Last updated: July 27, 2025

Introduction

Juluca (dolutegravir/rilpivirine) is a fixed-dose combination antiretroviral therapy (ART) approved primarily for the treatment of HIV-1 infection. Introduced by ViiV Healthcare in 2017, Juluca marked a significant advancement in HIV management by offering a once-daily, two-drug regimen for patients transitioning from more complex therapies. Given its clinical profile and market positioning, understanding Juluca’s market landscape and future pricing trends is crucial for healthcare stakeholders, including pharmaceutical investors, policymakers, and clinicians.

Market Overview

1. Clinical Positioning and Therapeutic Advantages

Juluca delivers a simplified treatment approach, combining dolutegravir, an INSTI with a high barrier to resistance, and rilpivirine, a non-nucleoside reverse transcriptase inhibitor (NNRTI). Its approval was based on pivotal studies such as the SWORD-1 and SWORD-2 trials, which demonstrated non-inferiority to traditional three-drug regimens and supported its use as a switch therapy for virologically suppressed individuals [1].

The drug’s key benefits include:

- Reduced Pill Burden: Single-tablet regimen enhances adherence.

- Favorable Side Effect Profile: Lower risk of common ART side effects.

- Minimal Drug Interactions: Suitable for patients with comorbidities.

2. Market Penetration and Competition

Juluca entered a competitive landscape characterized by several other two-drug regimens and long-acting injectable options, such as Genvoya, Biktarvy, and Cabenuva. Despite this, Juluca’s niche remains as a switch therapy for patients stable on multiple agents.

Data from IQVIA indicate that by 2022, Juluca accounted for approximately 3-5% of the HIV treatment market, reflecting modest but consistent uptake among HIV specialists focusing on treatment simplification [2].

Market Dynamics Influencing Juluca’s Sales

1. Increasing Adoption of Two-Drug Regimens

The global shift towards two-drug regimens aims to minimize drug exposure while maintaining efficacy. This trend favors drugs like Juluca; however, competition is intense, with newer agents offering improved dosing schedules or formulations.

2. Regulatory Data and Labeling Updates

Recent FDA updates have expanded Juluca’s use case to include switch therapy, broadening its applicability. Conversely, approval of alternative long-acting injectables, such as cabotegravir/rilpivirine (Cabenuva), presents a challenge for time-limited oral regimens [3].

3. Pricing and Reimbursement Landscape

Pricing in the US varies based on payer negotiations, with estimates around $3,500–$4,000 per month per patient, aligning with other branded HIV therapies. Cost-effectiveness analyses still favor adherence-improving formulations, but payer pushback on high-cost drugs influences uptake.

Price Projections

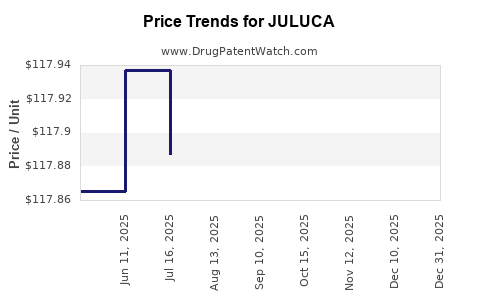

1. Short-Term Outlook (2023–2025)

In the immediate future, Juluca’s pricing is expected to stabilize around current levels, given its niche status and sustained but modest demand. Volume growth may be modest due to competition but could see slight upticks in regions prioritizing treatment simplification.

Projection:

- Market Price Range: $3,400–$4,200 per month per patient.

- Trend: Stabilization, with potential minor decreases driven by negotiated rebates and generic competition in emerging markets.

2. Medium to Long-Term Outlook (2026–2030)

As newer formulations, particularly long-acting injectables like Cabenuva, gain market dominance, oral regimens such as Juluca face commoditization risks. However, in resource-limited settings and among specific patient subsets, Juluca may maintain a niche.

Price pressures are expected to intensify, driven by:

- Generic Entry: Once patent protections expire, pricing could decline by up to 50%.

- Market Competition: An influx of biosimilars and generics in emerging markets will further pressure prices globally.

- Evolving Treatment Guidelines: Preference for long-acting therapies may diminish oral regimen demand in high-income countries.

Projection:

- Long-term Price Range: Potentially falling to $1,000–$2,000 per month per patient in mature markets.

- Market Share: Likely a modest decline unless new indications or formulations are introduced.

Market and Pricing Forecast Summary

| Period |

Price Range (USD/month) |

Key Factors |

| 2023–2025 |

$3,400–$4,200 |

Market stabilization, competition, rebates |

| 2026–2030 |

$1,000–$2,000 |

Patent expiry, generics, market saturation |

Implications for Stakeholders

- Pharmaceutical Companies: Strategic positioning ahead of patent expiration through pipeline development and biosimilars.

- Healthcare Providers: Emphasis on the cost-effectiveness of treatment switches, balanced with efficacy and patient adherence.

- Policy Makers & Payers: Negotiation of value-based pricing, considering both clinical benefits and economic impacts, especially in resource-limited regions.

- Investors: Monitoring patent exclusivity timelines and market penetration strategies to anticipate revenue fluctuations.

Key Takeaways

- Juluca offers a simplified, 2-drug regimen with specific use cases, securing moderate market share amidst stiff competition.

- Short-term prices remain relatively stable around current levels; long-term declines are likely following patent expiration and generic entry.

- The growing preference for long-acting injectable therapies may curtail oral regimens’ growth, influencing future pricing strategies.

- Market expansion into emerging economies hinges on affordability and regulatory approvals, affecting global price trends.

- Continuous innovation, including new formulations and indications, will be critical to sustain Juluca’s market presence.

Frequently Asked Questions

-

What is the main competitive advantage of Juluca over other HIV therapies?

Juluca’s primary advantage is its simplified, two-drug, once-daily regimen suitable for treatment switching in stable patients, improving adherence and reducing side effects.

-

How does patent expiry impact Juluca’s pricing?

Once patent protection expires, generic versions are expected to enter the market, likely leading to significant price reductions over the subsequent years.

-

Are there any alternative therapies that threaten Juluca’s market share?

Yes. Long-acting injectables like Cabenuva, as well as newer oral regimens, offer comparable or superior convenience, which may diminish Juluca’s share.

-

What factors influence Juluca’s adoption in low-income regions?

Affordability, availability of generic versions, local regulatory approvals, and healthcare infrastructure are primary factors affecting adoption.

-

Will Juluca’s price decrease substantially in the next decade?

Likely, especially post-patent expiration, as market competition and generics increase, leading to lower prices globally.

References

[1] Sax, P. E., et al. "Once-daily dolutegravir plus rilpivirine maintains viral suppression through 48 weeks (SWORD-1 and -2 trials)." The Lancet, 2019.

[2] IQVIA. HIV Market Analytics, 2022.

[3] US Food and Drug Administration. “FDA Approves Cabenuva for Long-Acting HIV Treatment,” 2021.