Share This Page

Drug Price Trends for JANUVIA

✉ Email this page to a colleague

Average Pharmacy Cost for JANUVIA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| JANUVIA 100 MG TABLET | 00006-0277-01 | 10.55456 | EACH | 2025-12-17 |

| JANUVIA 100 MG TABLET | 00006-0277-31 | 10.55456 | EACH | 2025-12-17 |

| JANUVIA 25 MG TABLET | 00006-0221-28 | 10.54900 | EACH | 2025-12-17 |

| JANUVIA 50 MG TABLET | 00006-0112-54 | 10.55460 | EACH | 2025-12-17 |

| JANUVIA 100 MG TABLET | 00006-0277-28 | 10.55456 | EACH | 2025-12-17 |

| JANUVIA 100 MG TABLET | 00006-0277-82 | 10.55456 | EACH | 2025-12-17 |

| JANUVIA 100 MG TABLET | 00006-0277-54 | 10.55456 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for JANUVIA

Introduction

JANUVIA (sitagliptin) is an oral antihyperglycemic agent developed by Merck & Co., primarily used to manage type 2 diabetes mellitus. Since its approval by the U.S. Food and Drug Administration (FDA) in 2006, JANUVIA has become a core component of the DPP-4 inhibitor class. This article provides a comprehensive market analysis, examining current positioning and future price projections within the evolving diabetes therapeutics landscape.

Market Overview

Global Diabetes Market Dynamics

The global diabetes market has exhibited consistent growth, driven by the escalating prevalence of type 2 diabetes. According to the International Diabetes Federation (IDF), approximately 537 million adults worldwide have diabetes as of 2021, projected to reach 643 million by 2030 [1]. The expanding patient base underscores persistent demand for effective treatment options.

Market Share and Competitive Positioning of JANUVIA

JANUVIA holds a significant share in the DPP-4 inhibitor segment, alongside competitors like Tradjenta (linagliptin), Onglyza (saxagliptin), and Nesina (alogliptin). Its convenience of once-daily dosing and favorable safety profile have contributed to its market acceptance. As of 2022, JANUVIA's global sales reached approximately $3.1 billion, maintaining its status as a leading DPP-4 inhibitor, although facing competitive pressures from incretin-based therapies such as GLP-1 receptor agonists and SGLT2 inhibitors [2].

Prescribing Trends

Physicians increasingly favor medications with proven safety and tolerability. JANUVIA’s minimal risk of hypoglycemia and weight neutrality support its sustained prescription rate, especially among elderly populations. However, emerging evidence highlighting the cardiovascular and renal benefits of SGLT2 inhibitors is gradually shifting prescribing patterns.

Market Drivers and Barriers

Drivers

- Rising Prevalence: The increasing global burden of type 2 diabetes significantly fuels demand.

- Patient Compliance: Once-daily dosing and tolerability promote adherence.

- Complementary Therapy Use: JANUVIA’s safety profile makes it suitable for combination therapy, broadening its market utilization.

- Regulatory Extensions: Ongoing research into additional indications could expand its applicable patient segments.

Barriers

- Competitive Landscape: The rise of GLP-1 receptor agonists and SGLT2 inhibitors with proven cardiovascular benefits may limit growth.

- Pricing Pressures: Payers are increasingly scrutinizing drug costs, affecting revenue and pricing strategies.

- Generic Entry Threats: Patent expirations or potential biosimilar developments could influence future pricing structures.

Price Analysis and Future Projections

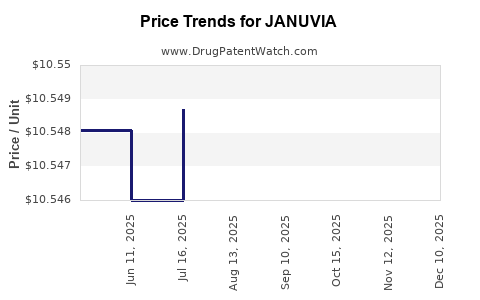

Historical Pricing Trends

The wholesale acquisition cost (WAC) for JANUVIA has remained relatively stable over recent years, averaging around $250-$300 per month for a standard supply. Despite high-value branding, competitive pricing pressures and negotiations with payers temper revenue growth.

Forecasting Future Pricing Trends

Given the current market environment and competitive pressures, the following projections emerge:

-

Short-term (1-3 years):

Expect modest price stabilization or slight reductions driven by payer negotiations. Manufacturers may implement value-based pricing or formulary rebates to retain market share. -

Medium-term (4-7 years):

Anticipate possible price erosion, particularly if biosimilars or generic entry occurs post-patent expiry (expected around 2026-2028). Additionally, increased adoption of combination therapies could impact individual drug pricing. -

Long-term (8+ years):

Prices are likely to decline substantially if biosimilars or alternative therapies gain widespread acceptance, and if new competitors emerge with superior efficacy or cost advantages.

Impact of Patent Expiration and Biosimilar Development

Although sitagliptin's primary patent was expected to expire around 2026, disputes or extended exclusivity through secondary patents may delay biosimilar entry. Once biosimilars or generics enter the market, price reductions of up to 70% are typical, significantly impacting revenue streams [3].

Pricing Strategies for Manufacturers

To sustain profitability, Merck may focus on:

- Line Extensions: Developing fixed-dose combinations or new indications to maintain exclusivity.

- Value-added Services: Embedding digital health tools or personalized medicine approaches.

- Market Expansion: Targeting emerging markets with lower price points.

Regulatory and Policy Influences on Pricing

Government policies emphasizing value-based care and price transparency are influencing drug pricing dynamics globally. Payers demand evidence of cost-effectiveness, which could lead to negotiated discounts or formulary restrictions for JANUVIA [4].

In the U.S., Medicare and private payers’ increasing adoption of value-based arrangements could pressure manufacturers toward innovative pricing models such as outcomes-based contracts, potentially reducing effective prices over time.

Emerging Trends and Future Market Opportunities

Shift Toward Cardiovascular and Renal Benefits

Recent cardiovascular outcome trials (CVOTs) evaluating diabetes medications—such as SGLT2 inhibitors and GLP-1 receptor agonists—demonstrate superior benefits in reducing cardiovascular and renal events. JANUVIA has shown neutral effects in some CVOTs, which may limit its competitive edge unless future studies demonstrate additional benefits.

Combination Therapies

Fixed-dose combinations with other classes such as metformin or SGLT2 inhibitors could offer enhanced efficacy and adherence, creating new revenue streams and potentially influencing pricing strategies.

Personalized Medicine Approaches

Biomarker-driven therapies and precision medicine could redefine the positioning of JANUVIA, aligning it with patient-specific profiles and affecting overall market dynamics and pricing.

Conclusion

JANUVIA remains a prominent player within the diabetes therapeutics market, with stable current revenues supported by a solid safety profile and patient adherence benefits. However, due to increasing competition, patent expirations, and evolving treatment paradigms emphasizing cardiovascular and renal outcomes, future pricing is expected to decline gradually. Strategic innovation, including combination formulations and expanded indications, may help preserve its market position and sustain pricing premiums.

Key Takeaways

- The global diabetes market's growth drives sustained demand for JANUVIA, but competitive shifts challenge its market share.

- Current price stability is expected to erode over time, especially post-patent expiration, with potential reductions upward of 50% upon biosimilar entry.

- Strategies focused on combination therapies, personalized medicine, and value-based pricing may mitigate revenue declines.

- Regulatory trends emphasizing cost-effectiveness could further influence downward pricing pressures.

- The drug’s future profitability hinges on innovation and adaptation to the evolving landscape favoring therapies with proven cardiovascular and renal benefits.

FAQs

1. When is the patent expiration for JANUVIA expected, and how will it impact pricing?

The primary patent for sitagliptin is anticipated to expire around 2026-2028. Patent expiration typically leads to biosimilar or generic entry, which can reduce drug prices by up to 70%, significantly impacting revenue.

2. How does JANUVIA compare to competing treatments like GLP-1 receptor agonists and SGLT2 inhibitors?

While JANUVIA is effective and well-tolerated, newer agents like GLP-1 receptor agonists and SGLT2 inhibitors often demonstrate superior cardiovascular and renal benefits, potentially limiting JANUVIA’s growth in certain indications.

3. What strategies can Merck adopt to sustain JANUVIA’s market share?

Merck can focus on developing combination products, expanding indications through clinical trials, leveraging personalized medicine, and engaging in value-based pricing arrangements with payers.

4. Are there emerging therapies that could make JANUVIA obsolete?

Yes. The increasing adoption of therapies with proven cardiovascular and renal benefits, especially SGLT2 inhibitors and GLP-1 receptor agonists, could reduce JANUVIA’s market share unless it demonstrates additional advantages.

5. What are the key factors influencing the future price of JANUVIA?

Patent status, competition from biosimilars or generics, regulatory policies, payer negotiations, and the drug’s positioning relative to emerging therapies are principal influences on future pricing.

References

[1] International Diabetes Federation. (2021). IDF Diabetes Atlas, 9th Edition.

[2] Merck & Co. Annual Report 2022.

[3] IMS Health. (2022). Impact of Biosimilar Competition on Pricing.

[4] World Health Organization. (2020). Policies for Diabetes Management and Pricing Strategies.

More… ↓