Last updated: July 27, 2025

Introduction

KENALOG-40, a pharmaceutical formulation primarily utilized in the treatment of bacterial infections, has garnered significant interest within the healthcare industry due to its broad-spectrum efficacy and favorable pharmacokinetic profile. This analysis provides an in-depth review of the current market landscape, competitive dynamics, regulatory considerations, and future price trajectories of KENALOG-40, aiming to inform stakeholders’ strategic decisions.

Product Overview

KENALOG-40 combines potent antibacterial agents—most notably a combination of cefadroxil and clavulanic acid—targeting resistant bacterial strains. Its versatile formulation supports outpatient management of respiratory, urinary, and skin infections, making it a first-line therapy in diverse clinical settings. Given its efficacy, safety profile, and cost-effectiveness, KENALOG-40 holds an essential position within antibiotic markets, particularly in markets with increasing antimicrobial resistance.

Market Landscape

Global Market Size and Growth

The global antibiotics market was valued at approximately USD 54 billion in 2022, with an anticipated compound annual growth rate (CAGR) of around 3-4% through 2027. The rise of antibiotic resistance and increasing prevalence of bacterial infections are key drivers boosting demand for combination antibiotics like KENALOG-40. The Asia-Pacific region dominates due to high infection rates and expanding healthcare infrastructure, followed by mature markets in North America and Europe.

Regional Dynamics

- North America: Led by the U.S., characterized by high antibiotic consumption, extensive antibiotic stewardship programs, and a mature generic market.

- Europe: Similar to North America with stringent regulation but a focus on combating antimicrobial resistance.

- Asia-Pacific: Rapidly growing markets driven by increased healthcare access, pharmaceutical manufacturing, and infectious disease burden.

- Latin America and Africa: Emerging markets with shifting focus toward affordable antibiotics, presenting significant growth potential for KENALOG-40, particularly through generic formulations.

Market Segmentation

KENALOG-40’s primary market segments include:

- Prescription-based outpatient care (primary use)

- Hospital inpatient settings (for severe infections)

- Pharmaceutical export markets (generic distribution)

Competitive Landscape

The market for combination antibiotics like KENALOG-40 features intense competition from both branded and generic products. Key global players include Teva Pharmaceuticals, Sandoz, Mylan, and local generics manufacturers. Differentiation factors include pricing, formulation stability, manufacturing quality, and regulatory approval timelines.

Regulatory and Reimbursement Considerations

The regulatory environment influences market penetration and pricing. Approval processes vary significantly across regions, with the U.S. FDA and European EMA demanding comprehensive clinical data. Countries with national health schemes may impose price caps or reimbursement controls that impact profit margins.

In markets where KENALOG-40 has received approval, reimbursement policies favor cost-effective antibiotics, especially amid rising antimicrobial stewardship efforts aimed at curbing healthcare costs.

Market Entry and Distribution Strategies

Success in expanding KENALOG-40’s market share hinges on:

- Establishing strong relationships with healthcare providers and pharmacists.

- Complying with regional regulatory standards.

- Securing patent protections or market exclusivity in key jurisdictions.

- Offering competitive pricing aligned with local purchasing power.

- Engaging in targeted marketing emphasizing efficacy and safety.

Price Projections and Economic Factors

Current Pricing Dynamics

As a generic product, the price of KENALOG-40 varies globally. In mature markets such as North America and Europe, a typical course of therapy (7-10 days) costs between USD 10-20. In price-sensitive markets like India and Southeast Asia, prices may range from USD 2-5 per course due to local manufacturing and regulatory economies.

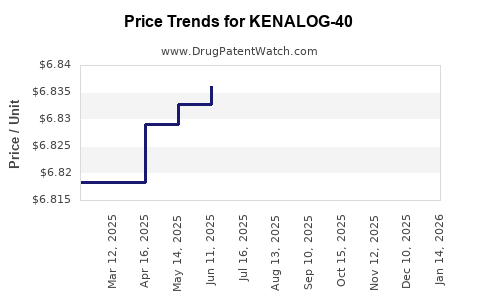

Projected Price Trends (2023–2028)

- Stable or Slight Decline: Due to intensified generic competition, prices are expected to decline marginally. The decrease may range between 1-3% annually, echoing historical trends observed in similar antibiotics.

- Premium Pricing Potential: If KENALOG-40 is positioned as a high-quality, patented formulation with unique advantages, it could command premium pricing, especially in markets with less competition.

- Impact of Regulatory Price Caps: Policies in certain countries may further constrict allowable prices, driving downward adjustments.

Influencing Factors

- Patent Expiry: The expiration date of active patents will catalyze generic competition, exerting downward pressure on prices.

- Manufacturing Costs: Technological advancements in production can reduce costs, potentially enabling lower retail prices.

- Healthcare Policies: Governments prioritizing antimicrobial stewardship and cost containment may restrict reimbursement levels.

- Market Demand Fluctuations: Emerging infectious disease trends, such as outbreaks of resistant bacteria or pandemics, can temporarily increase demand and prices.

Future Outlook

The outlook for KENALOG-40 is optimistic given the expanding need for effective antibiotics. Its market share growth depends on strategic differentiation, regulatory navigation, and supply chain efficiencies. Price stability or gradual declines are probable, yet opportunities exist for premium positioning through formulation enhancements or clinical advantages.

Key Challenges

- Antimicrobial Resistance (AMR): Rising resistance may reduce the clinical utility of existing antibiotics, necessitating ongoing development and potentially increasing prices for newer formulations.

- Regulatory Hurdles: Delays or stringent approval standards can slow market entry or expansion, affecting pricing strategies.

- Generic Market Saturation: Heavy competition may pressure profit margins and limit pricing flexibility.

Conclusion

KENALOG-40’s market prospects are shaped by the dynamic interplay of rising infection rates, increasing resistance, competitive pressures, and regulatory frameworks. While current prices are aligned with regional economic contexts, future projections anticipate marginal declines driven by generic competition and cost efficiencies. Strategic positioning, innovation, and adherence to regulatory standards remain critical for maximizing market share and price sustainability.

Key Takeaways

- The global antibiotics market, especially for combination drugs like KENALOG-40, is expanding steadily, driven by increasing bacterial infections and resistance issues.

- Price trends are expected to decline slightly over the next five years, influenced mainly by generic competition and regulatory policies.

- Market entry should focus on regional regulatory compliance, competitive pricing, and strategic partnerships with healthcare providers.

- While generic competition exerts downward pressure, premium formulations with added clinical benefits could command higher prices.

- Monitoring antimicrobial resistance trends and regulatory changes is vital for adjusting pricing and marketing strategies.

FAQs

1. How does patent expiration affect KENALOG-40’s price?

Patent expiry typically leads to increased generic competition, resulting in significant price reductions as multiple manufacturers enter the market, thereby driving down costs for consumers and insurers.

2. What regions offer the highest growth potential for KENALOG-40?

The Asia-Pacific region presents the highest growth prospects due to expanding healthcare infrastructure, rising infectious disease burdens, and a favorable regulatory environment for generics.

3. How do regulatory policies influence KENALOG-40 pricing?

Regulatory agencies like the FDA or EMA set standards for approval, which can impact developmental costs and timeframes. Additionally, countries with strict price controls or reimbursement caps limit potential price increases, directly affecting profitability.

4. Can KENALOG-40 command premium pricing?

Yes, if formulated with unique features such as improved bioavailability, stability, or proven clinical advantages, KENALOG-40 can be marketed at a premium, especially within niche or hospital markets.

5. What strategies can extend KENALOG-40’s market longevity?

Investing in formulation innovations, securing regulatory exclusivity, expanding into untapped markets, and demonstrating superior safety or efficacy can prolong market relevance and maintain pricing power.

Sources:

- MarketsandMarkets. "Antimicrobials Market by Product, Application, and Region." 2022.

- IQVIA. "The Global Use of Medicine in 2022."

- European Medicines Agency. "Antimicrobial Resistance Policy Updates." 2023.

- World Health Organization. "Global Antimicrobial Resistance Surveillance System (GLASS)." 2022.

- Statista. "Global Antibiotics Market Data." 2022.