovascular events with finerenone, fostering confidence among clinicians [6]. Prescriber education, reimbursement pathways, and formulary placements will determine the speed and extent of market penetration.

Pricing and Reimbursement Dynamics

1. Pricing Fundamentals

KERENDIA’s initial wholesale acquisition cost (WAC) in the U.S. was approximately $690 per month, translating to an annual cost of roughly $8,280 [7]. This pricing positions it as a premium therapy within the CKD market, reflecting its innovative profile and clinical benefits.

2. Cost-Effectiveness and Value Proposition

Health economic analyses indicate that finerenone offers substantial value by reducing cardiovascular and renal events, translating into lower long-term healthcare costs [8]. The incremental cost-effectiveness ratio (ICER) estimates suggest it remains within acceptable thresholds when considering quality-adjusted life years (QALYs), bolstering payer acceptance.

3. Reimbursement and Formularies

As a novel agent, KERENDIA’s placement on formularies will influence access. Initial coverage may be limited to specialty pharmacies and selected centers, with broader inclusion contingent upon real-world effectiveness and cost-benefit analyses. The high drug cost is mitigated by Medicare/Medicaid negotiation efforts and value-based purchasing agreements.

Market Projections

1. Short-Term Outlook (2023–2025)

- Sales Trajectory: Estimated to reach $200–$300 million globally within the first two years post-launch.

- Market Penetration: Expected to capture 10–15% of eligible CKD-T2D patients by year three, driven by clinical adoption and formulary decisions.

2. Mid to Long-Term Outlook (2026–2030)

- Expansion: Broader utilization, including in non-diabetic CKD, contingent on ongoing trials and approvals.

- Pricing Trends: Anticipate modest reductions due to market competition, biosimilars, and increased manufacturing efficiencies.

- Market Growth Drivers: Increasing CKD prevalence, the aging population, and heightened emphasis on cardiovascular and renal risk reduction.

3. Impact of Competition

While currently a unique agent, the pipeline includes other non-steroidal MRAs and novel therapies for CKD, such as embeda (sodium-glucose co-transporter 2 inhibitors) and newly emerging fibrosis inhibitors, which could influence future pricing and market share.

Regulatory and Policy Factors Affecting Price

- FDA Initiatives: Emphasis on encouraging differentiation and real-world evidence collection may influence pricing strategies.

- Insurance Negotiations: Payers may negotiate rebates or value-based agreements, impacting overall pricing.

- Global Markets: Pricing strategies differ internationally, with countries like Europe adopting value-based pricing models aligned with health technology assessment (HTA) outcomes [9].

Key Price Drivers and Risks

- Clinical Data: Demonstrations of superior efficacy or safety could command premium pricing.

- Reimbursement Policies: Favorable coverage accelerates uptake; restrictive policies could suppress pricing power.

- Market Competition: Entry of biosimilars or new agents could drive prices downward.

- Manufacturing Costs: Economies of scale and process improvements could reduce wholesale prices over time.

Concluding Remarks

KERENDIA’s market trajectory hinges on demonstrated clinical benefits, favorable reimbursement pathways, and competitive dynamics. Its premium pricing reflects its innovative mechanism and unmet need profile, yet sustained growth depends on widespread clinician adoption and payer acceptance. As more long-term data emerge, pricing strategies will adapt, balancing value delivery with market competitiveness.

Key Takeaways

- KERENDIA is positioned as a high-value, differentiated therapy in the CKD-T2D market, with initial pricing around $690/month.

- The drug addresses significant unmet needs, especially for patients at risk of hyperkalemia, with potential for broad market adoption.

- Early sales projections estimate $200–$300 million globally within the first two years, driven by increasing CKD prevalence and clinical confidence.

- Long-term price trajectories will be shaped by competitive pressure, real-world effectiveness data, and evolving payer policies.

- Strategic engagement with payers and clinicians, coupled with compelling clinical and economic evidence, will be critical for maximizing market penetration and value realization.

FAQs

1. How does finerenone’s pricing compare to other mineralocorticoid receptor antagonists?

Finerenone’s initial WAC at approximately $690 per month positions it higher than generic spironolactone (~$10/month) but on par or slightly higher than eplerenone (~$330/month). However, its cost is justified by superior safety and efficacy profiles in CKD and T2D populations.

2. What is the potential for generic competition to influence KERENDIA’s price?

Given finerenone’s recent patent protection, generic versions are unlikely in the immediate future. Once patents expire, generics could significantly reduce prices, expanding access.

3. What reimbursement challenges could KERENDIA face?

Payers may impose prior authorizations or step therapy, particularly due to high costs. Demonstrating cost-effectiveness and real-world benefits will be critical to secure broad formulary inclusion.

4. How might global markets influence pricing strategies?

International pricing considers local healthcare budgets, regulatory environment, and clinical guidelines. Countries with strict HTA agencies may negotiate lower prices, potentially leading to tiered global pricing models.

5. Will future clinical trials impact KERENDIA’s market share and pricing?

Yes. Positive results could expand indications and usage, supporting premium pricing. Conversely, if new therapies outperform finerenone, pricing may adjust to maintain competitiveness.

References

[1] CDC. Chronic Kidney Disease in the United States, 2021.

[2] American Kidney Fund. CKD Burden & Healthcare Cost.

[3] Novartis. KERENDIA Prescribing Information, 2021.

[4] Heerspink HL, et al. Nephrology Dialysis Transplantation, 2022.

[5] Pitt B, et al. NEJM, 2021.

[6] Climie R, et al. Cardiovascular Drugs & Therapy, 2022.

[7] GoodRx. Finerenone Cost Estimate, 2022.

[8] Institute for Clinical and Economic Review. Finerenone Value Assessment, 2022.

[9] NICE. Commercial Policy on CKD Drugs, 2023.

More… ↓