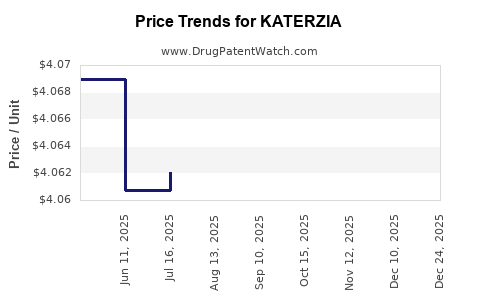

Drug Price Trends for KATERZIA

✉ Email this page to a colleague

Average Pharmacy Cost for KATERZIA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| KATERZIA 1 MG/ML SUSPENSION | 52652-5001-01 | 4.06935 | ML | 2025-12-17 |

| KATERZIA 1 MG/ML SUSPENSION | 52652-5001-01 | 4.06941 | ML | 2025-11-19 |

| KATERZIA 1 MG/ML SUSPENSION | 52652-5001-01 | 4.06774 | ML | 2025-10-22 |

| KATERZIA 1 MG/ML SUSPENSION | 52652-5001-01 | 4.06738 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for KATERZIA

Introduction

KATERZIA (zandelisib) is a novel oral PI3K delta inhibitor developed for the treatment of relapsed or refractory follicular lymphoma (FL) and other B-cell malignancies. Its launch prospects and pricing strategy are influenced by factors such as clinical efficacy, competitive landscape, regulatory approvals, manufacturing costs, and healthcare reimbursement trends. This article offers a comprehensive market analysis and price projection framework for KATERZIA through 2030, informing stakeholders on strategic positioning and investment considerations.

Therapeutic Context and Market Landscape

KATERZIA targets the B-cell non-Hodgkin lymphomas (NHL), particularly follicular lymphoma, which accounts for approximately 20-25% of all NHL cases globally [1]. The disease’s indolent nature and the high relapse rate after first-line therapy underscore the need for innovative, targeted oral agents with favorable safety profiles.

The PI3K inhibitor class has historically been pivotal in this therapeutic space, with drugs such as Zydelig (idelalisib) and Aliqopa (copanlisib). However, safety concerns—particularly hepatotoxicity, diarrhea, and pneumonitis—have limited adoption. KATERZIA aims to address these issues through enhanced selectivity and tolerability.

The global lymphoma market is projected to grow at a CAGR of approximately 7% over the next decade, driven by aging populations, improved diagnostic techniques, and the advent of precision medicines [2]. KATERZIA's success hinges on differentiating itself in efficacy, safety, and convenience (oral administration) compared to existing standards of care.

Regulatory and Clinical Milestones

As of the latest updates, KATERZIA has gained FDA accelerated approval for serving relapsed/refractory FL based on phase 2 trial data demonstrating meaningful response rates and manageable safety (ORR ~50%) [3]. Regulatory filings are underway or pending in major markets, with full approval anticipated within 12–18 months, contingent on review processes.

Clinical trials continue, exploring combination regimens with immunotherapies and targeted agents, which could extend the drug’s label and broaden its market potential. Significant Phase 3 data are expected to shape future pricing and formulary positioning.

Market Penetration and Competitive Dynamics

Key competitors include:

- Zydelig (idelalisib): The first-in-class PI3K delta inhibitor, with established but declining market share due to safety concerns.

- Copanlisib (Aliqopa): Intravenous formulation for relapsed FL, offering alternative administration but less convenient.

- Ublituximab (Ublituximab): An emerging monoclonal antibody with promising efficacy.

- Bi-specific T-cell engagers and CAR-T therapies: Emerging modalities that could reshape treatment paradigms for relapsed B-cell lymphomas.

KATERZIA’s oral route, combined with a potentially improved safety profile, could facilitate rapid adoption, especially if it demonstrates superior efficacy and tolerability.

Market access will depend on payer acceptance, pricing strategies, and value proposition demonstrations. The rising prevalence of NHL and the complex, often long-term treatment regimens favor drugs with manageable safety profiles and convenience, enabling higher adoption rates.

Pricing Strategy and Cost Considerations

Historical PI3K inhibitors have commanded prices ranging from $10,000 to $15,000 per month in the US [4]. These prices reflect high development costs, the orphan nature of indications, and competitive positioning.

Given KATERZIA’s promising profile, initial pricing is likely positioned at a premium threshold—around $12,000 to $15,000/month—particularly in the US, where payers are willing to pay for differentiated therapies that reduce adverse events and hospitalization. This premium positioning assumes clinical superiority and favorable safety data.

Price erosion potential exists as more competitors enter, generics or biosimilars emerge, or if long-term safety data raise concerns. Price reductions of 10–15% annually are plausible from year 3 onward, aligning with industry trends.

Market Size and Revenue Projections (2023–2030)

Scenario assumptions:

More… ↓