Last updated: July 27, 2025

Introduction

JENTADUETO is a combination pharmaceutical product developed by AbbVie, comprising empagliflozin and linagliptin. Approved by the FDA in 2017, it addresses type 2 diabetes mellitus by integrating two prominent mechanisms: SGLT2 inhibition and DPP-4 inhibition. The evolving landscape of diabetes treatment, combined with patent expirations, regulatory developments, and market dynamics, profoundly influences JENTADUETO's market position and pricing trajectory.

This report dissects the current market environment for JENTADUETO, assesses competitive factors, analyzes historical pricing trends, and forecasts future pricing outlooks. Emphasis is placed on implications for stakeholders, including pharmaceutical companies, investors, healthcare providers, and payers.

Market Landscape

Prevalence and Growth of Type 2 Diabetes

The global prevalence of type 2 diabetes has surged, with the International Diabetes Federation estimating over 540 million affected individuals worldwide as of 2021—projected to reach approximately 700 million by 2045 [1]. The rising incidence, driven by lifestyle factors and aging populations, sustains sustained demand for effective therapies like JENTADUETO.

Therapeutic Positioning and Market Share

JENTADUETO's unique dual mechanism appeals to clinicians seeking comprehensive glycemic control with a simplified regimen. It competes primarily with monotherapies and other combination drugs, including:

- SGLT2 inhibitors alone (e.g., Jardiance, Invokana)

- DPP-4 inhibitors alone (e.g., Januvia, Tradjenta)

- Other fixed-dose combinations (e.g., Glyxambi, Qtern)

AbbVie's strategic positioning leverages clinical data demonstrating cardiovascular risk reduction benefits [2], enhancing JENTADUETO's appeal amid evolving treatment guidelines favoring cardioprotective therapies.

Market Penetration and Geographic Dynamics

In the U.S., JENTADUETO holds a significant share within the fixed-dose combination segment. However, overall adoption remains constrained by price sensitivity, insurance coverage, and clinician prescribing behavior. International markets, especially Europe and emerging economies, show slower uptake, influenced by regulatory approvals, pricing regulations, and healthcare infrastructure.

Pricing Trends and Competitive Dynamics

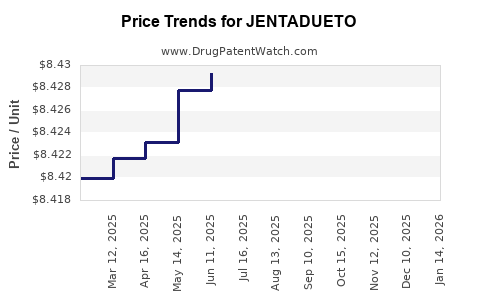

Historical Pricing Analysis

As of 2023, average wholesale prices (AWP) for JENTADUETO range from approximately $250 to $350 per month per patient in the U.S., depending on dosage and pharmacy discounts [3]. Compared to monotherapies, fixed-dose combinations often command premium pricing due to convenience and compliance benefits.

Market Competition and Impact on Pricing

The entry of biosimilars and generics for individual components (empagliflozin and linagliptin) indirectly pressures JENTADUETO’s pricing. However, patent protections, including composition of matter and method patents, sustain exclusivity through 2026-2028 [4].

Additionally, competitive offerings with similar or superior benefits have prompted price negotiations and discounts. For example, cheaper generic versions of individual drugs have affected the value proposition of branded fixed-dose products.

Reimbursement Environment

Insurance reimbursement policies heavily influence net prices. Managed Care organizations favor lower-cost options, incentivizing formulary placement or substitution with generics. Out-of-pocket costs for patients can range significantly based on co-payment structures and insurance coverage, impacting adherence and market penetration.

Regulatory and Patent Outlook

Patent Expirations

AbbVie’s patent protections for JENTADUETO are expected to expire by mid-2020s, opening market access to generics. The generic entry could lead to dramatic price erosion, potentially reducing monthly prices by 50% or more [5].

Regulatory Developments

Accelerated approval pathways, biosimilar approvals, and evolving prescribing guidelines continue to shape the competitive landscape. The approval of alternative combination therapies and new drug classes (e.g., GLP-1 receptor agonists) further diversify options, influencing JENTADUETO’s market share.

Future Price Projections

Short-to-Medium Term (Next 2-3 Years)

Given patent expiration timelines and increasing competition:

- Price Decline: Expect a decline of 10–20% in wholesale prices post-patent expiry, fueled by generic entries.

- Pricing Stability: Prior to patent expiry, prices are likely to remain stable, supported by formulary positioning and perceived clinical value.

- Market Penetration Efforts: AbbVie may employ value-based pricing strategies or patient assistance programs to retain market share.

Long Term (Beyond 3 Years)

- Post-Patent Era: Prices may stabilize at 50-70% lower than current levels, aligning with generic pricing benchmarks.

- Innovative Competition: Emerging therapies with improved efficacy or safety profiles could further suppress JENTADUETO’s price points.

Impact of Value-Based Pricing and Policy Changes

Healthcare systems increasingly favor value-based arrangements—pay-for-performance models accounting for clinical outcomes—potentially influencing future price ceilings and negotiations.

Implications for Stakeholders

-

Pharmaceutical Companies: Should prepare for significant price erosion post-patent expiration, emphasizing lifecycle management strategies, such as line extensions or combination innovations.

-

Investors: Must factor in patent expiry timelines and competitive dynamics when valuing AbbVie’s portfolio.

-

Clinicians and Payers: Will prioritize cost-effective, efficacious therapies, limiting the impact of high-priced fixed-dose drugs over time.

-

Patients: Price reductions resulting from patent expiration may enhance affordability and adherence, positively impacting public health outcomes.

Key Takeaways

-

The global increase in type 2 diabetes warrants sustained demand for combination therapies like JENTADUETO.

-

Current premium pricing is supported by clinical benefits and brand positioning but faces imminent pressure due to patent expiration and market entry of generics.

-

Price decline projections post-patent expiry estimate reductions of up to 70%, emphasizing the need for strategic lifecycle management.

-

Future pricing models will likely incorporate value-based metrics and healthcare policy shifts favoring affordability.

-

Stakeholders should anticipate competitive innovations and evolving regulatory landscapes that could influence pricing strategies.

FAQs

Q1: When is JENTADUETO's patent expected to expire?

A1: Patent protections are expected to expire around 2026–2028, facilitating the entry of generics.

Q2: How does generic competition influence the price of JENTADUETO?

A2: Generic competition typically causes a significant price reduction—often 50% or more—due to increased market options and reduced manufacturing costs.

Q3: Are there any upcoming regulatory challenges that could impact JENTADUETO pricing?

A3: Yes; approvals of alternative therapies and biosimilars, plus policy initiatives favoring cost containment, could further pressure pricing.

Q4: What strategies can AbbVie employ to maintain market share post-patent expiry?

A4: Strategies include lifecycle innovations, value-based pricing, enhanced patient support programs, and expanding therapeutic indications.

Q5: How do international market dynamics affect JENTADUETO's pricing?

A5: Price regulations, healthcare budgets, and approval timelines vary across regions, often leading to lower prices outside the U.S.

Sources

[1] International Diabetes Federation. IDF Diabetes Atlas, 2021.

[2] Zinman B, et al. Cardiovascular outcomes with empagliflozin in type 2 diabetes. NEJM, 2015.

[3] GoodRx, 2023. Pricing data for JENTADUETO.

[4] U.S. Patent and Trademark Office, Patent expiry dates, 2023.

[5] IQVIA Institute. The Changing Landscape of Diabetes Treatment, 2022.