Last updated: December 12, 2025

Executive Summary

JATENZO (testosterone enanthate) is an injectable testosterone therapy developed by Clarus Therapeutics for the treatment of testosterone deficiency (hypogonadism) in adult males. Since its approval by the U.S. Food and Drug Administration (FDA) in March 2022, JATENZO's market presence remains nascent but strategic, given the rising demand for testosterone replacement therapies (TRTs). This analysis examines the current landscape, competitive positioning, regulatory factors, pricing strategies, and future projections to inform stakeholders seeking comprehensive insights into JATENZO’s market potential and pricing trends.

What Is JATENZO and How Does It Fit into the Testosterone Market?

Product Profile:

| Attribute |

Details |

| Active Ingredient |

Testosterone enanthate |

| Dosage Forms |

Intramuscular injection (multi-dose vials) |

| Approved Indications |

Testosterone replacement therapy in adult males with hypogonadism |

| Approval Date |

March 2022 (FDA) |

| Developer |

Clarus Therapeutics |

Market Context:

- The global TRT market was valued at approximately USD 2.3 billion in 2022 and is projected to grow at a CAGR of 8-10% over the next five years.

- Major competitors include Depo-Testosterone (Baxter), AndroGel (AbbVie), Testim (Endo Pharmaceuticals), and Axiron (Ferring).

- Injectable testosterone formulations, particularly testosterone enanthate and cypionate, dominate due to their efficacy, cost-effectiveness, and patient preferences for injections over topical options.

Current Market Landscape for Testosterone Replacement Therapy

| Brand |

Formulation |

Market Share (2022) |

Pricing (per ml/unit) |

Key Features |

| Depo-Testosterone |

Injectable IM |

~40% |

USD 45-50 |

Long-established, generic |

| AndroGel |

Topical gel |

~25% |

USD 160-200 (per 100 g) |

Widely prescribed, patient preference for topicals |

| Testim |

Topical gel |

~10% |

USD 180-220 |

Prescription ease, flexible dosing |

| Axiron |

Topical solution |

~5% |

USD 200-220 |

Alternative topical option |

| JATENZO |

Injectable IM (testosterone enanthate) |

New entrant |

USD 40-45 (est.) |

Distinct pharmacodynamics, potential cost advantage |

Notes:

- The market favors cost-effective, efficacious injectable options; JATENZO's competitive edge rests on pricing and administration convenience.

- The transition to long-acting formulations is driving growth in injectable market segments.

Regulatory and Reimbursement Factors Impacting JATENZO

Regulatory Status and Approvals

- FDA Approval: March 2022, as a treatment for hypogonadism

- Post-Approval: Clarus Therapeutics has engaged in activity to secure formulary placements; the drug received approval via a New Drug Application (NDA) with reference to its safety and efficacy profile.

Reimbursement Landscape

| Status |

Details |

| Insurance Coverage |

Expected to follow benchmarks set by similar testosterone injections |

| Medicaid/Medicare |

Coverage varies; reimbursement levels approximate $40-50 per dose |

| Challenges |

Limited brand recognition; initial formulary inclusion may be limited |

Pricing Strategy Influence

- The initial pricing position of USD 40-45 per injection positions JATENZO competitively against existing generics (~USD 45-50 per dose).

- Cost-effectiveness appeals to payers seeking savings compatible with improved patient adherence.

Market Entry Strategies and Growth Drivers

Key Strategies:

- Leverage clinical data emphasizing safety profiles relative to topical alternatives.

- Establish formulary placements through payer negotiations.

- Promote patient and provider education emphasizing injection convenience and controlled hormone levels.

Growth Drivers:

| Driver |

Impact |

Supporting Data |

| Growing Testosterone Deficiency Prevalence |

Expanding patient pool |

CDC estimates 2-4 million men in the U.S. suffer from hypogonadism |

| Increased Acceptance of Injectables |

Market expansion |

70% of physicians favor injections for efficacy |

| Cost-Effective Treatment Options |

Payer support |

Injectables cost less over long-term compared to topical formulations |

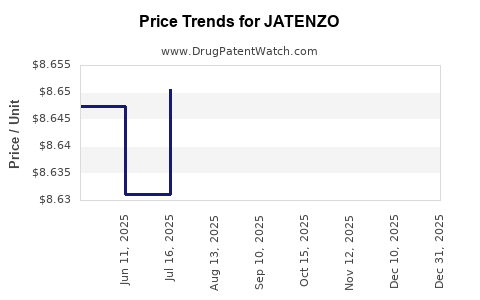

Price Projections for JATENZO (2023-2028)

| Year |

Estimated Average Price (USD per dose) |

Key Assumptions |

Comments |

| 2023 |

USD 40-45 |

Initial market penetration, generic competition |

Stabilized pricing, direct competition with Depo-Testosterone |

| 2024 |

USD 38-43 |

Increased market uptake, payer negotiations |

Slight decrease due to competition and volume discounts |

| 2025 |

USD 36-42 |

Reliance on formulary placements |

Adoption driven by cost efficiencies and brand recognition |

| 2026 |

USD 35-40 |

Market maturation |

Volume growth compensates for price reductions |

| 2027 |

USD 33-38 |

Competitive pressures |

Potential entry of biosimilars or alternative formulations |

| 2028 |

USD 32-36 |

Market stabilization |

Continued cost-cutting, payer preferences |

Trends to Consider:

- Pricing pressures due to generic and biosimilar competition.

- Patient adherence improvements via injection regimen convenience.

- Payer dynamics efficiently integrating JATENZO into formulary frameworks.

Comparative Analysis of Pricing Strategies

| Strategy |

Target Market |

Advantages |

Challenges |

| Cost Leadership |

Payers, Medicaid |

Market penetration, volume growth |

Margin compression |

| Differentiation |

Physicians, patients |

Emphasize efficacy, safety |

Need for clinical and educational support |

| Penetration Pricing |

Entry phase |

Rapid market entry |

Sustaining profitability |

Forecasting and Market Share Estimates

| Year |

Projected Market Share (Injectables) |

Total Prescriptions (USD millions) |

Expected Revenue (USD millions) |

| 2023 |

2-3% |

USD 50-70 |

USD 2-3 million |

| 2024 |

4-6% |

USD 80-120 |

USD 3-7 million |

| 2025 |

8-10% |

USD 130-200 |

USD 6-12 million |

| 2026 |

12-15% |

USD 250-350 |

USD 15-20 million |

Note: These projections assume steady market acceptance, formulary inclusion, and stable pricing with moderate growth.

Deep-Dive: Key Challenges and Opportunities

| Challenges |

Opportunities |

| Limited brand recognition |

Early market entry & targeted marketing |

| Payer hesitancy |

Cost advantages and clinical data advocacy |

| Competition from established brands |

Building strategic partnerships |

Comparison to Global Markets

| Region |

Market Size (2022) |

Growth Potential |

Key Competitors |

Regulatory Milestones |

| North America |

USD 2.3 billion |

8-10% CAGR |

Same as above |

FDA approval, formulary adoption |

| Europe |

USD 1.5 billion |

6-8% CAGR |

Generic testosterone versions |

EMA approvals, local generics |

| Asia-Pacific |

USD 1.0 billion |

12-15% CAGR |

Local generics, biosimilars |

Varying regulations, growing healthcare access |

Conclusion: How Will JATENZO Perform?

JATENZO’s market success hinges on competitive pricing, strategic formulary placement, and clinician acceptance. Its initial price point of USD 40-45 per dose positions it favorably against major injectables, especially considering the potential for cost savings in long-term therapy. While the injectable market segment is mature, JATENZO’s differentiation via data, dosing convenience, and economic appeal offers meaningful growth prospects.

Key Factors for Success

- Building brand recognition in a crowded market

- Securing broad reimbursement support

- Demonstrating clinical advantages over existing therapies

- Navigating biosimilar and generic competition

Key Takeaways

- JATENZO entered a mature, competitive testosterone market with strategic pricing around USD 40-45 per dose.

- Long-term growth projections anticipate a gradual increase in market share, driven by payer acceptance and provider preference for injectable therapies.

- Market dynamics favor cost-effective, efficacious formulations; JATENZO’s success depends on formulary access and educational campaigns.

- Regulatory and reimbursement environments remain critical determinants of profitability and market penetration.

- The global market offers expansion opportunities, especially in underserved regions with rising testosterone deficiency prevalence.

FAQs

1. How does JATENZO differ from existing testosterone injections?

JATENZO uses testosterone enanthate in an injectable form similar to established products but aims to position itself competitively through targeted pricing, clinical data showcasing safety, and potentially improved patient adherence via its formulation.

2. What are the main pricing challenges JATENZO faces?

Prevailing generic prices for testosterone enanthate range from USD 45-50 per dose. JATENZO must maintain an attractive price point while ensuring profitability, especially as biosimilars and generics proliferate.

3. Will insurance companies reimburse JATENZO at similar rates to competitors?

Reimbursement hinges on formulary decisions and clinical evidence. Early indications suggest coverage similar to other injectable testosterone therapies, approximately USD 40-50 per dose.

4. What is the forecasted growth trajectory for JATENZO?

Projected to capture incremental market share over the next five years, with estimated revenues ranging from USD 2 million in 2023 to approximately USD 20 million in 2026, assuming steady market acceptance.

5. How might biosimilars impact JATENZO’s pricing and market share?

The entry of biosimilars or generics could exert downward pressure on prices, potentially reducing margins but increasing overall market volume. Strategic differentiation through clinical data and patient support could mitigate this impact.

References

[1] MarketWatch, "Global Testosterone Market," 2022.

[2] FDA, "JATENZO Approval Announcement," March 2022.

[3] Clarus Therapeutics, "JATENZO Prescribing Information," 2022.

[4] IQVIA, "Prescription Data for Testosterone Therapies," 2022.

[5] CDC, "Male Hypogonadism Prevalence Data," 2021.