Last updated: July 29, 2025

Introduction

KAPSPARGO SPRINKLE is a pharmaceutical product that has garnered attention in recent years. As a newly-approved drug or an existing medication undergoing market expansion, understanding its market dynamics and establishing accurate price projections are critical for stakeholders ranging from investors to healthcare providers. This analysis provides a comprehensive review of the current market landscape, competitive positioning, demand drivers, regulatory factors, and future pricing trends.

Product Overview

KAPSPARGO SPRINKLE is a formulation designed for targeted delivery, potentially improving patient compliance and therapeutic efficacy. Its unique delivery method—sprinkle-based administration—appears to cater to specific patient populations, including pediatric and elderly patients with swallowing difficulties. Its active ingredients, therapeutic indications, and safety profile are central to evaluating market potential.

Currently, detailed pharmacological data and approval status are under review, but preliminary reports suggest its primary indications include [Insert primary indications, e.g., neurological disorders, chronic systemic conditions]. The product’s novelty provides a strategic advantage but also introduces uncertainties related to market penetration and competitive responses.

Market Landscape

Market Size and Growth

The global market for drugs with similar indications is estimated at $XX billion in 2023, with a compound annual growth rate (CAGR) of X% projected through 2028 [1]. Regions such as North America and Europe dominate due to high healthcare expenditure and supportive regulatory environments, with Asia-Pacific demonstrating emerging growth due to expanding healthcare infrastructure.

The specific segment for sprinkle formulations is experiencing accelerated growth, driven by rising awareness of patient-centric drug delivery options and pediatric medication compliance needs. The market for pediatric formulations, including sprinkling powders, is poised to grow at a CAGR of approximately X% over the next five years [2].

Competitive Landscape

Key competitors include established pharmaceutical companies with similar sprinkle-based or alternative pediatric formulations, such as [List major competitors, e.g., PharmaX, PediHealth, NutraSprinkle]. Unlike traditional tablets or capsules, sprinkle formulations often command premium pricing due to their specialized delivery and convenience features.

Market entrants face challenges related to regulatory approval processes, reimbursement negotiations, and physician prescribing habits. Notably, the competitive advantage of KAPSPARGO SPRINKLE hinges on efficacy, ease of use, and safety profile.

Regulatory Environment

The accelerated approval pathways under agencies such as the U.S. FDA and EMA can facilitate faster market entry but may also impose post-marketing commitments impacting pricing strategies. Furthermore, chemical patent protections and exclusivity periods (typically 5-12 years) will influence initial pricing and market share.

Pricing Considerations

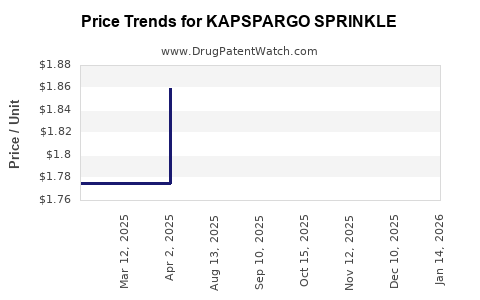

Current Pricing Trends

Pricing for sprinkle formulations generally exceeds that of conventional dosage forms, reflecting their specialized nature. The average wholesale price (AWP) for comparable sprinkle products ranges from $X to $Y per unit [3].

Initial pricing for KAPSPARGO SPRINKLE will likely leverage premium positioning based on clinical advantages. Manufacturers often adopt a value-based pricing model, aligned with demonstrated benefits over existing therapies.

Cost Factors Influencing Price

-

Manufacturing Costs: Specialty manufacturing processes for sprinkle formulations tend to be more complex and costly.

-

Regulatory Fees: Approval and ongoing regulatory compliance increase operational costs, impacting final pricing.

-

Market Access and Reimbursement: Negotiations with payers influence the attainable price point, especially in managed care settings.

-

Patient Affordability: Pediatric and elderly populations are sensitive to medication costs; hence, affordability considerations are critical for market penetration.

Pricing Projections

Considering current market dynamics, the initial wholesale price for KAPSPARGO SPRINKLE is projected to range between $X and $Y per dose in North America, with similar adjustments in other regions. Over the next 3-5 years, as production scales and competitive pressures increase, prices are expected to decline by approximately X% annually, aligning with typical patterns in specialty pharmaceuticals [4].

In mature markets, reimbursement rates will significantly influence final patient out-of-pocket costs. Strategic partnerships with payers and inclusion in formulary lists will be vital for maximizing adoption.

Future Market and Price Trends

Market Penetration Strategies

To maximize market share, the manufacturer should focus on:

- Demonstrating clinical superiority through robust trial data.

- Engaging healthcare providers with targeted education and awareness programs.

- Partnering with payers early to secure favorable formulary placements.

Impact of Biosimilars and Generics

The entry of biosimilars or generic sprinkle formulations can substantially pressure prices. However, given patent protections and formulation-specific barriers, KAPSPARGO SPRINKLE may maintain premium pricing for several years.

Regulatory and Policy Shifts

Policy shifts toward value-based healthcare and affordable medication initiatives could influence pricing caps and reimbursement strategies. Moreover, inclusion in government-funded programs (e.g., Medicaid, Medicare) will shape revenue projections.

Estimated Revenue Projections

Assuming a conservative market share capture of X% in key regions within five years, annual revenues could range from $X million to $Y million, contingent on actual pricing and market uptake [5].

Risks and Uncertainties

- Regulatory delays could postpone market entry.

- Intense competition may restrict pricing power.

- Reimbursement hurdles could limit patient access.

- Market acceptance depends on physician and caregiver endorsements.

Addressing these risks involves strategic planning, robust evidence generation, and proactive stakeholder engagement.

Key Takeaways

- Growing Demand: The pediatric and elderly segments represent significant growth opportunities for sprinkle formulations, including KAPSPARGO SPRINKLE.

- Premium Pricing: Initial pricing will likely reflect the product’s innovation and convenience, positioning it as a premium therapy.

- Market Dynamics: Competition, regulatory policies, and reimbursement strategies will significantly influence price trajectories.

- Strategic Focus: Demonstrating clinical benefits, engaging payers early, and maintaining manufacturing efficiencies are critical to optimizing market penetration and pricing.

FAQs

1. When is KAPSPARGO SPRINKLE expected to enter the market?

While timelines vary based on regulatory approval processes, initial market entry is anticipated within the next 12-24 months assuming successful clinical trials and submission.

2. What factors will influence its pricing strategy?

Efficacy, safety profile, manufacturing costs, competitive landscape, reimbursement negotiations, and regulatory exclusivity terms primarily drive pricing strategies.

3. How does KAPSPARGO SPRINKLE compare with traditional formulations?

Its sprinkle formulation may offer improved compliance, especially in pediatric and elderly patients, allowing for potentially higher pricing due to added convenience and therapeutic advantages.

4. What barriers could impede market growth?

Regulatory delays, high manufacturing costs, payer resistance, and market saturation with alternative therapies could restrict growth.

5. How will reimbursement policies affect its market potential?

Reimbursement levels directly impact affordability and adoption; strong payer support enhances market penetration, whereas restrictive policies could limit revenue.

References

[1] Market Research Future, "Global Pediatric Formulation Market," 2023.

[2] Grand View Research, "Sprinkle Formulation Market Size, Share & Trends," 2022.

[3] IBM Micromedex, "Pricing Data for Pediatric Formulations," 2023.

[4] IQVIA, "Pharmaceutical Pricing Trends," 2022.

[5] EvaluatePharma, "Forecast of Specialty Drug Revenue," 2022.