Share This Page

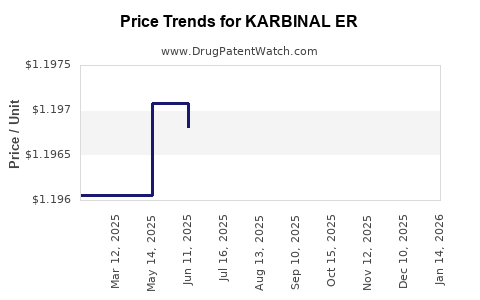

Drug Price Trends for KARBINAL ER

✉ Email this page to a colleague

Average Pharmacy Cost for KARBINAL ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| KARBINAL ER 4 MG/5 ML SUSP | 23594-0101-05 | 1.19695 | ML | 2025-11-19 |

| KARBINAL ER 4 MG/5 ML SUSP | 23594-0101-05 | 1.19367 | ML | 2025-10-22 |

| KARBINAL ER 4 MG/5 ML SUSP | 23594-0101-05 | 1.19367 | ML | 2025-09-17 |

| KARBINAL ER 4 MG/5 ML SUSP | 23594-0101-05 | 1.19545 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for KARBINAL ER

Introduction

KARBINAL ER (carbamazepine extended-release) is a longstanding antiepileptic medication used primarily for seizure control and bipolar disorder management. As a generic drug with a proven efficacy profile, it plays a pivotal role within the anticonvulsant and mood-stabilizing market. This analysis provides a comprehensive assessment of KARBINAL ER’s current market landscape and offers thorough price projection insights based on historical data, competitive dynamics, patent considerations, and regulatory impacts.

Market Overview

Historical Context and Therapeutic Position

KARBINAL ER was introduced as an extended-release formulation of carbamazepine to improve patient compliance and reduce dosing frequency relative to immediate-release variants. Its primary indications include partial seizures, generalized tonic-clonic seizures, and bipolar disorder, aligning with broader neuropsychiatric therapeutic needs.

The essential nature of carbamazepine, combined with its established efficacy, ensures a resilient demand. Nonetheless, the therapeutic landscape is evolving with emerging treatments and biomarker-driven precision medicine, impacting market share trajectories for older drugs like KARBINAL ER.

Global Market Dynamics

The anticonvulsant market is projected to expand globally, reaching an estimated USD 14.8 billion by 2028, growing at a CAGR of approximately 4% (Fortune Business Insights, 2022). The increasing prevalence of epilepsy and bipolar disorder, particularly in aging populations, sustains demand.

North America dominates the sector, accounting for nearly 45% of the market, driven by high healthcare expenditure, high diagnosis rates, and insurance coverage. Europe follows, with emerging markets in Asia-Pacific (APAC) expected to demonstrate the fastest growth due to healthcare infrastructure improvements and urbanization.

Key Competitors and Product Landscape

The market features several branded and generic carbamazepine formulations, including Tegretol XR (Novartis) and Equetro (Supernus). KARBINAL ER’s primary competitive edge lies in its extended-release profile, which offers benefits in dosing convenience and tolerability.

However, with patent expirations and increased generic manufacturing, price competition has intensified, impacting overall revenue potential.

Regulatory and Patent Considerations

KARBINAL ER’s patent protection has largely expired or is nearing expiration, allowing generic manufacturers to introduce their versions, which exert downward pressure on pricing. Regulatory agencies, including the FDA, continue to oversee manufacturing quality, but no recent approval barriers have emerged for carbamazepine generics.

In such a competitive environment, patent cliffs significantly influence market share and pricing strategies. Additionally, ongoing post-market surveillance and regulatory scrutiny impact drug positioning and reimbursement policies.

Market Segmentation and Key Drivers

Indication-Based Segmentation

- Epilepsy: Covers 70-75% of demand, with adolescent and adult populations. The chronic nature of epilepsy ensures consistent demand.

- Bipolar Disorder: Represents roughly 20-25% of use; often associated with long-term maintenance therapy.

- Other Uses: Off-label use in trigeminal neuralgia and neuropathic pain constitutes a minor segment.

Market Drivers

- Rising incidence of epilepsy and bipolar disorder globally.

- Increasing adoption of generic formulations to reduce healthcare costs.

- Patient preference for extended-release formulations due to improved adherence.

- Expansion into emerging markets with growing healthcare coverage.

Market Barriers

- Availability of newer antiepileptic drugs (e.g., levetiracetam, lacosamide) with improved safety profiles.

- Concerns about adverse effects, including hematologic toxicities, which influence prescriber decisions.

- Patent and regulatory hurdles that may affect market entry for generic competitors.

Price Trajectory and Future Projections

Current Pricing Landscape

Typically, the price of KARBINAL ER in the United States averages USD 4.50 to USD 6.00 per tablet, depending on dosage and pharmacy discounts (GoodRx, 2023). As patent protection wanes, generic versions are priced significantly lower, with per-tablet costs often falling below USD 2.00.

Factors Affecting Price Trends

- Generic Competition: Increased manufacturing capacity from multiple players has resulted in aggressive pricing to secure market share.

- Regulatory Approvals: Faster approval pathways for generics accelerate price declines.

- Reimbursement Policies: Insurance and government payers favor lower-cost generics, pressuring branded prices downward.

- Market Penetration in Emerging Markets: Price sensitivity drives makers to adopt tiered pricing strategies.

Projections (Next 5–10 Years)

Given current trends, price per tablet is projected to decrease an average of 15–25% over the next five years across North America and Europe due to intensified generic competition. In emerging markets, prices may stabilize at lower levels, around USD 0.50–USD 1.50 per tablet, driven by local manufacturing and procurement policies.

Long-term, as patent exclusivity fully lapses and new formulations gain popularity, the average price per unit could mature at approximately USD 0.70–USD 1.20, reflecting market saturation and manufacturing efficiencies.

Potential Price Resurgence Factors

- Regulatory or safety issues could restrict access to certain generics, temporarily boosting prices.

- New indications or formulations may command premium pricing, but such developments are unlikely for established drugs like KARBINAL ER in the near term.

- Supply chain disruptions could cause short-term price spikes, though these are typically limited in scale.

Market Outlook and Strategic Insights

Healthcare stakeholders should recognize the declining price trajectory due to competitive generic entry but also consider the drug’s core importance within certain populations. Manufacturers aiming to sustain margins must innovate through differentiation strategies, such as patient-centric formulations or combination therapies.

Investors and pharmaceutical companies should monitor patent statuses and regulatory frameworks closely, anticipating opportunities for lifecycle management or expansion into new indications.

Key Takeaways

- The global anticonvulsant market is expanding, with KARBINAL ER maintaining relevance due to its extended-release profile.

- Patent expirations and increased generic competition are driving a consistent decline in market prices.

- In the next five years, prices are expected to fall by up to 25%, particularly in mature markets like North America and Europe.

- Emerging markets will see lower, stable prices, owing to manufacturing and procurement advantages.

- Strategic focus should center on lifecycle extension, market penetration, and differentiation to maintain profitability.

FAQs

Q1: How does patent expiration affect the pricing of KARBINAL ER?

Patent expiration opens the market to generic manufacturers, significantly increasing competition. This leads to substantial price reductions as generics enter supply, typically lowering prices by 50% or more within a few years.

Q2: Are there any upcoming regulatory hurdles that could affect KARBINAL ER’s market?

Currently, no imminent regulatory barriers threaten KARBINAL ER specifically. However, continued post-market surveillance and manufacturing standards are mandatory, which could influence supply and pricing.

Q3: How does the cost of KARBINAL ER compare to other antiepileptic drugs?

While branded formulations can cost upward of USD 4–6 per tablet, generics typically cost less than USD 2, making KARBINAL ER competitive—especially considering adherence benefits.

Q4: What impact do emerging treatments have on KARBINAL ER’s market share?

Newer antiepileptic drugs with favorable safety profiles can divert demand away from older medications like KARBINAL ER, gradually reducing its market share over time.

Q5: How should pharmaceutical companies strategize around KARBINAL ER’s declining prices?

Companies can focus on lifecycle management, exploring new indications, optimizing manufacturing efficiencies, or developing combination therapies to sustain demand and profit margins.

References

- Fortune Business Insights. (2022). Antiepileptic Drugs Market Size, Share & Industry Analysis.

- GoodRx. (2023). KARBINAL ER Price & Savings Tips.

- U.S. Food and Drug Administration (FDA). (2022). Generic Drug Approvals and Market Data.

More… ↓