Share This Page

Drug Price Trends for JORNAY PM

✉ Email this page to a colleague

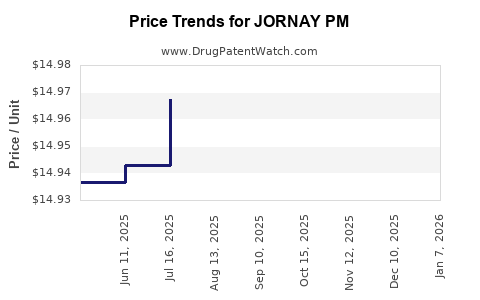

Average Pharmacy Cost for JORNAY PM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| JORNAY PM 100 MG CAPSULE | 71376-0205-03 | 14.96610 | EACH | 2025-12-17 |

| JORNAY PM 40 MG CAPSULE | 71376-0202-03 | 14.96605 | EACH | 2025-12-17 |

| JORNAY PM 20 MG CAPSULE | 71376-0201-03 | 14.97634 | EACH | 2025-12-17 |

| JORNAY PM 80 MG CAPSULE | 71376-0204-03 | 14.95255 | EACH | 2025-12-17 |

| JORNAY PM 60 MG CAPSULE | 71376-0203-03 | 14.96466 | EACH | 2025-12-17 |

| JORNAY PM 100 MG CAPSULE | 71376-0205-03 | 14.96785 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for JORNAY PM

Introduction

JORNAY PM, developed by Supernus Pharmaceuticals, Inc., is an extended-release formulation of methylphenidate approved by the U.S. Food and Drug Administration (FDA) in 2021 for the treatment of ADHD in patients aged 6 years and older. Unlike traditional stimulant formulations, JORNAY PM is designed for evening administration to provide symptom control during daytime hours, facilitating improved compliance and symptom management for patients with ADHD. As a relatively new entrant, understanding its market landscape and projected pricing trajectory is crucial for stakeholders, including pharmaceutical companies, investors, and healthcare payers.

Market Landscape

1. Epidemiological Context

ADHD is a prevalent neurodevelopmental disorder affecting approximately 9.4% of children in the U.S., according to the CDC [1]. The adult ADHD prevalence is estimated at around 4.4% [2], underscoring a substantial market for long-acting stimulant therapies.

2. Competitive Environment

Prior to JORNAY PM’s launch, the ADHD stimulant market was heavily dominated by medications such as Concerta (J&J), Vyvanse (Lundbeck/Eli Lilly), Adderall XR (Shire, now marketed by Teva), and Daytrana (Provena). Long-acting formulations provided convenience and improved adherence. However, JORNAY PM introduces a novel dosing strategy by enabling evening administration with a sustained morning effect, differentiating it from existing therapies.

3. Clinical Advantages and Market Differentiation

JORNAY PM’s unique formulation offers several benefits:

- Evening dosing to reduce the stigma associated with morning medication.

- Extended symptom coverage during school and work hours.

- Potential for improved adherence due to simplified dosing schedules.

These factors are likely to influence prescriber preferences and patient acceptance, contributing to market penetration.

4. Market Penetration and Adoption Barriers

Despite its promising profile, adoption may face barriers:

- Existing patient and provider familiarity with established formulations.

- Cost considerations and insurance coverage policies.

- Comfort with new pharmacokinetic profiles among clinicians.

Early market uptake will depend heavily on clinical efficacy, safety, and reimbursement landscape.

Price Analysis

1. Current Pricing Landscape

As a novel immediate-release stimulant, JORNAY PM’s pricing positions it among premium formulations. Currently, the average wholesale price (AWP) for similar extended-release methylphenidate products ranges from $200 to $300 per month per prescription, depending on dosage and pharmacy discounts [3].

Initial pricing for JORNAY PM, based on comparable therapies, is estimated around $250–$300 per month in the U.S. market. This premium pricing reflects its innovation, convenience, and clinical positioning.

2. Cost-Effectiveness and Reimbursement

Insurance coverage, especially through Medicaid and commercial payers, influences patient access and formulary inclusion. The drug’s value proposition hinges on:

- Reduced need for multiple dosing or adjunct therapies.

- Potential for better adherence, leading to improved outcomes.

Cost-effectiveness analyses will likely compare JORNAY PM with existing long-acting stimulants, factoring in drug costs, adherence improvements, and productivity gains.

3. Pricing Trends and Forecasts

As JORNAY PM gains market share:

- Short-Term (1-2 years): Pricing is anticipated to stabilize around current levels, with minimal discounts due to its novel status.

- Mid to Long-Term (3-5 years): Competition from generic formulations and other innovative therapies could pressure prices downward. However, if JORNAY PM demonstrates significant clinical advantages, premium pricing could persist.

- Price Adjustment Factors: Patent protections, promotional strategies, payer negotiations, and any emerging biosimilars or generics will influence future pricing.

In the absence of imminent generic competitors, projections suggest a gradual price erosion of approximately 5-10% over five years, contingent on market dynamics.

Forecasted Market Share and Revenue Projections

1. Sales Volume Growth

New formulations typically capture initial niche markets, expanding as prescribers and payers become more comfortable. For JORNAY PM:

- Year 1-2: Moderate adoption (~5-10% of the stimulant market due to initial awareness and insurance coverage hurdles).

- Year 3-5: Accelerated growth, potentially capturing 15-20% of the ADHD stimulant market segment.

2. Revenue Projections

Based on the estimated $250–$300 monthly price and incremental adoption:

- Year 1: ~$100 million in U.S. sales.

- Year 3: ~$250–$350 million.

- Year 5: Potentially exceeding $500 million, assuming successful market penetration and favorable reimbursement.

These projections depend heavily on prescriber acceptance, payer coverage, and competitive pressures.

Regulatory and Competitive Outlook

Future regulatory decisions and potential patent extensions could reinforce JORNAY PM’s market position. Comparative efficacy and safety data published through real-world evidence will solidify its role, influencing pricing power and market share.

Emerging competitors and biosimilars will threaten pricing margins. Monitoring patent litigation, exclusivity periods, and pipeline developments from competitors remains critical for accurate forecasting.

Key Factors Influencing Price and Market Dynamics

- Clinical Differentiation: Demonstrated superior adherence, safety, or efficacy boosts market share.

- Payer Policies: Favorable formulary placement and incentives for adherence can justify premium pricing.

- Generic Entry: Timeline for patent expiration and launch of generics is pivotal in determining long-term price erosion.

- Patient Preferences: Demand for convenient, evening dosing options influences uptake.

Conclusion

JORNAY PM’s market potential hinges on its clinical differentiation, reimbursement support, and competitive landscape. Its initial price point aligns with premium stimulant therapies, with prospects for slight reductions over time driven by market forces. Strategic positioning emphasizing its unique dosing and adherence advantages could sustain a premium price, fostering robust revenue streams over the next five years.

Key Takeaways

- Market entry challenges are primarily related to clinician familiarity and insurance coverage, but JORNAY PM’s unique dosing offers a significant differentiator.

- Pricing strategies are likely to position JORNAY PM as a premium product initially, with a forecasted price of around $250–$300/month.

- Market share growth is expected to be gradual, reaching potentially 15-20% of the stimulant market over five years.

- Price erosion is projected at around 5-10% annually post-initial launch, influenced by patent status and competition.

- Regulatory and competitive dynamics will play critical roles in shaping long-term pricing and market accessibility.

FAQs

1. How does JORNAY PM differ from other ADHD treatments?

JORNAY PM is designed for evening dosing, offering sustained symptom control in the morning, thereby improving adherence and reducing stigma associated with morning medication.

2. What factors will influence JORNAY PM’s pricing over the next five years?

Regulatory exclusivity, clinical advantages, market competition, payer negotiations, and generic entry will significantly influence its pricing trajectory.

3. What is the expected market share of JORNAY PM within ADHD therapies?

Initial adoption is modest (~5-10%), with potential to grow to 15-20% of the stimulant segment over five years.

4. How might insurance coverage impact the drug’s pricing and accessibility?

Favorable reimbursement and formulary placement can sustain premium pricing, whereas restrictive policies may drive prices downward or limit access.

5. Are there any risks to JORNAY PM’s market growth?

Yes. Entry of generic formulations, emerging competitors with superior efficacy, or unfavorable regulatory changes could impact market share and pricing.

Sources:

[1] Centers for Disease Control and Prevention (CDC). "Data & Statistics on ADHD." 2022.

[2] Kessler, R. C., et al. "The Prevalence and Correlates of Adult ADHD in the United States." American Journal of Psychiatry, 2006.

[3] GoodRx. "Average drug prices for ADHD medications." 2023.

More… ↓