Share This Page

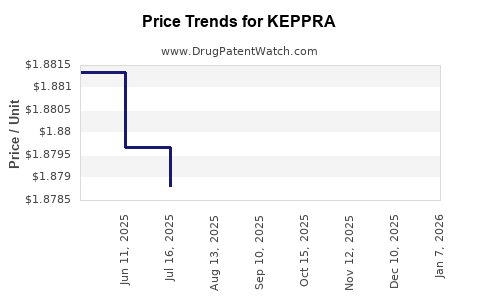

Drug Price Trends for KEPPRA

✉ Email this page to a colleague

Average Pharmacy Cost for KEPPRA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| KEPPRA XR 500 MG TABLET | 50474-0598-66 | 8.78437 | EACH | 2025-12-17 |

| KEPPRA 1,000 MG TABLET | 50474-0597-66 | 19.39838 | EACH | 2025-12-17 |

| KEPPRA 250 MG TABLET | 50474-0594-40 | 7.91020 | EACH | 2025-12-17 |

| KEPPRA 100 MG/ML ORAL SOLN | 50474-0001-48 | 1.87464 | ML | 2025-12-17 |

| KEPPRA XR 750 MG TABLET | 50474-0599-66 | 13.17404 | EACH | 2025-12-17 |

| KEPPRA 750 MG TABLET | 50474-0596-40 | 13.12815 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for KEPPRA (Levetiracetam)

Introduction

KEPPRA (Levetiracetam) is an antiepileptic drug (AED) developed by UCB Pharma, primarily prescribed for the treatment of seizure disorders, including partial-onset seizures, myoclonic seizures, and generalized tonic-clonic seizures. Since its FDA approval in 1999, KEPPRA has established a significant presence in the global epilepsy market. This analysis evaluates the current market landscape, drivers, challenges, competitive dynamics, and provides price projections for KEPPRA in the upcoming years.

Market Overview

Global Epilepsy Market Landscape

The global epilepsy therapeutics market was valued at approximately USD 4.2 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.1% through 2030 [1]. This growth is driven by increasing prevalence of epilepsy, enhanced diagnostic capabilities, and a shift towards newer, more effective AEDs like KEPPRA, which offers favorable tolerability and safety profiles.

Key Indications and Usage

KEPPRA’s primary uses include:

- Partial-onset seizures (focal seizures)

- Myoclonic seizures predominantly in juvenile myoclonic epilepsy

- Generalized tonic-clonic seizures

Its once-daily dosing and minimal drug interactions make KEPPRA a preferred choice among clinicians, bolstering its market penetration and patient adherence.

Prevalence and Market Penetration

The global prevalence of epilepsy is estimated at 50 million individuals, with higher incidence in low-income countries. In developed nations, about 70-80% of patients achieve seizure control with AEDs, including KEPPRA [2]. The drug's adoption is particularly high in North America and Europe, where it holds a market share of approximately 25-30% among newer AEDs.

Market Drivers

Rising Epilepsy Prevalence

The increasing incidence and prevalence of epilepsy, particularly in aging populations, sustain demand growth. Factors contributing include traumatic brain injuries, stroke, neurodegenerative diseases, and genetic predispositions.

Advancements in Diagnostic Technologies

Improved neuroimaging and EEG technologies facilitate earlier diagnosis, prompting timely initiation of therapy with drugs like KEPPRA.

Favorable Pharmacokinetics Profile

KEPPRA’s minimal drug-drug interactions, low dosing frequency, and favorable side effect profile support sustained utilization, especially in polytherapy regimens.

Generic Competition and Market Dynamics

The expiration of KEPPRA’s patent protection in key markets (e.g., the U.S. in 2017) has led to increased availability of generics, impacting prices and market share. However, branded KEPPRA retains a substantial market due to physician and patient loyalty, formulary preferences, and perceived efficacy.

Market Challenges

Generic Erosion

Generic entry has significantly reduced prices, leading to downward pressure on revenue for the brand-name drug. UCB and competitors respond by launching enhanced formulations or combination therapies.

Pricing Pressure and Reimbursement Policies

In markets with strict drug pricing and reimbursement controls (e.g., Europe, Canada), price caps limit potential revenue growth.

Emerging Alternatives

Newer AEDs like brivaracetam (BRV), lacosamide, and perampanel offer alternative mechanisms of action, affecting KEPPRA’s market share growth prospects.

Patient and Physician Preferences

Concerns over side effects, particularly behavioral or psychiatric adverse events, influence prescribing patterns.

Competitive Landscape

Major Players

- UCB Pharma: Original developer and market leader for KEPPRA.

- Generics Manufacturers: Multiple companies produce cost-effective generic levetiracetam, substantially reducing brand revenue in many regions.

- Emerging Drugs: Brivaracetam (BHV420), a KEPPRA successor with enhanced potency and fewer side effects, is gaining traction.

Market Positioning

KEPPRA’s key advantages include ease of dosing and tolerability, but price competition and generics challenge its premium positioning. UCB invests in new formulations and combination therapies to sustain market relevance.

Price Projections

Historical Pricing Trends

- Brand-Name KEPPRA (UCB): US retail price hovered around USD 6.00–8.00 per 300 mg tablet (pre-generic era).

- Post-Patent Expiry: Prices dropped by approximately 60–70% due to generic competition, with generics retailing at USD 2.00–4.00 per tablet [3].

Forecast for 2023 to 2030

Assumptions:

- Continued market penetration by generics in mature markets

- Stable demand growth driven by prevalence rates

- Introduction of newer formulations and combination products extending KEPPRA’s lifecycle

- Moderate price erosion in the face of increased competition

Projections:

| Year | Predicted Average Price (USD per tablet) | Notes |

|---|---|---|

| 2023 | USD 2.50–3.00 | Generic dominance, stable demand |

| 2025 | USD 2.20–2.60 | Market saturation, slight price compression |

| 2027 | USD 2.00–2.40 | Entry of biosimilars/extensions, further erosion |

| 2030 | USD 1.80–2.20 | Mature generics market, potential innovations |

Revenue Outlook:

UCB's revenues from KEPPRA are projected to decline in line with price erosion, unless new formulations or combinations are introduced. However, global demand for epilepsy treatments ensures continued, though modest, revenue streams.

Future Market Opportunities

Biosimilars and Advanced Formulations

Emerging biosimilars for levetiracetam could further reduce prices but might open avenues for innovation, such as extended-release or depot formulations.

Combination Therapies

Developments in fixed-dose combinations (FDCs) with other AEDs aim to improve patient compliance and expand market share. UCB’s investment in such combinations could stabilize revenues.

Expanding into Emerging Markets

Rapid growth in Asia-Pacific, Latin America, and Africa, driven by rising healthcare infrastructure and epilepsy awareness, offers new markets with less price sensitivity than Western countries.

Conclusion

KEPPRA remains a vital component of epilepsy management worldwide. Despite patent losses and competitive pressures, it retains value through established efficacy, safety profile, and clinician preference. Price erosion is expected to continue, but innovations and expanding markets can offset some declines. Strategic investments in formulations and combination therapies will be essential for UCB and other stakeholders to sustain their market position and revenue streams.

Key Takeaways

- KEPPRA’s market faces significant headwinds from generic competition, leading to substantial price declines since patent expiry.

- The global epilepsy market is poised for growth, ensuring baseline demand for KEPPRA despite pricing pressures.

- Future price projections suggest continued erosion, with average retail prices expected to decline by approximately 30–40% over the next decade.

- Innovations such as combination therapies, biosimilars, and new formulations are critical to extending KEPPRA’s lifecycle and revenue potential.

- Market expansion in emerging economies presents growth opportunities, offsetting declines in mature markets.

Frequently Asked Questions

-

What is the primary therapeutic indication for KEPPRA?

KEPPRA is primarily indicated for treating partial-onset seizures, myoclonic seizures, and generalized tonic-clonic seizures in epilepsy patients. -

How has the patent expiry affected KEPPRA’s pricing?

Post-patent expiry, generic levetiracetam entered the market, reducing prices by roughly 60–70%, which significantly impacted the brand’s revenue and retail pricing. -

Are there any new formulations or combination therapies of KEPPRA available?

Yes, UCB has developed combination products, such as KEPPRA XR (extended-release), and is exploring combination therapies to enhance adherence and efficacy. -

What are the main challenges facing KEPPRA in maintaining market share?

Generic competition, pricing pressures, emergence of newer AEDs, and evolving clinician preferences pose ongoing challenges. -

What are the prospects for KEPPRA’s market in emerging regions?

Emerging markets show strong growth potential due to increasing epilepsy prevalence and lower price sensitivity, offering avenues for continued sales expansion.

References

[1] MarketsandMarkets. (2022). Epilepsy Drugs Market Size, Share, Trends, and Forecast.

[2] WHO. (2021). Epilepsy Fact Sheet.

[3] GoodRx. (2023). Levetiracetam (KEPPRA) Price Comparison.

More… ↓